United States Milk Powder Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Milk Powder Market Trends & Summary

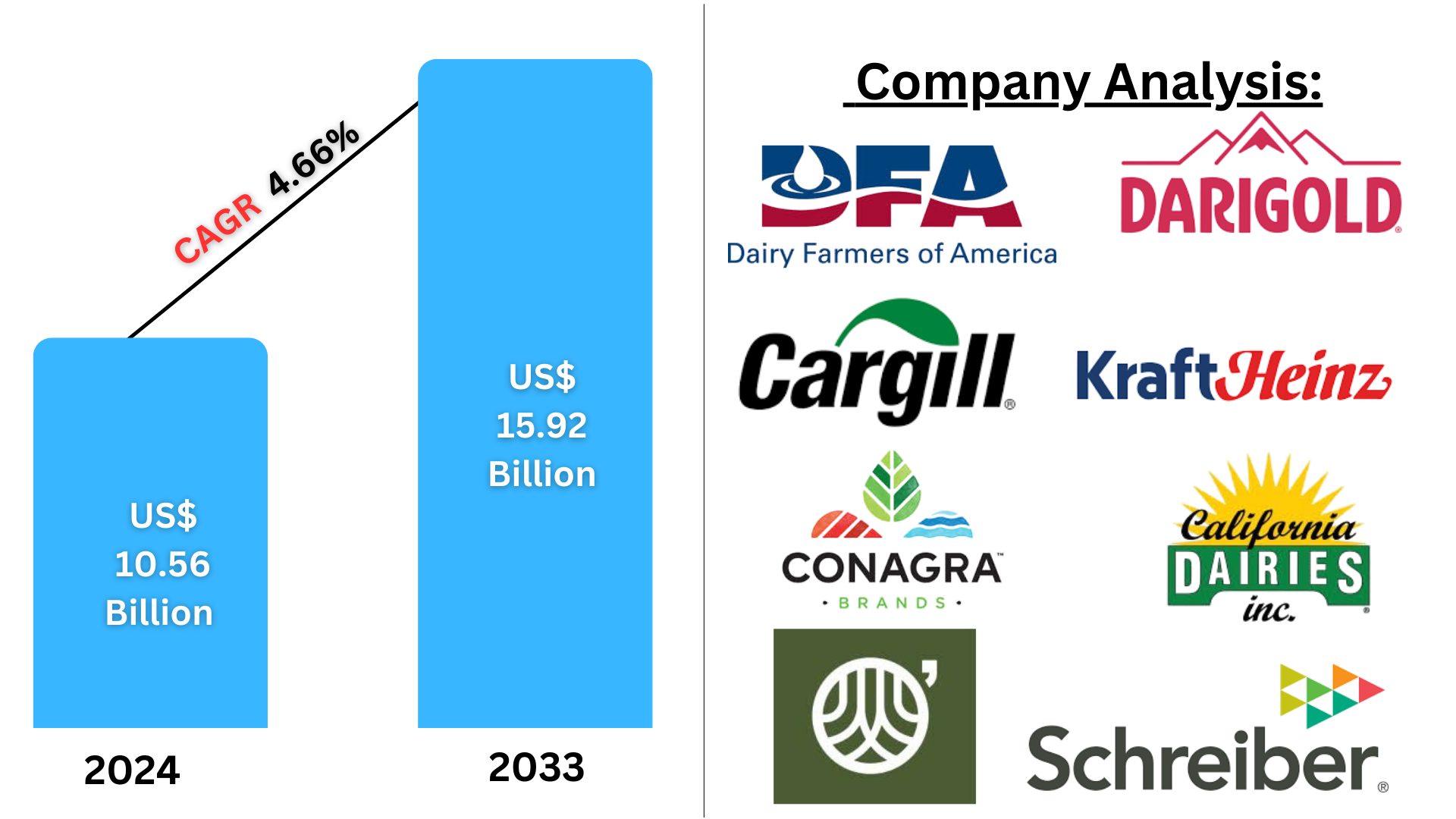

United States Milk Powder market is expected to reach US$ 15.92 billion by 2033 from US$ 10.56 billion in 2024, with a CAGR of 4.66% from 2025 to 2033. The market is growing because of a number of factors, including increased demand for products due to urbanization and population growth, the growing infant formula industry, rising health consciousness that encourages the consumption of dietary supplements, the expansion of the bakery and confectionery industries, and improved dairy technology.

