Adult Vaccines Market – Global Trends, Growth & Forecast Report 2025-2033

Buy NowGlobal Adult Vaccines Market Size and Forecast 2025-2033

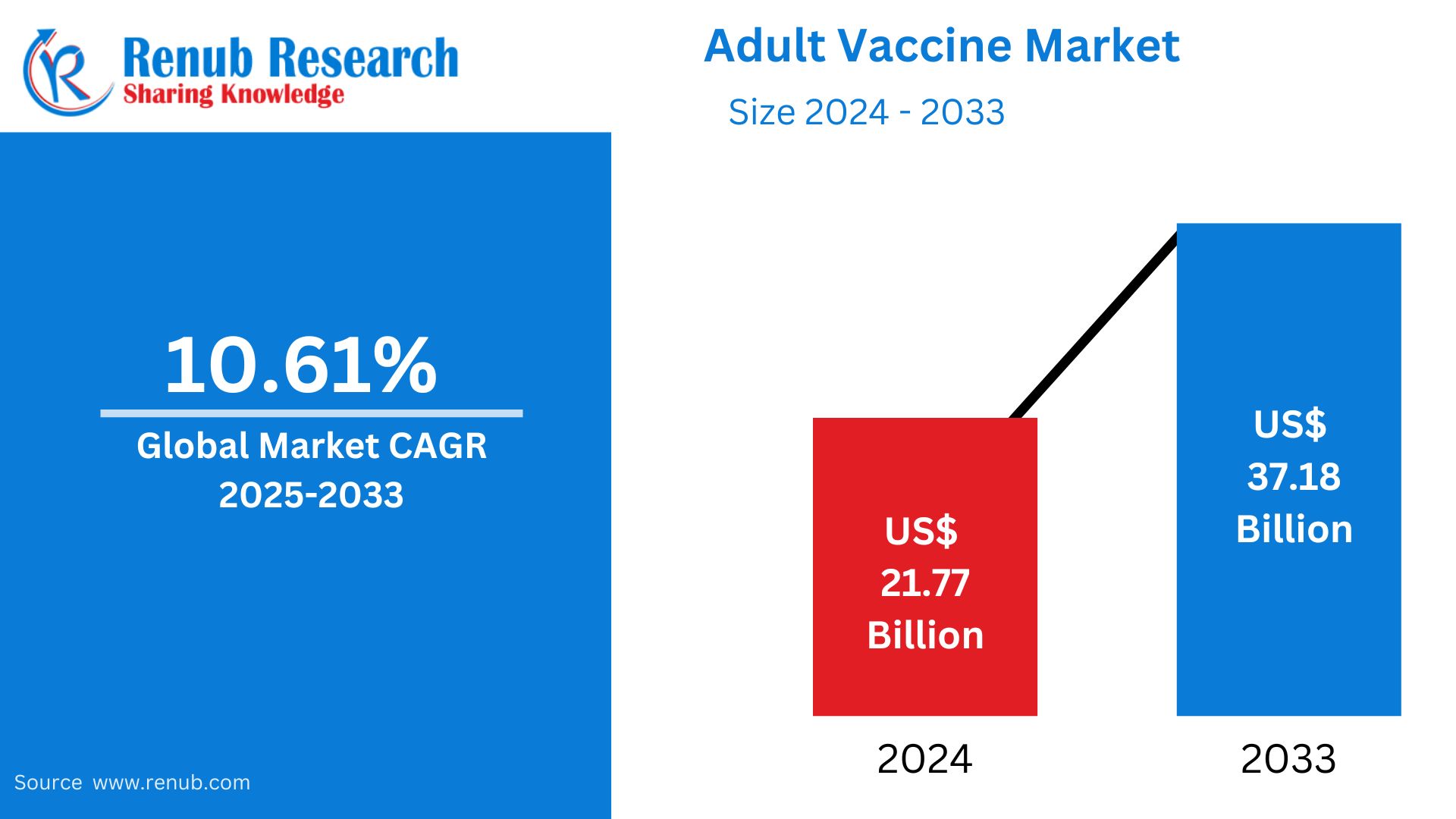

Global Adult Vaccines Market was worth USD 21.77 billion in 2024 and is forecasted to hit USD 37.18 billion by the end of 2033 at a CAGR of 6.13% between 2025 and 2033. Demand for vaccines increases due to mounting awareness regarding immunization in adults, high disease incidence, and an ageing global population.

The report Adult Vaccine Market Global Forecast covers by Disease wise (Influenza, Cervical Cancer (HPV), Zoster (Shingles), MMR (Measles, Mumps, and Rubella Vaccine), Pneumococcal, Meningococcal, Hepatitis, Tdap, Travel and Miscellaneous, Varicella) Countries and Company Analysis, 2025-2033.

