Tumor Profiling Market Size, Share & Forecast 2025-2033

Buy NowTumor Profiling Market Size and Forecast 2025-2033

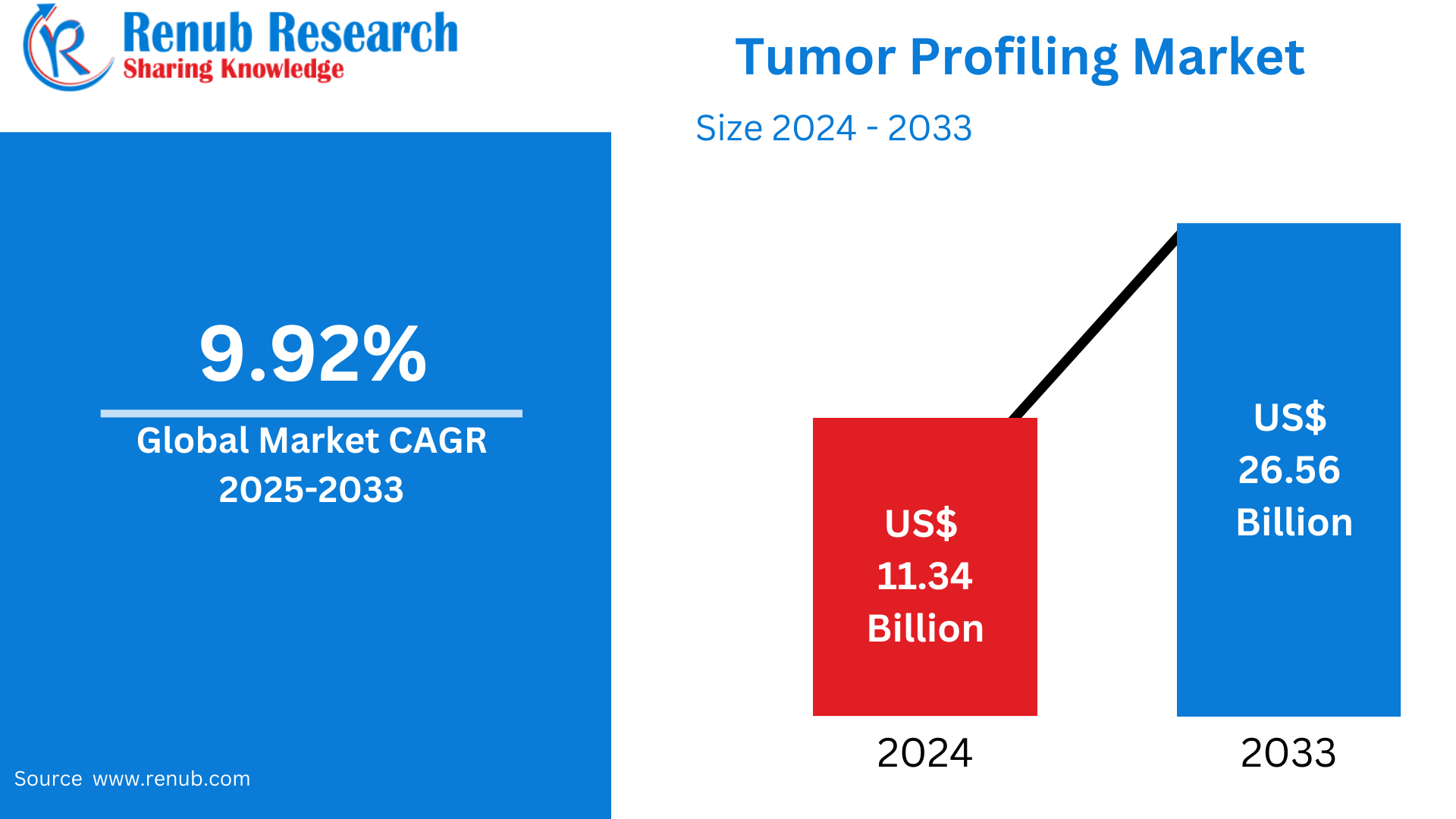

Global Tumor Profiling Market is expected to reach US$ 26.56 billion by 2033 from US$ 11.34 billion in 2024, with a CAGR of 9.92% from 2025 to 2033. The use of precision oncology, which customizes treatments according to a tumor's particular genetic composition, and the increase in cancer incidence are the main drivers of market expansion. Technological developments like next-generation sequencing are making tumor profiling faster and more accurate, which is promoting its broad use in cancer.

