North America Clinical Trials Market – Size, Trends & Forecast 2025-2033

Buy NowNorth America Clinical Trials Market Size and Forecast 2025-2033

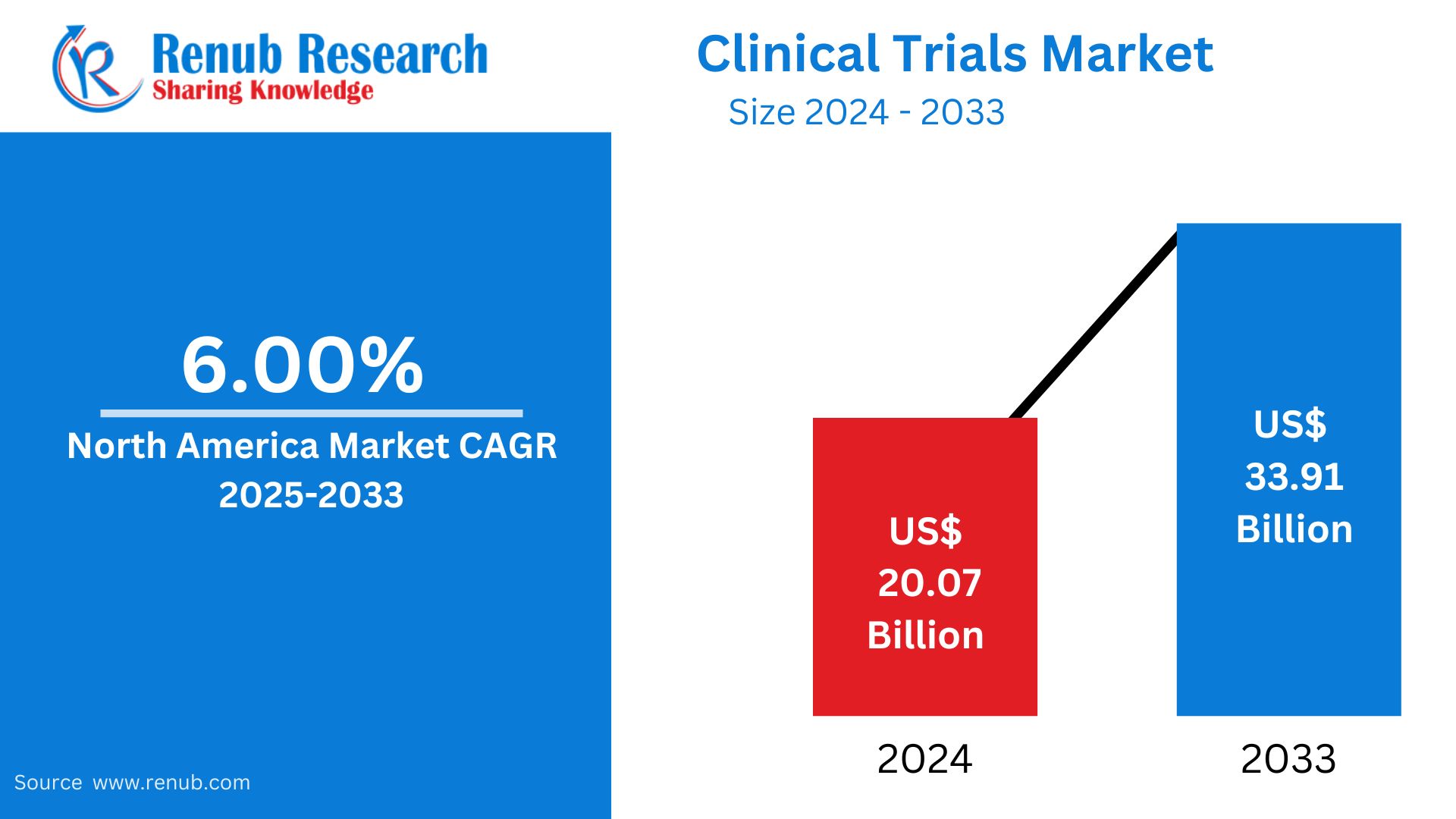

North America Clinical Trials Market is expected to reach US$ 33.91 billion by 2033 from US$ 20.07 billion in 2024, with a CAGR of 6.00% from 2025 to 2033. This is explained by longer clinical trial cycles, the demand for new treatments, and an increase in viral disorders as COVID-19 and diabetes, as well as advantageous government R&D spending.

