Japan Ultrasound Device Market – Imaging Trends & Forecast 2025–2033

Buy NowJapan Ultrasound Device Market Size and Forecast 2025-2033

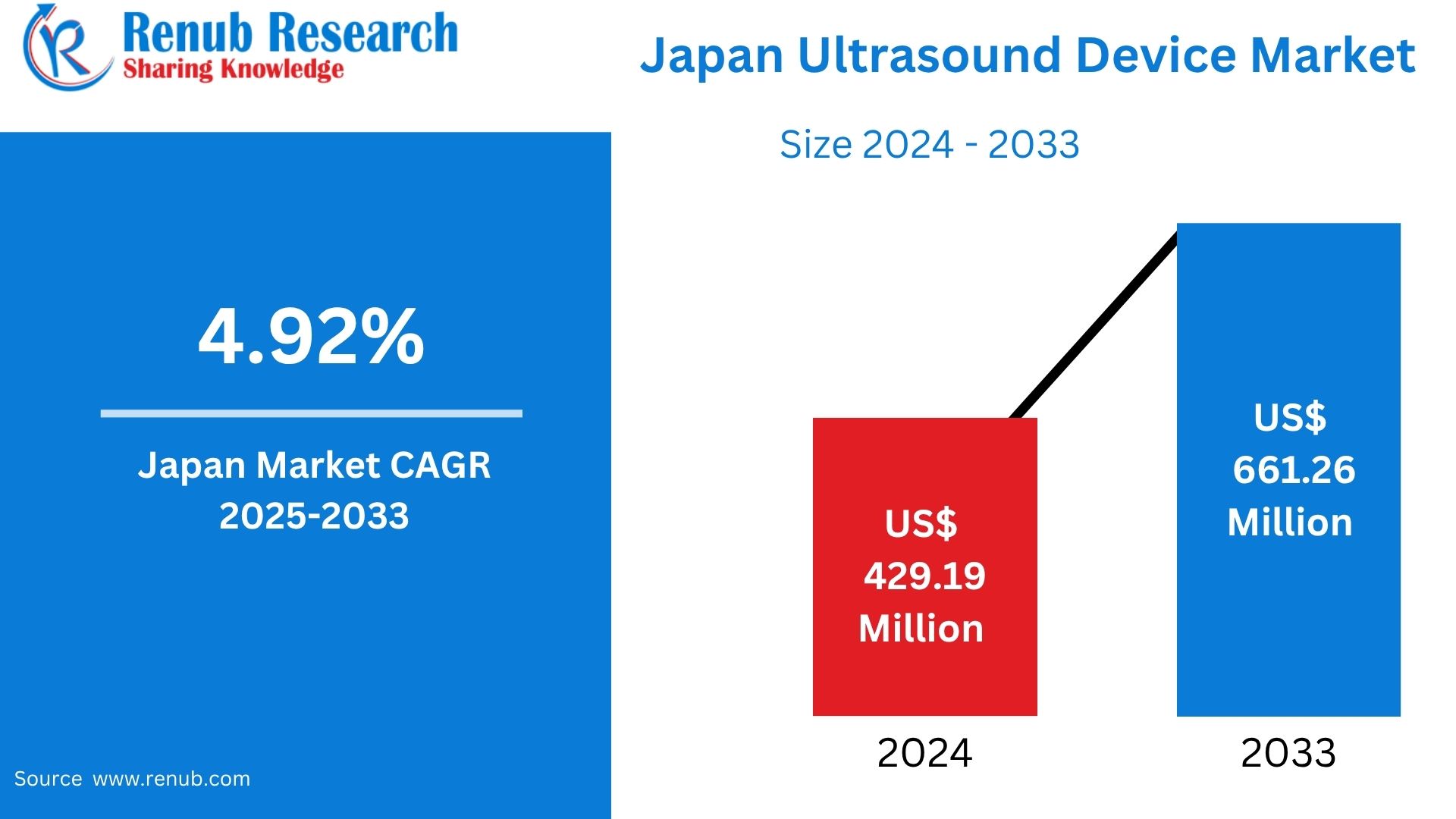

Japan Ultrasound Device Market is expected to reach US$ 661.26 million by 2033 from US$ 429.19 million in 2024, with a CAGR of 4.92% from 2025 to 2033. The market is expanding mainly because to the rising need for diagnostic imaging and therapy as well as the growing popularity of minimally invasive surgery.

