Semaglutide Market Size, Share, Growth & Forecast 2025–2033

Buy NowSemaglutide Market Size and Forecast 2025-2033

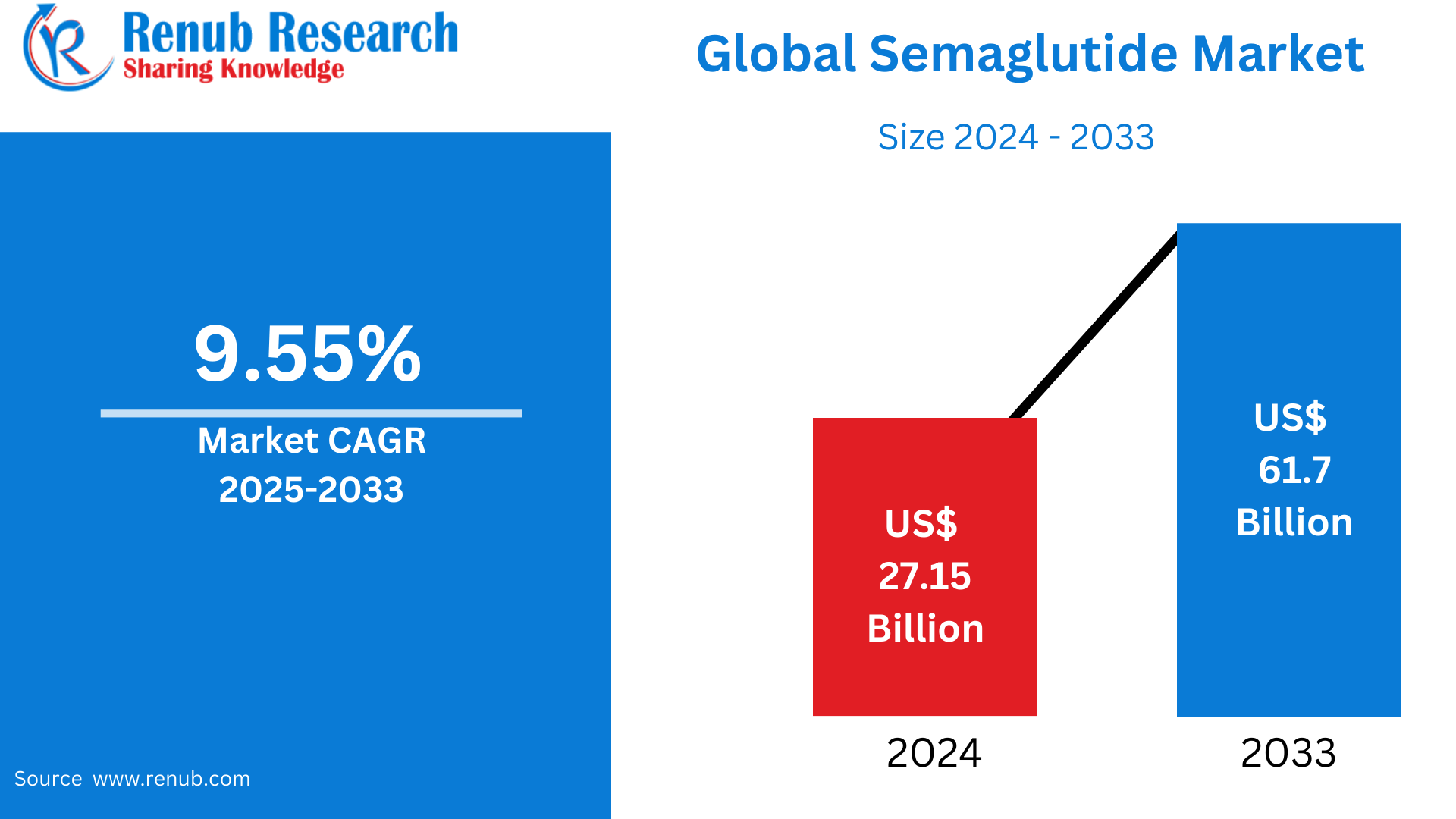

The Semaglutide market will reach US$ 61.7 billion in 2033 from US$ 27.15 billion in 2024 and is anticipated to grow at a CAGR of 9.55% from 2025 to 2033. As the incidence of obesity and type 2 diabetes increases, the efficacy of semaglutide in glycemic control and weight management is driving market demand. Growing awareness, increased approvals, and robust pipeline developments are also driving market growth worldwide.

The report Global Semaglutide Market & Forecast covers by Product (Ozempic, Rybelsus, Wegovy, Others), Application (Type 2 Diabetes, Obesity, Cardiovascular Risk Reduction), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies), Country and Company Analysis 2025-2033.

Semaglutide Market Overview

Semaglutide is a glucagon-like peptide-1 (GLP-1) receptor agonist indicated mainly for the treatment of type 2 diabetes and chronic weight management. Semaglutide acts similarly to the natural hormone GLP-1, triggering insulin secretion, inhibiting glucagon secretion, and reducing gastric emptying, all of which help to improve blood glucose levels and appetite control. Semaglutide is marketed under brand names like Ozempic, Rybelsus, and Wegovy and is administered by subcutaneous injection or oral tablet, depending on the product.

