United States Defense Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Defense Market Trends & Summary

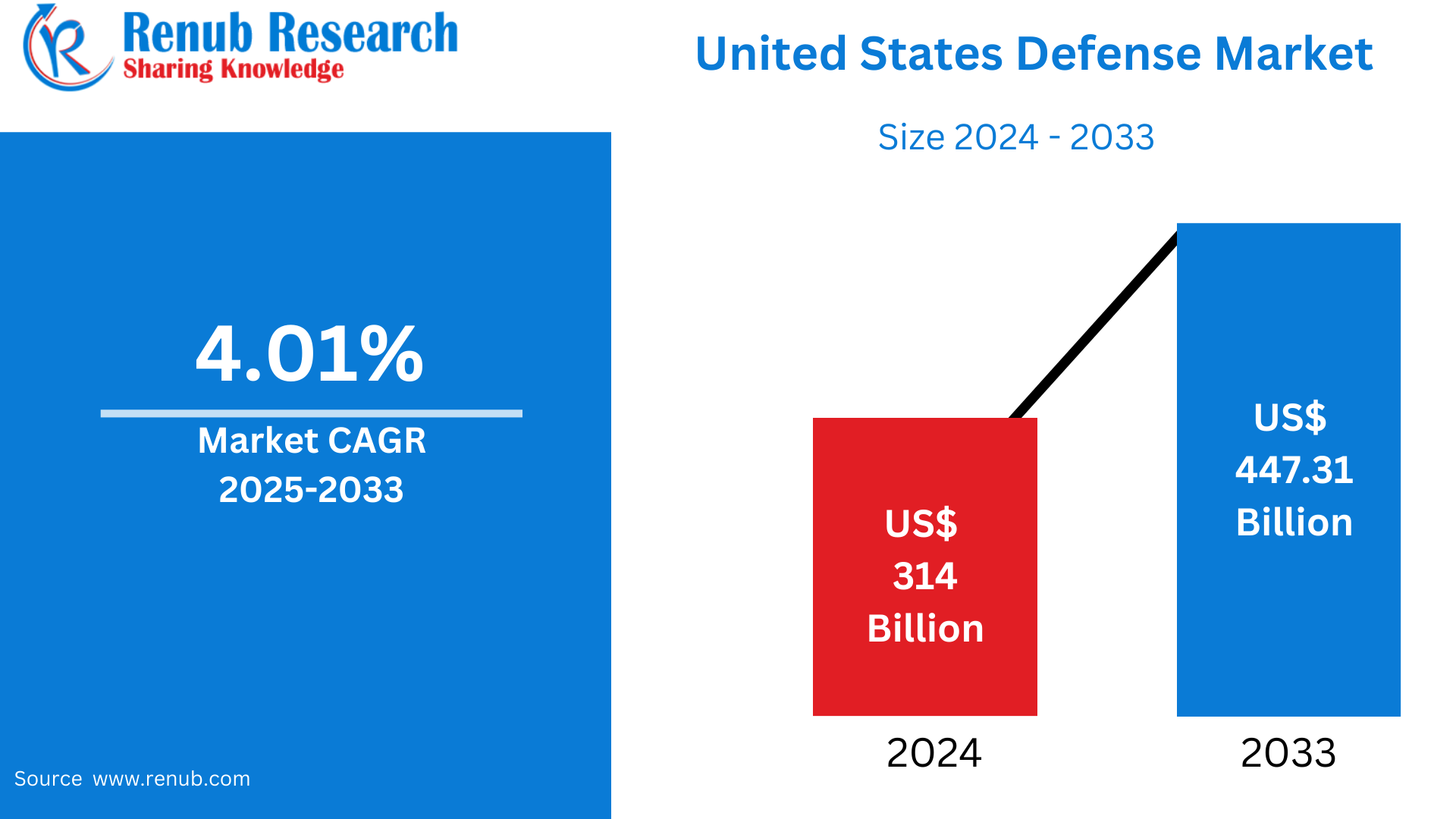

United States Defense Market is expected to reach US$ 447.31 billion by 2033 from US$ 314 billion in 2024, with a CAGR of 4.01% from 2025 to 2033. The military's purchase and modernization efforts to combat new threats are anticipated to be the main drivers of the US defense market's growth. There is now a need for defense equipment due to a number of active contracts from the military, air force, and naval force, as well as several new contracts that are expected to be distributed over the forecast period.