Tumor Profiling Global Market Report by Technique (Genomics, Proteomics, Metabolomics, Epigenetics), Technology (Immunoassays, Next-Generation Sequencing, Polymerase Chain Reaction, In Situ Hybridization, Microassays, Mass Spectrometry, Others), Application (Personalized Cancer Medicine, Oncological Diagnostics, Research), Countries and Company Analysis, 2025-2033.

Overview of Tumor Profiling Market

Due to the growing need for individualized cancer therapies and the development of genetic technologies, the worldwide tumor profiling market is expanding significantly. In order to find particular biomarkers that help direct treatment choices, tumor profiling entails examining the genetic, epigenetic, and proteomic changes that occur in cancer cells. At the vanguard of this innovation are methods like liquid biopsy, immunohistochemistry (IHC), and next-generation sequencing (NGS), which allow doctors to customize medicines for each patient, increasing effectiveness and reducing adverse effects. Tumor profiling tools that use artificial intelligence (AI) and machine learning (ML) improve data interpretation accuracy even further, enabling quicker and more accurate treatment choices.

A rising focus on customized medicine, with applications ranging from clinical diagnostics to research and medication development, is what defines the industry. Because of its strong healthcare system, large research budget, and early adoption of cutting-edge profiling technology, North America presently commands the largest share of the market. Europe is right behind, with nations like Germany and the UK making significant investments in cancer genomics. A growing cancer burden and rising healthcare expenditures are driving fast adoption in emerging Asia-Pacific regions, especially India. Notwithstanding the encouraging expansion, obstacles including exorbitant expenses, intricate data interpretation, and regulatory barriers still exist.

The aging of the population, unhealthy lifestyles, and exposure to carcinogens in the environment are some of the causes contributing to the rising prevalence of cancer worldwide. One of the main factors propelling the tumor profiling market is the growing need for cancer detection and treatment. The World Health Organization estimates that there were 9.7 million cancer-related deaths and around 20 million new cases in 2022. Precision oncology is a customized method of treating cancer that takes into account each patient's tumor's distinct genetic makeup, enhancing treatment choices and patient outcomes.

Growth Drivers for the Tumor Profiling Market

Developments in Precision Medicine and Genomics

The research of cancer and its treatment methods have been completely transformed by developments in genomic technology, such as NGS and proteomics. This is the reason for the rapid expansion of the tumor profiling market. Such cutting-edge technologies enable thorough tumor profiling, which in turn enables the development of customized treatments based on each patient's unique genetic composition. Treatment outcomes are getting better, and giving cancer patients precise care is becoming more important. According to reports, global spending in cancer treatment reached roughly USD 196 billion in 2022, growing at an average annual pace of about 12% during the previous five years. Advanced genomic technologies are increasingly being used for tumor profiling as a result of the rising need for novel diagnostic and therapeutic applications. By altering the oncology landscape and paving the path for more efficient and focused cancer therapies, these advancements are improving the prognosis for the cancer/tumor profiling industry.

Funding from the Government and Research

Tumor profiling is being boosted by the significant increase in funding and investment in precision medicine and cancer. Governments, pharmaceutical firms, and other research groups work together to develop more sophisticated profiling solutions that accelerate the development of cancer therapy and early diagnostic techniques. According to Cancer Research UK, the UK government has pledged to raise its overall spending in research and development (R&D) to 2.4% of GDP by 2027. The need for cancer/tumor profiling is driven by several projects, which highlight the increased emphasis on innovation in cancer diagnosis and therapies. In addition to increasing access to precision medicine, these investments support ground-breaking advancements in cancer therapy that are tailored to each patient's needs, which in turn drives market expansion.