In type 2 diabetes, semaglutide reduces blood sugar levels and decreases the risk of severe cardiovascular events such as heart attack and stroke. In obese and overweight patients with at least one condition related to weight, it facilitates meaningful and durable weight loss when used in addition to lifestyle changes. Semaglutide is attracting widespread interest because of its superior efficacy compared to most other antidiabetic and anti-obesity drugs. Its increased popularity and continued clinical development for new indications indicate a bright future for this treatment.

Drivers of Growth in the Semaglutide Market

Inceased Type 2 Diabetes and Obesity Prevalence

Increased worldwide prevalence of type 2 diabetes and obesity are key drivers for the semaglutide market. Sedentary lifestyles, poor diets, and genetics all play a role in causing these conditions. Semaglutide, a GLP-1 receptor agonist, has proved effective in glycemic control and weight loss, with it being the treatment of choice. With both benefits lying in tackling hyperglycemia and obesity, it results in better patient outcomes and overall quality of life. As diagnosis and awareness improve, demand for such efficient treatments as semaglutide will increase proportionately. In 2022, 2.5 billion adults aged 18 years and above were overweight, of which more than 890 million adults were obese. This is equal to 43% of adults aged 18 years and above (43% of men and 44% of women) who were overweight; up from 1990, when 25% of adults aged 18 years and above were overweight. Overweight prevalence differed by region, ranging from 31% in the WHO South-East Asia Region and the African Region to 67% in the Region of the Americas.

Clinical Expansions and Indications

Semaglutide's therapeutic applications go beyond diabetes treatment. Its efficacy in weight loss has been demonstrated through clinical trials, and it has been approved for the treatment of obesity under brand names such as Wegovy. Current research extends its applications in reducing cardiovascular risk and other metabolic diseases. Growing approved uses increase the pool of patients for semaglutide treatment, in turn expanding its market. Regulatory approvals and favorable clinical results strengthen clinician confidence and prescribing rates. May 2025, Novo Nordisk reported that the FDA has accepted its New Drug Application for once-daily oral 25 mg formulation of Wegovy® (semaglutide) for chronic weight management in adults with obesity or overweight and associated diseases. If approved, it will be the first oral GLP-1 medication for this indication.

Advancements in Drug Delivery Systems

Breakthroughs in drug delivery have improved semaglutide's availability and patient compliance. The creation of oral forms, like Rybelsus, provides a solution to injectable administration, responding to patient choice and lowering administration hurdles. Enhanced delivery systems add to enhanced compliance, particularly among injection-phobic populations. Such advancements not only enhance patient experience but also grow the market by appealing to new consumers looking for convenient treatment. September 2024,A new delivery system makes it possible to administer semaglutide, which is used in type 2 diabetes and weight management, just once a month rather than weekly. The long-acting form may make it easier for patients to stick with their medication and increase the effectiveness of the drug by keeping levels optimal. The system uses a hydrogel that is composed of two degradable polymers, which slowly releases semaglutide over a month following a single subcutaneous injection.

Challenges in Semaglutide Market

Limited Accessibility and Steep Treatment Prices

The semaglutide treatment may prove to be financially burdensome to most patients, especially in the low- and middle-income bracket. The available insurance cover or high out-of-pocket costs is a hindrance to mass accessibility. Economic barriers influence access, which translates into uneven health consequences. Measures against cost reduction with generic options or subsidies are pivotal to mitigating this challenge so that treatment will be made freely available.

Supply Chain Limitations and Manufacturing Challenges

Satisfying the increasing demand for semaglutide has put manufacturing capacity under pressure, resulting in supply shortages in certain markets. Production intricacies, regulatory challenges, and quality control problems have the potential to upset supply chains. These limitations not only limit drug availability but also influence market expansion and patient confidence. Investment in manufacturing infrastructure and streamlined regulatory processes is needed to address these issues.

Ozempic Semaglutide Market

Ozempic, being the once-weekly injectable semaglutide, is mainly used in type 2 diabetes treatment. Its effectiveness in reducing the level of HbA1c as well as inducing weight loss has made it a preferred option among health practitioners. The fact that it is dosed weekly increases patient compliance over daily drugs. Ozempic's popularity has played a crucial role in boosting Novo Nordisk's revenues, which are a clear indication of its dominance in the market. Ongoing marketing initiatives and favorable clinical results underpin its consistent expansion in the diabetes care market.

Wegovy Semaglutide Market

Wegovy, indicated for chronic weight management, is a major breakthrough in the treatment of obesity. Clinical trials have shown significant weight loss among patients treated with Wegovy, which has been approved and widely adopted in the market. Its availability meets the unmet need for effective pharmacologic therapy in obesity, a disease with few treatment options. The success of Wegovy highlights the growing use of semaglutide in the management of metabolic health beyond glucose control.

