United States Real Estate Market by Segments, Category (Private Construction (Residential & Non- Residential) & Public Construction (Residential & Non- Residential)), and Company Analysis 2021-2027

Buy NowUnited States Real Estate Market Outlook

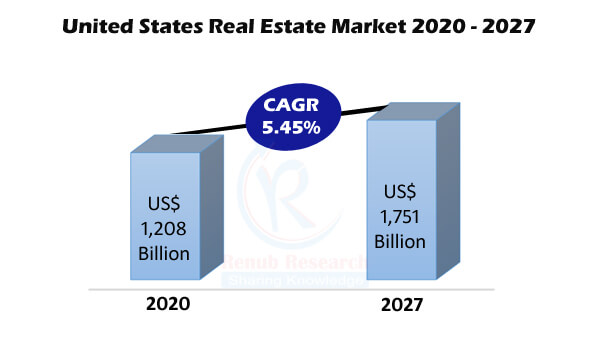

The United States is one of the most developed countries across the globe. Real-estate is playing a pivotal role in the U.S. economy. The overall US economic activity determines the demands of real estate, which influences the market of residential and commercial real estate property. As per the National Association of Realtors (NAR), in October 2020, the sale of an existing home hit its highest level since 2006. According to Renub Research new report, United States Real Estate Market is expected to reach USD 1,751 Billion by 2027.

In the United States, the market of Real estate is surging despite the pandemic COVID-19 crisis. For many Americans, residence is the highest source of prosperity and investment. Non-Residential or Commercial construction includes lodging, Office, health care, Educational, temples, Amusement and recreate, transportation, manufacturing, etc. It provides a source of more revenue in return. As per research findings, United States Real Estate Industry was USD 1,208 Billion in 2020.

The United States is among the largest construction market globally. Infrastructure constructions take lots of time and capital to build and design project. In the United States, massive numbers of infrastructure and construction industry are built with government and private companies' support. Constructions made to provide support to the maximum population. The construction project is booming in the country, changing lifestyle and increasing population will propel the Real Estate market in this country. As per this report, Real Estate Market in the United States will grow with a CAGR of 5.45% from 2020 to2027.

U.S real estate is growing year on year, and numerous infrastructure projects are being introduced every year. Northern Arizona University is planning for large construction projects that include STEM disciplines and the Biological Sciences Building renovation. The Southwest Florida International Airport is planning an enormous US$ 250 Million terminal expansion, and Citizens in the city of Shoreline will see a US$ 64.3 Million roadway reconstruction project launched in 2022 and many more cities. The upcoming year promises to bring a construction project to every region of the United States.

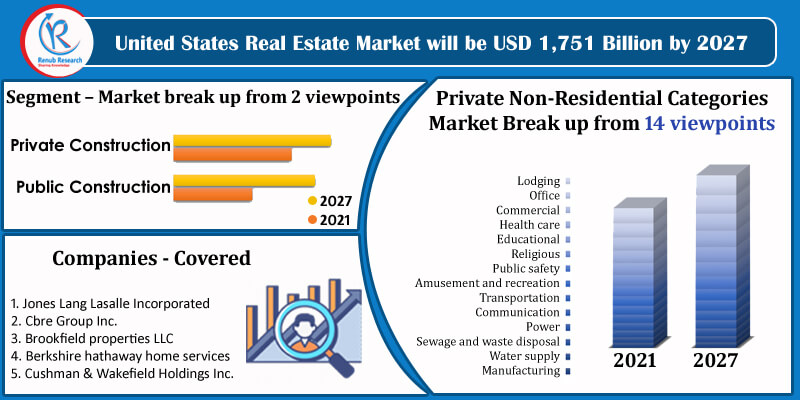

Renub Research latest report "United States Real Estate Market by Segments, Category (Private Construction (Residential & Non- Residential) & Public Construction (Residential & Non- Residential)), Company (Jones Lang Lasalle Incorporated, Cbre Group Inc., Brookfield properties LLC, Berkshire Hathaway home services, Cushman & Wakefield Holdings Inc.)" provides a complete analysis of USA Real Estate Industry.