Growing Cancer Prevalence

This rise has been significantly accelerated by the rising incidence of cancer worldwide. The prevalence of cancer is at its highest point, and as the need for precise and targeted diagnosis solutions to improve patient outcomes grows yearly, so does the need for sophisticated tumor profiling techniques. According to the American Cancer Society, 9.7 million people died from cancer in 2022, with roughly 20 million new cases diagnosed globally. This alarming pattern emphasizes how urgently improved diagnostic and therapeutic alternatives are needed. Furthermore, it is predicted that by 2050, there may be 35 million instances of cancer due to a combination of environmental influences, lifestyle changes, and an aging population. These figures demonstrate how tumor profiling is becoming more and more important in meeting the need for individualized treatments and increased cancer patient survival.

Challenges in the Tumor Profiling Market

High Cost of Profiling Technologies

There is substantial cost ramifications associated with the new technologies utilized in tumor profiling, including as transcriptomics, proteomics, and next-generation sequencing (NGS). These techniques need for state-of-the-art technology, which is costly to purchase and maintain. The consumables and reagents required for these tests also add to the overall high cost. The results must be analyzed by qualified staff, such as molecular biologists and bioinformaticians, which drives up expenses even further. Because healthcare funds are tight in low- and middle-income nations, this cost barrier is especially significant there. As a result, many patients could not have access to these crucial diagnostic resources, which would restrict tumor profiling's worldwide reach and efficacy in addressing inequities in cancer care.

Data Interpretation Complexity

Interpreting the enormous volumes of intricate genomic and molecular data generated by tumor profiling is a difficult undertaking. Both in-depth understanding of the cancer genome and specific bioinformatics skills are needed for the study. Because mutations might vary from one area of the tumor to another, tumor heterogeneity—the changes within a single tumor's cells—makes it even more difficult to interpret data. Furthermore, cancer mutations are constantly changing, which makes it difficult to provide reliable, useful insights. The issue is made worse by our incomplete knowledge of some genetic variations, especially in uncommon or poorly researched malignancies. Tumor profiling is more difficult to use clinically if accurate data interpretation is not available to provide individualized therapy choices.

United States Tumor Profiling Market

The market for tumor profiling in the United States is growing quickly due to improvements in genetic technology and a significant emphasis on individualized therapy. Through the analysis of genetic, epigenetic, and proteomic changes in cancer cells, tumor profiling makes it possible to find biomarkers that inform specific therapy choices. This change is mostly due to techniques like liquid biopsy, immunohistochemistry, and next-generation sequencing (NGS), which enable more precise, individualized cancer treatments with higher effectiveness and fewer adverse effects. With the help of a strong healthcare system, significant research funding, and a high degree of innovation from top medical firms, the United States is at the forefront in adopting this cutting-edge technology. The United States continues to lead the world in tumor profiling, with the goal of enhancing cancer diagnosis and treatment results, despite obstacles including exorbitant expenses and complicated data interpretation.

The American Cancer Society estimates that more than 2,041,910 new cases of cancer will occur in the United States in 2025, which will increase need for sophisticated profiling tools. Market expansion is also supported by the nation's robust research infrastructure and continuous investments in precision oncology.

Germany Tumor Profiling Market

The market for tumor profiling in Germany is expanding rapidly due to improvements in genetic technology and an emphasis on individualized therapy. Tumor profiling improves therapy results by precisely identifying biomarkers that direct targeted treatments by examining genetic, epigenetic, and proteomic alterations in cancer cells. Germany is at the forefront of the market's adoption of techniques such as liquid biopsy, immunohistochemistry (IHC), and next-generation sequencing (NGS). This expansion is further supported by the nation's strong healthcare system, large research expenditures, and the existence of top medical technology firms. Germany continues to lead the world in developing tumor profiling technology, with the goal of improving the accuracy of cancer diagnosis and therapy, despite obstacles including exorbitant prices and complicated data interpretation.