Type 2 Diabetes Semaglutide Market

The position of semaglutide in the management of type 2 diabetes is well-established, providing important gains in glycemic control and weight loss. Its mode of action through mimicking the hormone GLP-1 stimulates insulin release and inhibits glucagon secretion, causing improved control over blood glucose. The bonus feature of weight loss tackles an essential comorbidity in patients with diabetes. Such therapeutic benefits establish semaglutide as a cornerstone in current diabetes treatment guidelines. By 2050, IDF estimates indicate that 1 in 8 adults, roughly 853 million, will have diabetes, which is up by 46%. The estimated number of individuals with diabetes is expected to increase to 853 million by 2045.

Obesity Semaglutide Market

The worldwide increase in obesity prevalence has fueled the need for successful weight management therapies. Semaglutide, with its appetite-inhibiting and satiety-promoting properties, enables massive weight reduction. Its approval for the treatment of obesity is a breakthrough in the management of this public health emergency. As knowledge about health complications resulting from obesity increases, semaglutide's contribution to holistic weight management therapies takes center stage.

Semaglutide Retail Pharmacies Market

Retail pharmacies are also important for the distribution of semaglutide, and they offer accessible points of care for patients. Pharmacists provide medication adherence counseling, side effect management, and lifestyle changes, which improve the outcomes of treatment. The large number of retail pharmacies ensures semaglutide reaches a broad population, supporting market penetration. Pharmaceutical companies' partnerships with chains of pharmacies can further simplify distribution and patient education initiatives.

Semaglutide Online Pharmacies Market

The advent of internet pharmacies revolutionized access to medication, bringing convenience and confidentiality to patients. Semaglutide's digital availability responds to the increasing interest in telemedicine services. Online pharmacies enable the filling of prescriptions, home delivery, and telemedicine consultations, which resonate with contemporary consumer demands. This delivery channel widens semaglutide's penetration, especially for technology-adopter and mobility-constrained patients.

United States Semaglutide Market

The United States is a major market for semaglutide, fueled by high rates of type 2 diabetes and obesity. Strong healthcare infrastructure, insurance, and patient awareness support its widespread use. Regulatory clearances and clinical recommendations have established semaglutide as a treatment standard. Continued research and marketing activities continue to support its market growth in the U.S. January 2025, Novo Nordisk reports that the FDA approved Ozempic® to lower the risk of worsening kidney disease, kidney failure, and cardiovascular death in adults with type 2 diabetes and CKD. This indication, added to its current uses for enhancing glycemic control and lowering large cardiovascular events in patients with heart disease, makes Ozempic® (semaglutide) the most widely indicated GLP-1 receptor agonist in its class.

Germany Semaglutide Market

Germany's market for semaglutide is driven by increasing metabolic disorder incidences and aging populations. Germany's focus on chronic disease management and preventive care fuels the uptake of successful treatments such as semaglutide. Patient access to innovative treatments is made possible through healthcare policies and reimbursement schemes. Further investments in healthcare infrastructure and public health activities are anticipated to maintain market growth.

India Semaglutide Market

India is experiencing a rising incidence of diabetes and obesity due to urbanization, lifestyle, and genetic predisposition. Semaglutide's introduction fills the gap for the effective treatment of these conditions. Healthcare access, affordability, and awareness improvement are essential for market development. Government-private partnerships can maximize distribution and patient awareness, accelerating semaglutide's uptake. Jan 2022, the Danish pharmaceutical company Novo Nordisk launched oral semaglutide in India to treat type 2 diabetes.

Saudi Arabia Semaglutide Market

The semaglutide market in Saudi Arabia is growing because of rising incidence of lifestyle diseases and government policies fostering healthcare growth. The nation's Vision 2030 focuses on transformation of the health sector, favoring the use of cutting-edge therapies. Public campaigns and investments in healthcare facilities improve treatment accessibility. These elements combined lead to the increasing demand for semaglutide in the region. April 2025, Novo Nordisk entered into a Memorandum of Understanding (MOU) with Lifera, a Saudi Public Investment Fund-owned biopharmaceutical company, to localize the production of semaglutide GLP-1 therapies in Saudi Arabia.

Semaglutide Market Segmentation

Product

- Ozempic

- Rybelsus

- Wegovy

- Others

Application

- Type 2 Diabetes

- Obesity

- Cardiovascular Risk Reduction

Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Regional Insights

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Novo Nordisk A/S

- Eli Lilly and Company

- AstraZeneca plc

- Biocon Ltd

- Johnson and Johnson

- fizer Inc

- AbbVie Inc.

- Sanofi S.A.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Semaglutide Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Semaglutide Market Share Analysis

6.1 By Product

6.2 By Application

6.3 By Distribution Channel

6.4 By Countries

7. Product

7.1 Ozempic

7.2 Rybelsus

7.3 Wegovy

7.4 Others

8. Application

8.1 Type 2 Diabetes

8.2 Obesity

8.3 Cardiovascular Risk Reduction

9. Distribution Channel

9.1 Retail Pharmacies

9.2 Hospital Pharmacies

9.3 Online Pharmacies

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Novo Nordisk A/S

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Eli Lilly and Company

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 AstraZeneca plc

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Biocon Ltd

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Johnson and Johnson

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Pfizer Inc

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 AbbVie Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Sanofi S.A.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com