India Cashew Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Cashew Market Size and Forecast 2025-2033

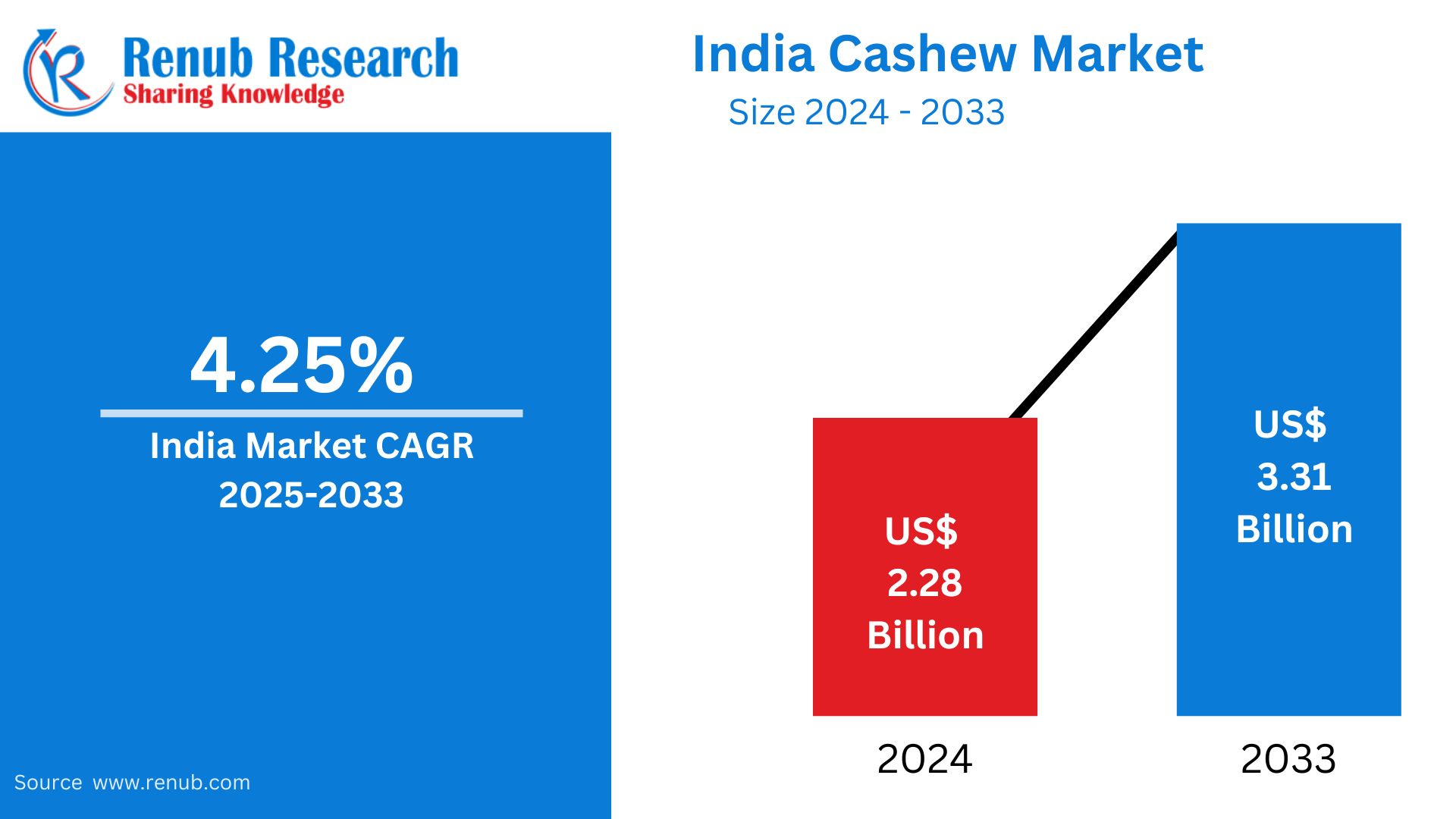

India Cashew Market is expected to reach US$ 3.31 billion by 2033 from US$ 2.28 billion in 2024, with a CAGR of 4.25% from 2025 to 2033. Growing health consciousness, increased domestic consumption, and growing export prospects are the main factors propelling the cashew industry in India. Domestic demand is increasing as health-conscious customers choose nutrient-dense foods like cashews. Furthermore, the United States, the United Arab Emirates, and Japan continue to be major cashew consumers, making India a top exporter of cashews.