Global Adult Vaccines Market Outlooks

Adult vaccines are the vaccines specifically for persons 18 years and above that are given to prevent disease from various infections. Although vaccination in childhood establishes initial immunity, adult immunization is important to sustain long-term health and ward off disease epidemics. Vaccines commonly recommended for adults are against influenza, hepatitis A and B, human papillomavirus (HPV), herpes zoster or shingles, pneumococcal disease, tetanus, and diphtheria. These vaccines are especially crucial for older adults, those with chronic diseases, healthcare personnel, and travelers.

The demand for adult vaccines has increased across the world, particularly after the COVID-19 pandemic, which showed the importance of immunization among elderly people. Governments and health bodies increasingly advocate for adult immunization through increased awareness campaigns and standard health check-ups. Industrialized countries like Europe and North America have established adult vaccination programs, whereas developing economies in Asia-Pacific, Latin America, and the Middle East are building their public health infrastructure to enhance adult vaccine coverage. This change is generating robust global demand for adult vaccines.

Growth Drivers in the Global Adult Vaccines Market

Increasing Geriatric Population and Immunosenescence

The world population is growing old very fast, thus increasing the age-related diseases and a compromised immune system, which is referred to as immunosenescence. As people grow older, they become weaker in fighting infections, and immunization at the right time becomes necessary. Vaccines like influenza, shingles, and pneumococcal are most sought after among the elderly. By 2030, 1 in 6 individuals on the planet will be 60 years or older, with this age group growing from 1 billion in 2020 to 1.4 billion. By 2050, it will reach 2.1 billion, and those 80 and above will triple to 426 million. As a result, global healthcare systems are adding routine adult immunization to preventive care plans. This demographic shift is strongly propelling the demand for adult vaccines and motivating pharmaceutical firms to develop age-specific and more potent formulations.

More Government Vaccination Campaigns and Awareness

Governments and global health agencies are stepping up efforts to promote adult immunization through awareness campaigns and subsidized vaccination programs. Programs like the CDC's adult immunization schedule and WHO's expanded immunization agenda are raising public awareness and acceptance of adult vaccines. These initiatives focus on preventing preventable hospitalizations, minimizing healthcare expenditures, and restraining the spread of preventable disease among adults. With supportive regulatory measures and increased public health focus, these initiatives are driving up higher vaccine penetration rates in developed and emerging economies, serving as a key market growth catalyst. World Immunization Week, which occurs during the fourth week of April 2025, encourages the value of immunization to safeguard all ages against vaccine-preventable diseases. The Vaccines National Strategic Plan 2021–2025 provides the U.S. vision for the elimination of these diseases within the next five years.

Improvements in Vaccine Technology and Innovation

Innovations in vaccine technology—recombinant DNA methods, mRNA platforms, and adjuvant systems—are improving vaccine efficacy, safety, and shelf life. These advances facilitate quicker production of adult-specific needs vaccines such as HPV, shingles, and flu. Further, the COVID-19 pandemic catapulted R&D spending and collaborations, which overtrickled into wider vaccine innovation. Pharmaceutical companies are currently concentrating on combination vaccines and multivalent adult vaccines with enhanced convenience and coverage. These technological leaps are opening up new opportunities in the global adult vaccines market, encouraging wider immunization across various adult age groups. April 2025, Uganda's Ministry of Health has confirmed the introduction of the R21/Matrix-M™ malaria vaccine into routine immunization, making it the 19th African country to do so. The vaccine will first target 1.1 million children under the age of two in 105 high- and moderate-transmission districts, with nationwide rollout plans.

Global Adult Vaccines Market Challenges

Vaccine Hesitancy and Misinformation

Despite demonstrated efficacy, adult vaccination is resisted due to pervasive misinformation and doubt. Adult individuals downplay the danger of vaccine-preventable disease or feel immunization is solely needed during childhood. Social media sites frequently drive vaccine hesitancy by disseminating false information regarding side effects and safety. This resistance impedes uptake, particularly in low- and middle-income countries with poor health literacy. Addressing misinformation and enhancing trust in public health advice is critical to overcoming this obstacle and attaining widespread adult vaccine coverage.

High Costs and Restricted Access in Low-Income Areas

Adult vaccines may be costly, especially in nations without universal healthcare coverage. In low-income areas, access to crucial vaccines is restricted because of poor infrastructure, lack of cold chain logistics, and prohibitive out-of-pocket expenses. In contrast to pediatric vaccines, that are subsidized or delivered through global schemes such as GAVI, adult immunization does not have a similar financing arrangement in most nations. Such an approach of financing and logistics hampers the distribution of vaccines as well as efforts to establish a robust adult immunization program, thus slowing market growth overall.