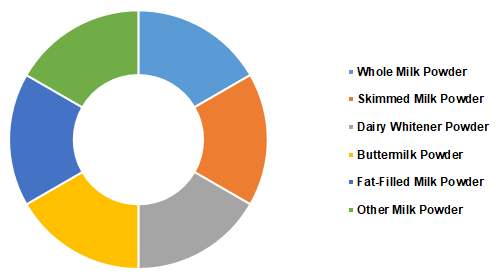

The report United States Milk Powder Market & Forecast covers by Type (Whole Milk Powder, Skimmed Milk Powder, Dairy Whitener Powder, Buttermilk Powder, Fat-Filled Milk Powder, Other Milk Powder), Application (Nutritional Food, Infant Formulas, Confectionaries, Baked Sweets, Savories, Others) and Company Analysis 2025-2033.

United States Milk Powder Industry Overview

Evaporation or spray drying are two methods used to remove moisture from pasteurized milk to create milk powder. Its shelf life is increased by this conversion, allowing it to be kept for a longer amount of time without going bad. Consequently, milk powder is used in the culinary sector to make a variety of baked goods and confections.

Currently, a number of variables are driving the milk powder industry in the United States. The thickening, gelling, and whipping qualities of milk powder are unique. Because of this, it is used to make delicacies including cakes, mousses, ice cream, and marshmallows. Accordingly, powdered milk is a good source of vitamins A, D, E, and K as well as magnesium, calcium, zinc, and potassium. It is also a staple in drinks, smoothies, puddings, and gravies because of this. Additionally, powdered milk is more portable than liquid milk, which increases demand in the area. In addition, consumers' growing knowledge of the unique nutritional advantages of milk powder has contributed to the market's expansion.

Growth Drivers for the United States Milk Powder Market

Growing baby formula market

A key component of infant formula, a necessary food item for non-breastfed babies, is milk powder. Given its vital function in giving babies the vitamins, minerals, and nutrition they need, the growing infant formula business greatly drives the milk powder market. Rising birth rates, expanding numbers of working moms looking for convenient feeding options, and growing knowledge of the advantages of enriched infant formula are all driving this industry's expansion. The market is supported by the growing demand for premium milk powder as producers work to satisfy the strict quality and nutritional requirements needed for baby nourishment.

Growing popularity of dietary supplements

The market for milk powder is greatly impacted by the rise in health consciousness in the US and the need for dietary supplements. A popular element in the creation of these supplements is milk powder, which is high in calcium, protein, and other vital minerals. In order to meet their nutritional demands, preserve their health, and improve their general well-being, consumers are increasingly turning to dietary supplements. Because milk powder is used in protein shakes, bars, and health drinks, this trend is especially noticeable in the fitness and wellness sectors, which fuels demand for the product and, in turn, market expansion.

Urbanization and population growth

As the population increases and urbanization quickens, the need for handy, non-perishable food items rises, fueling the US milk powder industry. Food items like milk powder that are easy to store and last a long time are preferred by urban lifestyles, which are defined by hectic schedules and smaller living areas. It provides a useful answer for customers looking for wholesome, easy-to-make solutions that blend in with the hectic pace of the city. The industry is growing because milk powder's longevity and storage effectiveness—which eliminates the need for refrigeration—perfectly match the urban need for food alternatives that are long-lasting and convenient.

Challenges in the United States Milk Powder Market

High Competition from Imported Product

The U.S. milk powder business faces a serious threat from competition from imported milk powder goods, especially from nations like the European Union and New Zealand. Because of advantageous agricultural policies, reduced labor costs, and effective production techniques, these areas frequently have lower production costs, which enables them to sell milk powder at more affordable pricing. Because of this, domestic prices are under pressure to decline, which makes it more difficult for American firms to compete without sacrificing margins. The competition may also be heightened by imports' ability to provide a variety of product compositions that appeal to various market categories. In order to lessen the effect of international competition on their market share, this scenario compels American manufacturers to concentrate on increasing product innovation, streamlining operations, or utilizing trade agreements.