Japan Ultrasound Device Market Report by Product (Diagnostic Ultrasound Systems, Therapeutic Ultrasound Systems), Portability (Trolley/Cart-based Ultrasound Devices, Compact/Handheld Ultrasound Devices), Display Type (Color Ultrasound Devices, Black & White (B/W) Ultrasound Device), Application (Radiology/General Imaging, Cardiology, Gynecology, Vascular, Urology, Others), End Users (Hospitals, Surgical Centers, Diagnostic Centers, Maternity Centers, Ambulatory Care Centers, Academic Institutions) and Company Analysis, 2025-2033.

Japan Ultrasound Device Market Overview

An ultrasound instrument, often known as a sonogram, is a piece of medical equipment that uses high-frequency acoustic waves to take real-time pictures from inside the body. Without the need for surgery, it allows medical professionals to identify problems with the kidneys, liver, ovaries, pancreas, spleen, thyroid, testicles, uterus, eyes, gallbladder, and vascular systems. Furthermore, because ultrasound doesn't rely on radiation as other imaging techniques do, it's essential for tracking fetal growth during pregnancy. It also makes it easier to place a needle precisely for operations such as biopsies or tumor treatments, examines breast abnormalities, examines the thyroid, detects problems with the genitalia and prostate, and evaluates disorders pertaining to bone metabolism.

Furthermore, research carried out in Japan revealed that the weighted prevalence of atherosclerosis and cardiovascular illnesses in the studied population was 33.5% and 37.3%, respectively, according to an article published by SpringerLink in January 2023. The source said that among the most prevalent subcategories of cardiovascular illnesses were cerebrovascular disorders, coronary heart disease, and carotid artery disease.

Additionally, a study conducted in Japan revealed that the pooled prevalence of chronic musculoskeletal pain was 39.0% in Japan, with the majority of cases occurring in men (36.3%) and women (41.8%), and that the prevalence rose with age, according to an article published in August 2022 by BMC Musculoskeletal Disorders. Therefore, it is anticipated that the high incidence of these chronic illnesses and Japan's growing elderly population would increase the use of ultrasound equipment for diagnosis, propelling the market's expansion.

Moreover, it is anticipated that the increasing advancements by major companies and other organizations—such as collaborations, agreements, product launches, and acquisitions—will boost market growth by expanding access to technologically sophisticated goods in Japan. For example, Olympus Corporation and Hitachi, Ltd. inked a five-year agreement in Tokyo in January 2021 to work together on the development of endoscopic ultrasound systems (EUS). Under this agreement, Hitachi would also keep providing Olympus with diagnostic ultrasound systems and associated components used in EUS.

Key Factors Driving the Japan Ultrasound Device Market Growth

Aging Population and Rising Chronic Diseases

One of the main drivers of the ultrasound device market's expansion in Japan is the country's growing aging population. The country has a significant prevalence of age-related chronic illnesses, with over 36 million people 65 and older, or approximately 29% of the overall population. Elderly people are more likely to suffer from conditions including cardiovascular diseases, musculoskeletal issues, and different types of cancer, which need for prompt diagnosis and ongoing monitoring. For several chronic conditions, ultrasound imaging is a non-invasive, reasonably priced, and trustworthy diagnostic method. Ultrasound technology is being adopted by hospitals, diagnostic centers, and senior care facilities as a result of Japan's ongoing demographic changes, which are increasing the need for routine medical examinations and long-term care.

Technological Advancements in Ultrasound Devices

Ultrasound technology advancements in recent years are revolutionizing diagnostic capabilities in a variety of medical specialties. The precision and detail of visualizations have increased with the incorporation of 3D and 4D imaging, which is especially helpful in specialties like cardiology, obstetrics, and gynecology. Additionally, image processing, anomaly detection, and diagnostic effectiveness are being enhanced by the application of artificial intelligence (AI) and machine learning. By enabling doctors to make clinical judgments more quickly and accurately, these technologies shorten the period between diagnosis and treatment. Improvements in imaging software and transducer technology have also resulted in better picture functionality and resolution. These advancements are speeding up the deployment of ultrasound technologies in Japanese public and private medical settings by increasing their adaptability and attractiveness to healthcare professionals.