Influenza Adult Vaccines Market

The influenza adult vaccines market is a significant segment because of the high incidence and mortality of seasonal flu globally, particularly among immunocompromised and elderly people. Health organizations across the world recommend annual flu shots, so influenza vaccines have become a norm in adult prevention. Pharmaceutical companies continue to innovate flu vaccine performance with quadrivalent and high-dose formulations. Public health programs and corporate wellness programs further encourage annual flu vaccination. The market experiences strong demand in North America, Europe, and Asia-Pacific, aided by both public and private healthcare systems.

TdaP Adult Vaccines Market

TdaP vaccines are essential for adult booster immunization, particularly among healthcare professionals, caregivers, and pregnant women. Growing awareness of pertussis outbreaks and the need for maternal immunization has propelled the TdaP segment. In most nations, adults are recommended to get a TdaP booster every 10 years, leading to repeat market demand. Moreover, the TdaP recommendation during every pregnancy to safeguard newborns has increased uptake. Governments are also incorporating TdaP into occupational health practices, broadening its application among adult populations.

Meningococcal Adult Vaccines Market

The adult meningococcal vaccines market is gaining momentum with increased cases of meningitis outbreaks and susceptibility of travelers, military recruits, and college students in residential settings. Meningococcal serogroup (e.g., A, C, W, Y, and B) vaccines are now being used in adults who are at risk in certain settings or traveling to endemic areas. Colleges and universities, particularly in the U.S. and Europe, mandate meningococcal vaccination for dormitory residents. Increased surveillance and outbreak response measures are also fueling demand. Pharmaceutical innovation has also enhanced vaccine effectiveness and expanded serogroup coverage.

Hepatitis Adult Vaccines Market

Hepatitis A and B adult vaccines remain a high priority in worldwide immunization programs because of the chronic and potentially life-threatening nature of these illnesses. Vaccination is especially important in healthcare professionals, individuals with liver disease, those traveling to epidemic regions, and high-risk individuals like intravenous drug users. Hepatitis vaccines have been included in adult vaccination schedules in numerous countries. Organizations such as the WHO are vigorously advocating hepatitis elimination programs, propelling market development. Combination vaccines and long-duration formulations further promote patient compliance and market uptake.

United States Adult Vaccines Market

The market for U.S. adult vaccines is strong and well-developed, having benefited from a solid healthcare infrastructure, regulatory environment, and public education. CDC programs, Medicare, and private insurance all provide wide access to adult vaccines like influenza, shingles, TdaP, and pneumococcal. The impact of COVID-19 also helped boost adult immunization infrastructure. Ongoing public health campaigns, high health literacy, and technology-enabled vaccine tracking all add to high uptakes. In addition, the U.S. is a leader in vaccine R&D and innovation, with large pharmaceutical corporations based in the country, improving domestic accessibility and international market leadership. October 2024, Pfizer Inc. released that the FDA has approved ABRYSVO® (a bivalent RSV vaccine) to help prevent lower respiratory tract disease caused by RSV in people 18 through 59 years old who are at high risk.

Germany Adult Vaccines Market

Germany is one of Europe's champions of adult immunization, underpinned by universal health coverage and direct government engagement in disease prevention. The Robert Koch Institute periodically updates adult immunization recommendations, stimulating uptake. Strong influenza vaccination coverage among older people, regular TdaP booster shots, and increasing awareness of shingles and pneumococcal vaccination are propelling market growth. Germany also enjoys robust public trust in vaccine safety and effectiveness, supporting overcoming hesitancy. Pharmaceutical innovation and EU-level partnerships further enhance the nation's adult vaccine infrastructure and supply chain effectiveness. April 2025, The European Commission greenlighted Pfizer's Abrysvo vaccine for prevention of RSV-related lower respiratory tract illness in adults aged 18 to 59 at heightened risk. This approval is for all 27 EU nations and was supported by the European Medicines Agency panel.

India Adult Vaccines Market

India's adult vaccines market is growing based on growing health awareness, mounting prevalence of chronic diseases, and government-supported immunization programs. While historically child vaccines prevail, recent efforts for adult populations, including hepatitis B vaccination among health workers and influenza vaccination among older adults, are picking up. Urbanization, medical tourism, and private sector investment in healthcare further drive demand. Yet access is uneven in urban versus rural settings. Public-private partnerships and information campaigns are most important in enhancing vaccine literacy and coverage. India's strong pharma manufacturing industry also contributes to fueling vaccine availability and affordability. Aug 2024, Artemis Hospitals, in partnership with Pfizer India, has inaugurated a Centre for Adult Vaccination to strengthen preventive healthcare in India. This program is designed to address the high vaccine-preventable disease mortality among adults, which is usually neglected in relation to childhood immunization.