North America Clinical Trials Market Report by Phases (Phase 1, Phase 2, Phase 3, Phase 4), Indications (Autoimmune/Inflammation, Pain management, Oncology, CNS Condition, Diabetes, Obesity, Cardiovascular, Others), Study Designs (Interventional, Observational, Expanded Access), Countries (United States, Canada, Mexico, Rest of North America) and Company Analysis, 2025-2033

North America Clinical Trials Industry Overview

The growing need for novel medicines in a variety of therapeutic areas, including neurology, cardiology, and oncology, is the main factor propelling the North American clinical trials market's constant expansion. As a market leader, the United States enjoys the advantages of strong infrastructure, top-notch research facilities, and substantial investments in innovative healthcare. Drug development procedures are becoming faster and more efficient because to technological developments like big data, artificial intelligence, and decentralized clinical trials. Government financing and support for clinical research also contribute to the market's expansion. Nonetheless, the sector is still affected by issues including regulatory barriers, trouble recruiting patients, and expensive trial operating expenses. The market is nevertheless vibrant and is anticipated to continue evolving in spite of these obstacles.

The market will expand quickly as a result of the growing number of clinical trials in North America, the pharmaceutical industry's expensive R&D costs, and the rising incidence of illnesses. Clinical trials for new or uncommon diseases are anticipated to benefit from the diverse disease profiles that are found to be growing with time due to the growing population in the North American region. Therefore, biopharmaceutical companies would be encouraged to increase their investment in clinical trials for a particular disease segment based on the number of patients with that ailment.

As of September 2022, there were over 13,323 ongoing clinical studies in various stages for cancer indications in the US, according to the US National Library of Medicine. Over the past few years, pharmaceutical corporations have likewise been spending more and more on research and development (R&D). This was mostly caused by a large number of patents expiring, which leaves many pharmaceutical companies with no choice except to create new medications. As a result, businesses are investing more in R&D to speed up the creation of medications through clinical trials, which will increase the market as a whole.

Growth Drivers for the North America Clinical Trials Market

Rising Prevalence of Chronic Diseases

One of the main factors propelling the North American clinical trials market's expansion is the growing incidence of chronic illnesses including diabetes, cancer, and cardiovascular disorders. Clinical trials are being conducted by pharmaceutical corporations and research institutions due to the growing demand for new treatments and therapies as these diseases proliferate. These studies are essential for assessing the efficacy and security of possible treatments. Clinical trials are crucial for expanding medical knowledge and enhancing patient outcomes since chronic diseases frequently call for long-term management and innovative treatment choices. An older population, which is more likely to suffer chronic illnesses, supports this trend and increases the need for ongoing clinical research and innovative therapy development.

Advancements in Technology

Technological developments are drastically changing the clinical trials environment in North America. Clinical study design, management, and execution are being improved by emerging technologies including artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies aid in the real-time analysis of massive volumes of trial data, the more accurate identification of qualified applicants, and the prediction of patient outcomes. They thereby shorten trial durations, cut down on mistakes, and enhance decision-making. AI and ML are also being used to remotely monitor patient adherence and optimize protocol design, which lowers costs and increases trial efficiency. These developments make technology a potent growth engine in the dynamic clinical research environment since they not only speed up drug development but also increase trial success rates.

Increased Investment in Oncology Research

One of the main factors propelling the growth of the clinical trials market is the rising incidence of cancer in North America, which has greatly increased funding for oncology research. The creation of novel cancer treatments is receiving a significant amount of support from public and private institutions as well as pharmaceutical firms. Clinical trials focusing on cancer, such as immunotherapies, targeted medicines, and personalized medical methods, have increased as a result of this financial boom. Research efforts have been sped up by the need to find efficient treatments and raise survival rates, which has prompted quicker trial initiation and increased cooperation between sponsors and research institutes. Since cancer is still one of the top causes of mortality, the region's clinical trial activity is growing in scope and size due to the strong emphasis on oncology research.

Challenges in the North America Clinical Trials Market

High Operational Costs

One major issue facing the clinical trials sector in North America is high operating costs. Significant costs are associated with conducting a clinical trial, such as hiring highly qualified personnel, investing in cutting-edge technology, building out the facility, adhering to regulations, and continuously gathering and tracking data. Complex trial designs, multi-site coordination, and longer study durations can all result in further increases in these expenses. Financial limitations can make it difficult for smaller biotech companies and research institutes to start or continue trials, frequently forcing them to rely on collaborations or outside funding. There is still a lot of pressure to strike a balance between cost effectiveness, data quality, and legal requirements. The cost of trials only goes up as they get more creative and customized, which is a major obstacle to larger research and development initiatives.