Real Estate Market of United States have been broadly Studied from 2 Segments

1. Private Construction

2. Public Construction

Private Construction Market has been divided into 2 Categories and its Non-Residential Category is further divided into 14 Sub-Categories

A. Residential

B. Non-Residential

1. Lodging

2. Office

3. Commercial

4. Health care

5. Educational

6. Religious

7. Public safety

8. Amusement and recreation

9. Transportation

10. Communication

11. Power

12. Sewage and waste disposal

13. Water supply

14. Manufacturing

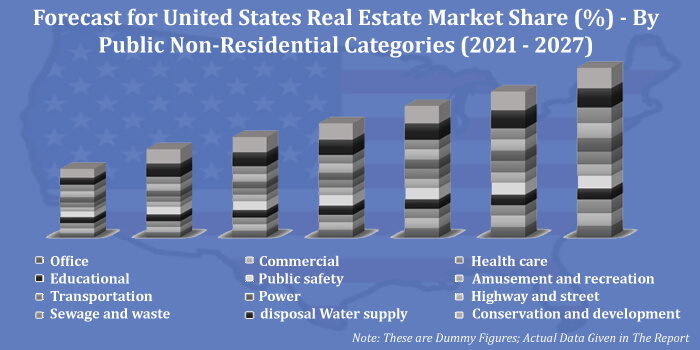

Public Construction Market has been divided into 2 Categories and its Non-Residential Category is further divided into 12 Sub-Categories

A. Residential

B. Non-Residential

1. Office

2. Commercial

3. Health care

4. Educational

5. Public safety

6. Amusement and recreation

7. Transportation

8. Power

9. Highway and street

10. Sewage and waste disposal

11. Water supply

12. Conservation and development

All companies have been covered from 3 viewpoints

• Overviews

• Recent Developments

• Revenues

Company Analysis

1. Jones Lang Lasalle Incorporated

2. Cbre Group Inc.

3. Brookfield Properties LLC

4. Berkshire Hathaway home services

5. Cushman & Wakefield Holdings Inc.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Real Estate Market

6. United States Real Estate Market Share

6.1 By Segments

6.2 By Private Non-Residential Categories

6.3 By Public Non-Residential Categories

7. Segment – United States Real Estates Market

7.1 Private Construction

7.2 Public Construction

8. Private Construction by Categories

8.1 Residential

8.2 Non-Residential

8.2.1 Lodging

8.2.2 Office

8.2.3 Commercial

8.2.4 Health care

8.2.5 Educational

8.2.6 Religious

8.2.7 Public safety

8.2.8 Amusement and recreation

8.2.9 Transportation

8.2.10 Communication

8.2.11 Power

8.2.12 Sewage and waste disposal

8.2.13 Water supply

8.2.14 Manufacturing

9. Public Construction by Categories

9.1 Residential

9.2 Non-Residential

9.2.1 Office

9.2.2 Commercial

9.2.3 Health care

9.2.4 Educational

9.2.5 Public safety

9.2.6 Amusement and recreation

9.2.7 Transportation

9.2.8 Power

9.2.9 Highway and street

9.2.10 Sewage and waste disposal

9.2.11 Water supply

9.2.12 Conservation and development

10. Company Analysis

10.1 Jones Lang Lasalle Incorporated

10.1.1 Overviews

10.1.2 Recent Developments

10.1.3 Revenues

10.2 Cbre Group Inc.

10.2.1 Overviews

10.2.2 Recent Developments

10.2.3 Revenues

10.3 Brookfield Properties LLC

10.3.1 Overviews

10.3.2 Recent Developments

10.3.3 Revenues

10.4 Berkshire Hathaway home services

10.4.1 Overviews

10.4.2 Recent Developments

10.4.3 Revenues

10.5 Cushman & Wakefield Holdings Inc.

10.5.1 Overviews

10.5.2 Recent Developments

10.5.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com