The report India Cashew Market & Forecast covers by Cashew Production Market - By States (Maharashtra, Andhra Pradesh, Orissa, Karnataka, Tamil Nadu, Kerala, Others), Cashew Export Market – By Countries (UAE, Netherland, Japan, Saudi Arabia, Vietnam, Others) and Company Analysis, 2025-2033.

India Cashew Market Overview

In terms of both production and exports, India's cashew sector makes a substantial economic contribution to the country. India grows more than 0.8 million tonnes of cashews a year on an area of about 0.7 million hectares. Tamil Nadu, Karnataka, Odisha, Andhra Pradesh, and Maharashtra are the main cashew-producing states. The industry plays a significant role in rural employment, employing around 1.5 million people in the farming and processing sectors.

With areas like Kollam in Kerala serving as key hubs, India leads the world in cashew processing. The UAE, Japan, the Netherlands, and the US are among the more than 60 countries to which the nation exports cashew kernels. Through increased cultivation and the use of high-yield cultivars, government programs like the Rashtriya Krishi Vikas Yojana (RKVY) and the Mission for Integrated Development of Horticulture (MIDH) seek to increase production.

People who eat nuts more than four times a week can lower their risk of coronary heart disease by 37%, per a study published in the British Journal of Nutrition. Given these findings, it is anticipated that more cashews will be utilized in the production of snack bars, a nutritious substitute for high-calorie chocolate bars. For the majority of businesses, cashew consumption and value addition result in new projects and advancements. They are making progress on projects involving cashew pulp and other items made from cashews.

For example, Sahyadri Farms established the largest cashew processing facility in Nashik in 2023, capable of processing 100 metric tons of cashews daily. The plant's economic value is increased by producing cashew oil from the shells during the cashew processing process.

Growth Drivers for the India Cashew Market

Changing Consumption Patterns

Beyond their customary use as festive or infrequent treats, cashews are fast becoming a mainstay in Indian homes. More accessibility through contemporary retail channels and changing consumer habits are the main drivers of this shift. A larger population now has easier access to cashews due to the quick growth of supermarkets, hypermarkets, and online shopping platforms. Furthermore, cashews are becoming more and more versatile in Indian kitchens as they are used in a wide range of commonplace culinary applications, from snacks and plant-based recipes to gravies and desserts. This tendency is further supported by the ease of packaged, ready-to-eat cashew goods and the allure of value-added options like roasted or flavored variants. Domestic demand is rising dramatically in urban and semi-urban regions as a result of these changing consumption patterns.

Product Innovation

The expansion of the cashew industry in India is largely due to product innovation, as brands are putting more of an emphasis on flavored, organic, and value-added variations. These days, consumers are drawn to products that offer both taste and nutrition, such as cashews that are chili-roasted, honey-coated, or masala-flavored. Customers who are concerned about their health and the environment are drawn to organic cashews since they are devoid of artificial chemicals and pesticides. Furthermore, value-added goods like cashew milk, cashew butter, and snack bars are becoming more and more well-liked, particularly among vegan and lactose-intolerant customers. These developments enable businesses reach a larger audience in both local and international markets by improving shelf presence and brand uniqueness in addition to satisfying the needs of niche customers.

Health and Wellness Trends

As a wholesome snack that fits in nicely with growing health and wellness trends, cashews have become more and more popular. They are abundant in vital minerals like copper, zinc, and magnesium, as well as heart-healthy monounsaturated fats and vitamins B6 and E. Cashews are a popular choice for consumers who are concerned about their health because of their nutrients, which promote heart health, immune system function, and general well-being. As a result, there is now a greater demand for creative plant-based substitutes in addition to raw and roasted cashews. Among vegans and those who are lactose intolerant, products like cashew milk, cashew butter, and dairy-free cheeses are becoming more popular. The market for cashews is expanding both domestically and internationally due to consumers' preference for clean-label, nutrient-dense goods.

Challenges in the India Cashew Market

Outdated Processing Technology

In the Indian cashew business, outdated processing technology continues to be a significant obstacle. For shelling, peeling, and grading cashews, many small and medium-sized businesses still use time-consuming, traditional processes. This impacts consistency in quality and yield in addition to lowering productivity and raising labor expenses. Indian processors find it challenging to compete with technologically advanced nations like Vietnam, where automated systems have dramatically increased productivity and decreased prices, due to the lack of contemporary technology and automation, which limits scalability and operational efficiency. The industry runs the risk of becoming even less competitive globally if modernization is not funded on time, which will make it more difficult to meet growing domestic demand and maintain export market share.