China Tumor Profiling Market

The market for tumor profiling in China is expanding quickly thanks to developments in genomic technology and a strong emphasis on customized therapy. The need for accurate diagnostic instruments and focused treatments is growing as the number of cancer patients rises. This growth is mostly due to techniques like liquid biopsy, immunohistochemistry, and next-generation sequencing (NGS), which enable doctors to customize medicines for each patient for increased effectiveness and fewer adverse effects. Accurate data interpretation is further improved by combining machine learning (ML) with artificial intelligence (AI). Despite obstacles like high costs and complicated data analysis, China is establishing itself as a leader in enhancing cancer diagnosis and treatment outcomes by adopting cutting-edge tumor profiling technologies thanks to large investments in healthcare infrastructure and cancer research.

United Arab Emirates Tumor Profiling Market

Tumor profiling is advancing significantly in the United Arab Emirates (UAE) thanks to advances in genetic technology and a dedication to customized therapy. Under the direction of M42, the Emirati Genome Programme has sequenced more than 800,000 genomes, including those of 702,000 Emiratis, making it one of the world's most extensive genetic databases. By promoting medical advancements and luring pharmaceutical firms to the area, this project seeks to diversify Abu Dhabi's economy away from fossil fuels. Next-generation sequencing (NGS), liquid biopsy, and immunohistochemistry are being incorporated into clinical practice to improve the accuracy of cancer diagnosis and enable customized treatment plans. These developments are backed by large expenditures in medical research and infrastructure, making the UAE a pioneer in implementing international cancer care technologies. It is anticipated that the UAE's emphasis on individualized therapy would continue to propel expansion in the tumor profiling market, notwithstanding obstacles including exorbitant pricing and complicated data interpretation.

Recent Developments in Tumor Profiling Industry

- In order to enhance its capabilities in oncology-related solutions, Illumina and AstraZeneca announced in October 2024 that they would be collaborating to develop novel companion diagnostics based on next-generation sequencing (NGS).

- Thermo Fisher's commitment to expanding cancer genomics diagnostic choices was demonstrated in September 2024 with the introduction of the Oncomine Comprehensive Assay Plus, a focused NGS tool intended to identify critical mutations in solid tumors.

Tumor Profiling Market Segments

Technique:

- Genomics

- Proteomics

- Metabolomics

- Epigenetics

Technology:

- Immunoassays

- Next-Generation Sequencing

- Polymerase Chain Reaction

- In Situ Hybridization

- Microassays

- Mass Spectrometry

- Others

Application:

- Personalized Cancer Medicine

- Oncological Diagnostics

- Research

Country:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

-

Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Illumina Inc.

- Qiagen N.V.

- Exact Sciences Corporation

- NeoGenomics Laboratories

- Oxford Gene Technology IP Limited

- Bruker Spatial Biology, Inc.

- GenomeDX

- Guardant Health

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Technique, Technology, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Tumor Profiling Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Tumor Profiling Market Share Analysis

6.1 By Technique

6.2 By Technology

6.3 By Application

6.4 By Countries

7. Technique

7.1 Genomics

7.2 Proteomics

7.3 Metabolomics

7.4 Epigenetics

8. Technology

8.1 Immunoassays

8.2 Next-Generation Sequencing

8.3 Polymerase Chain Reaction

8.4 In Situ Hybridization

8.5 Microassays

8.6 Mass Spectrometry

8.7 Others

9. Application

9.1 Personalized Cancer Medicine

9.2 Oncological Diagnostics

9.3 Research

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Illumina Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Qiagen N.V.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Exact Sciences Corporation

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 NeoGenomics Laboratories

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Oxford Gene Technology IP Limited

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Bruker Spatial Biology, Inc.

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 GenomeDX

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Guardant Health

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com