Environmental Impact

With growing worries about its effects on the environment, sustainability demands are having an increasing impact on the milk powder sector in the United States. Methane emissions from animals, in particular, are a major source of greenhouse gas emissions from the dairy industry. Manufacturers of milk powder are facing pressure to lessen their carbon footprint as governments and consumers call for more environmentally friendly operations. This entails limiting waste, cutting back on water use, and using energy-efficient devices. Furthermore, a significant worry is the effect of transportation on the environment, as it contributes significantly to the carbon emissions of the sector. Making large investments in eco-friendly packaging, sustainable sourcing, and greener production methods may be necessary to meet sustainability targets. Although necessary for long-term sustainability, these adjustments can raise operating expenses and have an impact on profit margins, making it difficult for manufacturers to strike a balance between financial and environmental goals.

Skimmed milk powder's low-fat content drives strong demand in the U.S.

Skimmed milk powder is one of the leading segments in the U.S. market. This is because of heightened health consciousness. It caters to the increasing demand for healthier nutritional selections with decreased fat content. Skimmed milk powder is a flexible factor used in numerous food applications, making it a desired option for manufacturers. Besides, its longer shelf life and easy storage contribute to consumer convenience. As fitness-aware traits persist, the recognition of skimmed milk powder continues to push upward, driving its prominence within the market.

Infant formula holds substantial market share due to growing demand

Infant formula commands one of the significant shares of the U.S. milk powder market. This is owed to its essential function in early childhood nutrition. With growing awareness about the importance of proper toddler feeding and increasing numbers of working parents, the demand for toddler formulation remains sturdy. Further, advancements in formulation improvement, consisting of fortified variants catering to specific fitness needs, contribute to its market dominance. Furthermore, stringent regulatory requirements ensure product safety, bolstering consumer consideration. These factors collectively function infant formula as a crucial United States milk powder market section.

United States Milk Powder Market Share, By Type (Percentage)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

Type – United States Milk Powder Market breakup in 6 viewpoints:

1. Whole Milk Powder

2. Skimmed Milk Powder

3. Dairy Whitener Powder

4. Buttermilk Powder

5. Fat-Filled Milk Powder

6. Other Milk Powder

Application – United States Milk Powder Market breakup in 6 viewpoints:

1. Nutritional Food

2. Infant Formulas

3. Confectionaries

4. Baked Sweets

5. Savories

6. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Dairy Farmers of America Inc.

2. Darigold

3. Cargill Corporation

4. The Kraft Heinz Company (U.S)

5. Conagra Brands Inc.

6. Land O'Lakes, Inc.

7. Schreiber Foods Inc.

8. California Dairies Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type and Application |

| Type Covered | 1. Whole Milk Powder 2. Skimmed Milk Powder 3. Dairy Whitener Powder 4. Buttermilk Powder 5. Fat-Filled Milk Powder 6. Other Milk Powder |

| Companies Covered | 1. Dairy Farmers of America Inc. 2. Darigold 3. Cargill Corporation 4. The Kraft Heinz Company (U.S) 5. Conagra Brands Inc. 6. Land O'Lakes, Inc. 7. Schreiber Foods Inc. 8. California Dairies Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the U.S. milk powder market by 2033?

- What is the expected CAGR of the U.S. milk powder market from 2025 to 2033?

- What are the key factors driving the growth of the U.S. milk powder market?

- How does urbanization contribute to the increasing demand for milk powder?

- Why is the infant formula industry a major driver of milk powder demand in the U.S.?

- How does rising health consciousness influence milk powder consumption?

- What role does the expansion of the bakery and confectionery industries play in market growth?

- How does the nutritional value of milk powder contribute to its demand?

- What are the major challenges facing the U.S. milk powder market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Milk Powder Market

6. Market Share

6.1 By Types

6.2 By Application

7. Types

7.1 Whole Milk Powder

7.2 Skimmed Milk Powder

7.3 Dairy Whitener Powder

7.4 Buttermilk Powder

7.5 Fat-Filled Milk Powder

7.6 Other Milk Powder

8. Application

8.1 Nutritional Food

8.2 Infant Formulas

8.3 Confectionaries

8.4 Baked Sweets

8.5 Savories

8.6 Others

9. Value Chain Analysis

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Dairy Farmers of America Inc.

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 Darigold

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Cargill Corporation

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 The Kraft heinz company (U.S)

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Conagra Brands Inc.

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Land O'Lakes, Inc.

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Schreiber Foods Inc.

12.7.1 Overview

12.7.2 Recent Development

12.8 California Dairies Inc.

12.8.1 Overview

12.8.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com