Growth of Portable and Handheld Ultrasound Devices

The diagnostic environment in Japan is changing as a result of the growing demand for handheld and portable ultrasound instruments. These small systems are particularly useful in emergency care, ambulatory settings, and rural clinics since they are portable, easy to use, and reasonably priced. Portable ultrasound equipment provides real-time imaging at the point of care, facilitating speedier diagnosis and treatment decisions as healthcare systems strive to deliver faster and more accessible care. Their use has expanded beyond conventional hospital settings to encompass home care and field-based applications because to their lightweight form and simplicity of use. This expanding trend supports Japan's efforts to decentralize healthcare services, increase accessibility for underprivileged areas and elderly populations, and ultimately increase demand for these devices overall.

Challenges in the Japan Ultrasound Device Market

High Cost of Advanced Ultrasound Equipment

Although technological developments have greatly improved ultrasound equipment' diagnostic capabilities, they are expensive. The cost of buying, setting up, and maintaining modern systems with features like 3D/4D imaging, artificial intelligence (AI), and sophisticated imaging software is high. Accessibility is restricted by these exorbitant expenses, particularly for outpatient clinics, tiny clinics, and rural healthcare providers with tight resources. Adoption of such technology is severely hampered by its cost in Japan's non-urban areas, where medical funding and resources are frequently limited. This price barrier may hinder the nationwide adoption of state-of-the-art ultrasound technology, limiting their accessibility to larger, better-funded institutions and exacerbating the disparity in healthcare between urban and rural locations.

Market Saturation in Urban Areas

Japan's metropolitan areas, including Tokyo and Osaka, have highly developed healthcare systems and widespread access to cutting-edge medical technology, including ultrasound machines. This mature market becomes saturated, leaving little opportunity for new competitors or substantial growth for current firms. There is fierce competition and little room for expansion because the majority of large hospitals and clinics already have state-of-the-art ultrasound equipment. As a result, businesses are turning their attention to rural regions. Nevertheless, these areas frequently lack the financial resources, steady demand, and healthcare infrastructure required to encourage the use of expensive ultrasound equipment. In order to access and maintain operations in neglected and less developed regions, this urban-rural divide poses a strategic challenge that calls for specialized solutions and investments.

Market Segmentations

Product

- Diagnostic Ultrasound Systems

- Therapeutic Ultrasound Systems

Portability

- Trolley/Cart-based Ultrasound Devices

- Compact/Handheld Ultrasound Devices

Display Type

- Color Ultrasound Devices

- Black & White (B/W) Ultrasound Device

Application

- Radiology/General Imaging

- Cardiology

- Gynecology

- Vascular

- Urology

- Others

End User

- Hospitals

- Surgical Centers

- Diagnostic Centers

- Maternity Centers

- Ambulatory Care Centers

- Academic Institutions

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- GE Healthcare

- Siemens Healthcare

- Philips

- Canon INC.

- Fujifilm Holdings Corporation

- Samsung Medison Co. Ltd. (Samsung Electronics Co. Ltd.)

- Hitachi Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Product, By Portability, By Display Type, By Application and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Japan Ultrasound Devices Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By Portability

6.3 By Display Type

6.4 By Application

6.5 By End Users

7. Product

7.1 Diagnostic Ultrasound Systems

7.2 Therapeutic Ultrasound Systems

8. Portability

8.1 Trolley/Cart-based Ultrasound Devices

8.2 Compact/Handheld Ultrasound Devices

9. Display Type

9.1 Color Ultrasound Devices

9.2 Black & White (B/W) Ultrasound Device

10. Application

10.1 Radiology/General Imaging

10.2 Cardiology

10.3 Gynecology

10.4 Vascular

10.5 Urology

10.6 Others

11. End Users

11.1 Hospitals

11.2 Surgical Centers

11.3 Diagnostic Centers

11.4 Maternity Centers

11.5 Ambulatory Care Centers

11.6 Academic Institutions

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 GE Healthcare

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Siemens Healthcare

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Philips

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 Canon INC.

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 Fujifilm Holdings Corporation

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 Samsung Medison Co. Ltd. (Samsung Electronics Co. Ltd.)

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 Hitachi Ltd.

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com