The report United States Defense Market & Forecast covers by Armed Force (Army, Navy, Air Force), Type (Fixed-wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems), Region (Northeast, Midwest, West, South) and Company Analysis, 2025-2033.

United States Defense Industry Overview

Due to the country's international military presence, defense policy, and technical dominance, the United States has one of the biggest and most developed defense industries in the world. The industry covers a broad spectrum of defense-related tasks, such as designing, producing, and maintaining military hardware, weaponry, and cybersecurity. With one of the largest military budgets in the world, the United States funds the research and acquisition of advanced technologies including fighter planes, drones, navy ships, and missile defense systems. In a dynamic geopolitical climate, sustaining military primacy and national security is the goal of this investment in technology and defense infrastructure.

With major contributions to space exploration, artificial intelligence, aerospace, and cyber defense technology, the sector is also a major force behind innovation. Important participants include private firms that collaborate closely with the Department of Defense and other governmental organizations, including Lockheed Martin, Boeing, Northrop Grumman, and Raytheon. Additionally, a huge nationwide network of supply chains, R&D projects, and skilled labor are all supported by the U.S. military sector. The United States continues to be a dominant force in the military industry, constantly improving its capabilities to address new security threats, despite obstacles including growing competition from superpowers and worries about defense budget.

The Air Force and Navy of the United States employ a number of aircraft. The United States is preparing to address any possible problems China could cause for nations with close links to the United States, such as Taiwan and Japan, as a result of the growing international confrontation with China over its aggressiveness in the South China Sea. As a result, during the past several years, large expenditures have been made to upgrade the current fleet and/or buy a new fleet with effective technology.

The US aerospace and defense industry is poised for tremendous expansion, but supply chain weaknesses present serious obstacles. The pandemic's effects on production and logistics demonstrate how vulnerable the industry's supply networks, which are frequently complex and worldwide, are to interruptions. Furthermore, new avenues for cybersecurity threats are created by the growing integration of digital technology and networking in defensive systems. A major worry is the increasing sophistication of state-sponsored cyberthreats that target defense contractors and vital infrastructure. For example, there were 30,659 cybersecurity assaults on US federal institutions in 2022.

Growth Drivers for the United States Defense Market

Geopolitical Tensions and National Security

National security issues and geopolitical conflicts are two of the main factors propelling the expansion of the US military sector. The United States is increasing defense expenditures and modernizing its military capabilities in response to ongoing wars and growing threats from countries such as China, Russia, and North Korea. A strong and flexible military force that can handle a variety of threats, from cyber and space security issues to conventional combat, is necessary to address these tensions. The United States is concentrating on developing its technologies, improving preparedness, and maintaining military dominance in response. In order to ensure that the United States is ready to handle new threats, expenditures in new military systems, weapons, and strategic infrastructure are also driven by the desire to preserve national interests and worldwide influence.

Defense Budget and Government Spending

The significant defense budget of the United States government, which is usually the highest in the world, is essential to maintaining the expansion of the military sector. The development of cutting-edge technology and next-generation weaponry systems is made possible by the funding of research and development. In order to keep the armed forces prepared for changing threats, the defense budget also funds the upkeep, upgrade, and acquisition of military hardware. These funding support the development of new defense technologies, including autonomous systems, cybersecurity, and artificial intelligence, in addition to enhancing military preparedness. The U.S. government maintains its military superiority on the international scene while bolstering national security through constant investments in defense infrastructure.

Cybersecurity and Space Defense

The United States is investing significant resources to improve space defense and cybersecurity as these fields become more and more important to national security. Cybersecurity has become a significant issue due to the increasing frequency of cyber threats, particularly assaults on vital infrastructure. To prevent hacking and interruption of both military and civilian networks, the U.S. government is investing in cutting-edge cybersecurity measures. Furthermore, a lot of emphasis is being paid to space defense, especially in light of the development of satellite technology and its significance for military navigation, communications, and surveillance. To protect against any assaults or espionage, the United States is creating countermeasures and satellite defense systems. The increasing awareness of the importance of the cyber and space domains in contemporary national defense policy is reflected in these initiatives.