Regulatory Complexities

One of the biggest obstacles facing the clinical trials sector in North America is the complexity of regulations. To guarantee the safety and effectiveness of novel medications and therapies, organizations such as the U.S. Food and Drug Administration (FDA) implement strict and ever-changing regulations. Although these rules are necessary, following them can cause delays in trial approvals and raise compliance expenses dramatically. The procedure, which can be time- and resource-intensive, entails thorough documentation, ethical evaluations, and adherence to stringent criteria. Conducting multinational or multi-site studies also adds another level of complexity because different regulatory requirements in different locations need to be carefully maintained. These elements may cause delays in the start of trials, cause schedule disruptions, and increase the administrative load on sponsors and research institutions.

United States Clinical Trials Market

Thanks to a robust healthcare system, state-of-the-art research facilities, and substantial public and private investment, the US clinical trials industry is among the biggest and most developed in the world. Leading biotechnology and pharmaceutical firms, universities, and contract research organizations (CROs) that carry out a broad range of clinical investigations in many therapeutic areas are all located in the nation. Innovation and trial activity are encouraged by favorable government assistance, which includes financing from organizations like the FDA and NIH as well as regulatory advice. Furthermore, decentralized trial methods and improvements in digital health technologies are increasing patient access and optimizing operations. Notwithstanding its advantages, the market nevertheless has to contend with issues including high operating expenses, intricate legal constraints, and the constant demand for a more varied patient base.

Higher per capita healthcare spending and the incidence of both chronic and infectious diseases are factors contributing to regional growth. The market is also influenced by a number of contrast research organizations (CROs) based in the United States, including Charles River Laboratory, ICON plc, Parexel International Corporation, Syneos Health, Inc., and IQVIA. In December 2023, 145,218 studies were listed for clinical trials in the United States, making up around 31% of all clinical trials worldwide, according to the Clinicaltrial.gov report. The record for the most clinical trials in the United States is set by this surge.

Canada Clinical Trials Market

With a strong research infrastructure and a supportive regulatory environment, the clinical trials market in Canada is an essential part of the nation's healthcare and life sciences ecosystem. The country is appealing to both local and foreign sponsors conducting trials in a variety of therapeutic areas, such as neurology, infectious illnesses, and oncology, due to its efficient ethics and approval procedures. Canada's superiority in clinical research is a result of its highly educated workforce, many academic institutions, and state-of-the-art healthcare facilities. Furthermore, government assistance and public-private sector cooperation promote creativity and the creation of novel therapies. To guarantee more inclusive and successful outcomes, the market must overcome obstacles such participant recruiting, rivalry from other international research centers, and the requirement for a more diverse clinical trial population.

Mexico Clinical Trials Market

The market for clinical trials in Mexico is expanding significantly due to a number of factors, including improved regulations, cost advantages, and expanding patient access. The nation is a desirable location for clinical research outsourcing due to its close proximity to the United States and its cheaper operational costs, which include labor, site expenses, and regulatory fees. By expediting approval procedures and cutting down on clinical trial setup periods, Mexico's Federal Commission for the Protection against Sanitary Risk (COFEPRIS) has increased its attractiveness to international sponsors. Furthermore, Mexico is now a competitive center for clinical research thanks to the use of decentralized and virtual trial models, which have been sped up by developments in digital health technologies. Together, these elements support Mexico's rising stature in the world of clinical trials.

North America Clinical Trials Market Type

Phases–Market breakup in 4 viewpoints:

- Phase 1

- Phase 2

- Phase 3

- Phase 4

Indications–Market breakup in 4 viewpoints:

- Autoimmune/Inflammation

- Pain management

- Oncology

- CNS Condition

- Diabetes

- Obesity

- Cardiovascular

- Others

Study Designs–Market breakup in 4 viewpoints:

- Interventional

- Observational

- Expanded Access

Country –Market breakup in 4 viewpoints:

- United States

- Canada

- Mexico

- Rest of North America

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- ICON Plc

- Wuxi AppTec

- SGS SA

- Syneos Health

- PRA Health Sciences Inc

- Pfizer Inc.

- IQVIA

- Medpace

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Phases, Indications, Study Designs and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Clinical Trials Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Phases

6.2 By Indications

6.3 By Study Designs

6.4 By Countries

7. Phases

7.1 Phase 1

7.2 Phase 2

7.3 Phase 3

7.4 Phase 4

8. Indications

8.1 Autoimmune/Inflammation

8.2 Pain management

8.3 Oncology

8.4 CNS Condition

8.5 Diabetes

8.6 Obesity

8.7 Cardiovascular

8.8 Others

9. Study Designs

9.1 Interventional

9.2 Observational

9.3 Expanded Access

10. Countries

10.1 United States

10.2 Canada

10.3 Mexico

10.4 Rest of North America

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 ICON Plc

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Wuxi AppTec

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 SGS SA

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Syneos Health

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 PRA Health Sciences Inc

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Pfizer Inc.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 IQVIA

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Medpace

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com