Labor Shortages and Skill Gaps

Labor shortages and skill gaps are becoming serious issues for the Indian cashew processing industry. The industry, which historically relied on manual labor for jobs like peeling and shelling, is currently experiencing a labor shortage as younger generations avoid these physically taxing and frequently dangerous occupations. Interest can be further discouraged by the potential for respiratory and skin irritation from handling raw cashews. Because of this, many processing facilities have trouble hiring qualified personnel, which causes operations to lag and production to decline. In addition to raising wages, the labor shortage has raised manufacturing costs overall. The industry runs the danger of long-term operational inefficiencies and decreased global competitiveness if focused efforts are not made in skill development, training programs, and better working conditions.

Maharashtra Cashew Market

Approximately one-fourth of India's cashew crop comes from Maharashtra, making it a major contributor to the country's cashew sector. Large-scale cashew agriculture is supported by the state's ideal coastline environment, especially in districts like Ratnagiri, Sindhudurg, and Kolhapur. Despite this, Maharashtra is the biggest importer in India due to issues like pest infestations, climate-related output changes, and its reliance on imported raw cashew nuts. The processing industry is still primarily labor-intensive and small-scale, with little technical developments and a lack of qualified staff.

The Maharashtra Cashew Board intends to increase cultivation by 12,000 hectares over three years, emphasizing high-density, high-yielding, and organic types, in order to overcome these problems. This program seeks to increase production while lowering imports of raw materials by 25%. Furthermore, initiatives are being made to market value-added goods like wine and cashew apple juice, which have the potential to increase agricultural revenues by 20%. The plan to increase the state's standing in the international cashew market also includes the construction of model nurseries, farmer training initiatives, and upgraded processing facilities.

Kerala Cashew Market

A Once a global leader, Kerala's cashew industry is today dealing with serious difficulties. With a production of only 83,000 MT of raw cashew nuts compared to a demand of 600,000 MT, the state currently ranks fifth in production and sixth in area among Indian states. The low productivity of conventional crops and a decrease in the area used for cashew farming are the causes of this deficit.

Ninety-five percent of the 300,000 workers in the business are women. However, a shortage of raw materials and high operating expenses have forced the closure of some processing facilities, particularly in Kollam. In order to increase output without compromising the livelihood of workers, the Kerala State Cashew Development Corporation (KSCDC) has started the process of acquiring raw cashew nuts from African governments and is partially mechanizing the process.

Vietnam Cashew Market

Vietnam is a major exporter of processed cashews and a major player in the worldwide cashew market. Vietnam receives a lot of raw cashews from India, one of the biggest exporters of cashew nuts, for processing. The cashew business in Vietnam has experienced tremendous expansion, and the nation is now the world's top exporter of cashew kernels. Over 730,000 tons of processed cashews were exported by Vietnam in 2024, bringing in a record $4.37 billion. This success is mostly due to Vietnam's effective processing capabilities, as the nation processes over 80% of the cashew supply worldwide. Vietnam's cashew business continues to dominate international markets in spite of obstacles like growing shipping costs and a minor drop in domestic supply of raw materials.

India Cashew Market Segmentation

Cashew Production Market - By States, Market breakup in 7 viewpoints:

- Maharashtra

- Andhra Pradesh

- Orissa

- Karnataka

- Tamil Nadu

- Kerala

- Others

Cashew Export Market – By Countries, Market breakup in 6 viewpoints:

- UAE

- Netherland

- Japan

- Saudi Arabia

- Vietnam

- Others

All the Key players have been covered from 4 Viewpoints:

- Key Person

- Overview

- Revenue Analysis

- Recent development & Strategy

Company Analysis:

- Wonderland Foods

- Kalbavi Cashews

- Britannia Industries Limited

- Haldirams

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Production by States and Export by Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Cashew Market

6. Market Share

6.1 Production by States

6.2 Export Share by Countries

7. Cashew Production Market – By States

7.1 Maharashtra

7.2 Andhra Pradesh

7.3 Orissa

7.4 Karnataka

7.5 Tamil Nadu

7.6 Kerala

7.7 Others

8. Cashew Export Market – By Countries

8.1 UAE

8.2 Netherland

8.3 Japan

8.4 Saudi Arabia

8.5 Vietnam

8.6 Others

9. Porter’s Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Key Players Analysis

11.1 Wonderland Foods

11.1.1 Key Person

11.1.2 Overview

11.1.3 Recent Development

11.1.4 Revenue Analysis

11.2 Kalbavi Cashews

11.2.1 Key Person

11.2.2 Overview

11.2.3 Recent Development

11.2.4 Revenue Analysis

11.3 Britannia Industries Limited

11.3.1 Key Person

11.3.2 Overview

11.3.3 Recent Development

11.3.4 Revenue Analysis

11.4 Haldirams

11.4.1 Key Person

11.4.2 Overview

11.4.3 Recent Development

11.4.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com