Challenges in the United States Defense Market

Rising Costs and Budget Constraints

Budgetary restrictions and growing expenses are major obstacles in the US defense industry. Despite the considerable defense budget, financial resources are under pressure due to the rising expenditures of manpower, equipment upkeep, and modern technology. Budgets may be strained by the expensive research and integration costs of emerging technologies like autonomous systems, cyber security, and artificial intelligence. The cost of maintaining and modernizing outdated military hardware also increases. The capacity to fund new initiatives or stay up with the quickly changing military requirements may be hampered by these growing costs. Therefore, keeping military preparedness without sacrificing other defense goals depends on cost control and making sure money is allocated effectively.

Technological Obsolescence and Innovation Pace

The U.S. military market faces constant difficulties due to technological obsolescence and the speed of innovation. The military needs to continuously improve its current systems and integrate cutting-edge technology like autonomous systems, cyber capabilities, and artificial intelligence in order to stay ahead of the competition. This calls for both the incorporation of new technology into older systems and ongoing investment in research and development. It is challenging to keep ahead of possible enemies while maintaining the military's flexibility in the face of new threats due to the rapidly changing nature of defensive technology. The difficulty with rapidly advancing technology is not only staying up to date with new developments but also effectively adopting them without sacrificing operational readiness or going over budget.

Northeast United States Defense Market

Due to the significant presence of government organizations, military facilities, and defense contractors, the Northeastern United States is a vital area for the military and defense-related sectors. Major defense centers with contracts in advanced technologies, cybersecurity, and aerospace are located in states like Virginia, Maryland, and New Jersey. Defense services, from R&D to manufacturing, are in great demand due to the Pentagon in Virginia and other government organizations in the area. The area gains from government investment in national security, a trained labor force, and a well-established defense infrastructure. Growing emphasis on cutting-edge technology like cybersecurity, drones, and artificial intelligence broadens market potential and draws in both big businesses and creative entrepreneurs in the defense industry.

Midwest United States Defense Market

One of the most important areas for defense production, research, and contracting is the Midwest of the United States. There are significant defense companies and military installations in states including Ohio, Michigan, Illinois, and Indiana. The aerospace, automotive, and advanced manufacturing sectors of the region's industrial base are well-known for supporting the manufacture of defense-related goods such military vehicles, planes, and naval equipment. Major corporations with a substantial presence include General Dynamics, Northrop Grumman, and Boeing. The military industry benefits from the Midwest's strong emphasis on innovation in robotics, autonomous systems, and cybersecurity. Regional defense efforts are also supported by military stations such as the Air Force bases in Illinois and Ohio. The Midwest is still vital to the U.S. military sector because of its highly qualified workforce and continuous government spending.

United States Defense Market Segments

Armed Force – Market breakup in 3 viewpoints:

- Army

- Navy

- Air Force

Type – Market breakup in 8 viewpoints:

- Fixed-wing Aircraft

- Rotorcraft

- Ground Vehicles

- Naval Vessels

- C4ISR

- Weapons and Ammunition

- Protection and Training Equipment

- Unmanned Systems

Regions – Market breakup in 4 viewpoints:

- Northeast

- Midwest

- West

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Revenue

Company Analysis:

- Lockheed Martin Corporation

- The Boeing Company

- RTX Corporation

- General Dynamics Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- CACI International Inc.

- Textron Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Armed Force, Type and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Defense Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Armed Force

6.2 By Type

6.3 By Region

7. Armed Force

7.1 Army

7.2 Navy

7.3 Air Force

8. Type

8.1 Fixed-wing Aircraft

8.2 Rotorcraft

8.3 Ground Vehicles

8.4 Naval Vessels

8.5 C4ISR

8.6 Weapons and Ammunition

8.7 Protection and Training Equipment

8.8 Unmanned Systems

9. Region

9.1 Northeast

9.2 Midwest

9.3 West

9.4 South

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Lockheed Martin Corporation

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 The Boeing Company

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 RTX Corporation

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 General Dynamics Corporation

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Northrop Grumman Corporation

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 L3Harris Technologies Inc.

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 CACI International Inc.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Textron Inc.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com