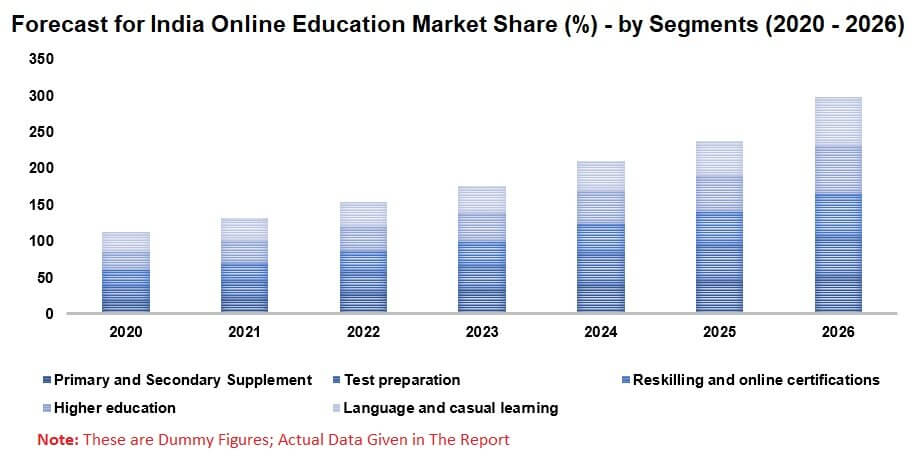

India Online Education Market, By Segments (Primary and Secondary Supplement, Test preparation, Reskilling and online certifications, Language and casual learning), Company Analysis

Buy NowGet Free Customization in This Report

Online education in India has witnessed an enhanced acceptance over a few years. It is becoming an integral part of the school, colleges and even in offices across India. One of the advantages of online education has is that this kind of education model is easily scalable. The Indian government is also allowing the universities to offer fully online degrees a change that could reshape the education industry in the country. According to our analysis, India Online Education Market will be US$ 8.6 Billion by 2026.

Easy availability of the internet is the primary reason for the growth of online education in India. Between 2019 and 2020 the number of internet users in India increased by 128 million. For the first time, rural India has more number of internet users compared to urban India. According to a report by Internet & Mobile Association of India (IAMAI) and Nielsen, there were 227 Million internet users in rural India compared to 205 Million in urban India.

Factors Driving India E-learning Market

1. Improvement in internet connectivity due to the low cost of 4G data.

2. Growth in smartphone penetration.

3. Online education cost is comparatively small compared to traditional programmes.

4. Favourable e-learning government policies such as e-Basta, SWAYAM and Digital India

5. Rising demand among working professionals due to the flexibility of time.

COVID impact on Online Education Industry in India

Due to pandemic coronavirus schools, colleges and other educational institutions are witnessing a shift towards online learning. As India was under lockdown, e-learning changed the perception of education. The digital education market has a bright future ahead as even when the schools will reopen; they will have to work with reduced classroom strength, to ensure social distancing.

Renub Research report titled “India Online Education Market, By Segments (Primary and Secondary Supplement, Test preparation, Reskilling and online certifications, Higher education, Language and casual learning) Education Business Model, Technology Innovation, Government Policies and Initiatives, Company (BYJU’S, Doubtnut, UpGrad, TestBook, Toppr, Unacademy, Vedantu)"

India Online Education Market by Segments

• Primary and Secondary Supplemental

• Test Preparation

• Reskilling and Online Certifications

• Higher Education

• Language and Casual learning

All the companies have been studied from three points

• Overview

• Recent Developments & Strategy

• Sales Analysis

Company Analysis

• BYJU’S

• Doubtnut

• UpGrad

• TestBook

• Toppr

• Unacademy

• Vedantu

Report also covers

• India Online Education Business Model

• Technology Innovation

• Government Policies and Initiatives

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Online Education Market

5.1 Market Size

5.2 Consumption Behavior Snapshot

5.3 Future Outlook for Online Educator

6. Market Share – India Online Education Market by Segment

7. Segments – India Online Education Market

7.1 Primary and Secondary Supplement

7.2 Test preparation

7.3 Reskilling and online certifications

7.4 Higher education

7.5 Language and casual learning

8. India Online Education Business Model

9. Technology Innovation

10. Government Policies and Initiatives

11. Company Analysis

11.1 BYJU’S

11.1.1 Business Overview

11.1.2 Recent Development & Strategy

11.1.3 Sales Analysis

11.2 Doubtnut

11.2.1 Business Overview

11.2.2 Recent Development & Strategy

11.2.3 Sales Analysis

11.3 UpGrad

11.3.1 Business Overview

11.3.2 Recent Development & Strategy

11.3.3 Sales Analysis

11.4 TestBook

11.4.1 Business Overview

11.4.2 Recent Development & Strategy

11.4.3 Sales Analysis

11.5 Toppr

11.5.1 Business Overview

11.5.2 Recent Development & Strategy

11.5.3 Sales Analysis

11.6 Unacademy

11.6.1 Business Overview

11.6.2 Recent Development & Strategy

11.6.3 Sales Analysis

11.7 Vedantu

11.7.1 Business Overview

11.7.2 Recent Development & Strategy

11.7.3 Sales Analysis

List of Figures:

Figure-01: India – Online Education Market (Million US$), 2016 – 2019

Figure-02: India – Forecast for Online Education Market (Million US$), 2020 – 2026

Figure-03: India – Primary and Secondary Supplement Market (Million US$), 2016 – 2019

Figure-04: India – Forecast for Primary and Secondary Supplement Education Market (Million US$), 2020 – 2026

Figure-05: India– Test Preparation Education Market (Million US$), 2016 – 2019

Figure-06: India – Forecast for Test Preparation Education Market (Million US$), 2020 – 2026

Figure-07: India – Reskilling and Online Certifications Market (Million US$), 2016 – 2019

Figure-08: India – Forecast for Reskilling and Online Certifications Market (Million US$), 2020 – 2026

Figure-09: India – Higher Education Market (Million US$), 2016 – 2019

Figure-10: India – Forecast for Higher Education Market (Million US$), 2020 – 2026

Figure-11: India – Language and Casual Learning Market (Million US$), 2016 – 2019

Figure-12: India – Forecast for Language and Casual Learning Market (Million US$), 2020 – 2026

Figure-13: BYJU’S – Global Revenue (Million US$), 2018 – 2019

Figure-14: BYJU’S – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-15: Doubtnut – Global Revenue (Million US$), 2018 – 2019

Figure-16: Doubtnut – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-17: UpGrad – Global Revenue (Million US$), 2018 – 2019

Figure-18: UpGrad – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-19: TestBook – Global Revenue (Million US$), 2018 – 2019

Figure-20: TestBook – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-21: Toppr – Global Revenue (Million US$), 2018 – 2019

Figure-22: Toppr – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-23: Unacademy – Global Revenue (Million US$), 2018 – 2019

Figure-24: Unacademy – Forecast for Global Revenue (Million US$), 2020 – 2026

Figure-25: Vedantu – Global Revenue (Million US$), 2018 – 2019

Figure-26: Vedantu – Forecast for Global Revenue (Million US$), 2020 – 2026

List of Tables:

Table-1: India – Market Share By Segments (Percent), 2016 – 2019

Table-2: India – Forecast for Market Share By Segments (Percent), 2020 – 2026

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com