Saudi Arabia Adult Vaccines Market

Saudi Arabia's adult vaccines market is spurred by government health programs, compulsory vaccinations for Hajj pilgrims, and a high rate of travel-related diseases. The Ministry of Health encourages adult immunization, particularly for influenza, meningococcal, and hepatitis vaccines. Seasonal pilgrimages present a distinct control challenge in diseases, hence the need for vaccination. Additionally, Vision 2030 healthcare reforms within the Kingdom highlight preventive care, further increasing demand. Increased chronic diseases such as diabetes and cardiovascular diseases among adults also drive demand for vaccines to avoid infection complications. Increased public sector investments further support market growth. In September 2023, The government invested $133 million to set up a factory to increase domestic vaccine and medicine production in order to decrease dependence on overseas suppliers and make them available during emergencies.

Adult Vaccine Market Segments

Disease wise – Adult Vaccines Market

- Influenza

- Cervical Cancer (HPV)

- Zoster (Shingles)

- MMR (Measles, Mumps, and Rubella Vaccine)

- Pneumococcal

- Meningococcal

- Hepatitis

- TdaP

- Travel and Miscellaneous

- Varicella

Disease wise – Numbers of Vaccinated Adults

- Influenza

- Cervical Cancer (HPV)

- Zoster (Shingles)

- MMR

- Pneumococcal

- Meningococcal

- Hepatitis

- TdaP

- Varicella

Regional Analysis – Adult Vaccine Sales by Country

North America

- United States

- Canada

Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Switzerland

Asia-Pacific

- India

- China

- Japan

- Australia

- South Korea

Latin Africa

- Mexico

- Brazil

- Argentina

Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

Rest of the World

Companies have been covered from 5 viewpoints

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Major Players in the Adult Vaccination Market

- GlaxoSmithKline, plc.

- AstraZeneca plc

- Sanofi Pasteur

- Pfizer, Inc.

- CSL Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Disease wise and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Driver

4.2 Challenges

5. Global Adult Vaccines Market

5.1 Market

5.2 Volume (people)

6. Adult Vaccines Market & Numbers Share Analysis

6.1 Adult Vaccine Market Share

6.2 By Country Adult Vaccine Market Share

6.3 Adult Vaccinated Population Share

7. Disease wise – Adult Vaccines Market

7.1 Influenza

7.2 Cervical Cancer (HPV)

7.3 Zoster (Shingles)

7.4 MMR (Measles, Mumps, and Rubella Vaccine)

7.5 Pneumococcal

7.6 Meningococcal

7.7 Hepatitis

7.8 TdaP

7.9 Travel and Miscellaneous

7.10 Varicella

8. Disease wise – Numbers of Vaccinated Adults

8.1 Influenza

8.2 Cervical Cancer (HPV)

8.3 Zoster (Shingles)

8.4 MMR

8.5 Pneumococcal

8.6 Meningococcal

8.7 Hepatitis

8.8 TdaP

8.9 Varicella

9. Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 United Kingdom

9.2.2 Germany

9.2.3 France

9.2.4 Russia

9.2.5 Italy

9.2.6 Spain

9.2.7 Switzerland

9.3 Asia-Pacific

9.3.1 India

9.3.2 China

9.3.3 Japan

9.3.4 Australia

9.3.5 South Korea

9.4 Latin Africa

9.4.1 Mexico

9.4.2 Brazil

9.4.3 Argentina

9.5 Middle East and Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.6 Rest of the World

10. Porter’s Five Forces

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Mergers and Acquisitions in the Vaccine Industry

13. Vaccines and Regulator’s Interventions

13.1 Making and Meeting Standards of Quality and Safety

13.2 Vaccine Funding

14. Vaccines – Products and Pipeline

14.1 GSK Vaccine Product Pipeline

14.2 AstraZeneca plc Vaccine Product Pipeline

14.3 Sanofi Vaccine Product Pipeline

14.4 Pfizer Vaccine Product Pipeline

15. Vaccines Key Players Analysis

15.1 GlaxoSmithKline, plc.’s Vaccines Sales

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 Product Portfolio

15.1.5 Revenue

15.2 AstraZeneca plc Vaccines Sales

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 Product Portfolio

15.2.5 Revenue

15.3 Sanofi Pasteur’s Vaccines Sales

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 Product Portfolio

15.3.5 Revenue

15.4 Pfizer, Inc.’s Vaccines Sales

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 Product Portfolio

15.4.5 Revenue

15.5 CSL Limited sales

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 Product Portfolio

15.5.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com