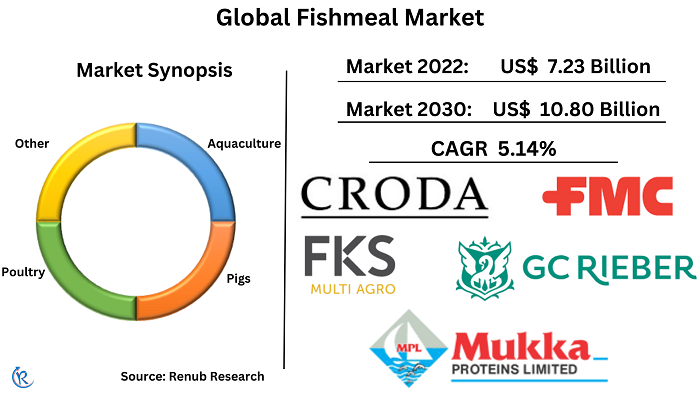

Fish Meal Market, Size, Global Forecast 2023-2030, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowFish Meal Market Analysis

Global Fish Meal Market is anticipated to be US$ 10.80 Billion in 2030, according to Renub Research. Fish meal has been a key player in the expansion and intensification of aquaculture on a global scale, making it an essential component of aquaculture feeds. With the increasing demand for fish production, the need for nutritious and high-quality feeds became paramount. Fish meal emerged as a valuable ingredient due to its exceptional nutritional composition. It is rich in essential amino acids, minerals, and omega-3 fatty acids, making it an ideal protein source for farmed fish.

By incorporating fish meal into aquaculture feeds, farmers have been able to achieve efficient growth and development in their fish populations. The inclusion of fish meal ensures that fish receive the necessary nutrients to thrive and reach their full potential. Fishmeal's contribution to the aquaculture story cannot be overstated. It has paved the way for the development of feeds that support the sustainable intensification of aquaculture operations worldwide.

The fish meal Industry is experiencing significant growth due to multiple factors.

- The expanding aquaculture industry and the rising demand for high-quality seafood products are driving the demand for fish meal. As aquaculture continues to grow, the need for nutritious feed ingredients becomes crucial, and fish meal is recognized for its nutritional value.

- Environmental concerns also contribute to the demand for fish meal as a naturally-sourced alternative to chemical-based feed additives. With increasing awareness of the negative impacts of chemical additives on the aquatic ecosystem, there is a growing preference for sustainable and environmentally-friendly options like fish meal.

- The presence of heavy metals such as mercury, lead, and cadmium in conventionally-cultured seafood has raised concerns about high prevalence of numerous chronic disorders to consumer health. This has further propelled the market for fish meal, as it provides a safer alternative for feed production, reducing the risk of consuming contaminated seafood.

- The industrialization of meat and dairy production has boosted the demand for high-grade feed additives like fish meal. These additives are utilized to stimulate reproduction, enhance metabolism, and mitigate disease outbreaks in livestock. As the meat and dairy industries continue to grow, the need for effective feed ingredients intensifies.

Global fish meal market is expected to grow at a CAGR of 5.14% between 2022 and 2030

Consumer preferences for fish meal are evolving as environmental and ethical awareness increases. The demand for sustainable and ethically sourced fish meal is rising, with consumers willing to pay extra for such products. Key references include sustainability, ethics, quality, and value. Consumers seek responsibly sourced fish meal that does not harm animals or the environment, meet safety standards, and offers good value. In response, the global fish meal market is adopting sustainable practices, investing in R&D, and enhancing traceability. Adapting to these preferences is crucial for industry competitiveness, and companies meeting consumer demands will thrive.

Peru holds a prominent position as the leading producer in the global fish meal market

By Production, the global fish meal market is classified into Peru, Vietnam, EU-27, Chile, China, Thailand, United States, Norway, Japan, and Morocco. Peru, the world's largest fishmeal producer, accounted for producing 2.28 million metrictons (MMT) of fish meal, as reported by the International Fishmeal and Fish Oil Organization (IFFO), in 2022. This versatile product is utilized in aquaculture feed, poultry feed, and pet food, providing essential nutrition to farmed fish, marine animals, chickens, turkeys, and pets like dogs and cats. With increasing demand for aquaculture products and a growing global population, the demand for fishmeal is anticipated to maintain its upward trajectory, driving further growth in the Peruvian fish meal industry in the foreseeable future.

Norway, the fastest growing country in the global fish meal market, benefits from a robust aquaculture industry and abundant fish resources. The country's focus on research and development has led to technological advancements in fishmeal production. Government support through subsidies and incentives further strengthens Norway position as a leader in the fish meal market.

Turkey robust aquaculture industry is playing a pivotal role in driving the country rising consumption within the global fishmeal market

By Consumption, the global fish meal market is broken up into China, EU-27, Vietnam, Japan, Norway, Thailand, Turkey, United States, Chile, and Taiwan. Turkey leads the global fishmeal market in consumption growth, driven by its expanding aquaculture industry supported by increasing seafood demand, government support, and favorable resources. With a decline in domestic fish catch, Turkey relies heavily on imported fishmeal to meet its aquaculture sector's protein requirements. Economic growth and rising disposable incomes contribute to the growing demand for quality seafood products and, subsequently, fishmeal. The Turkish government's policies, including subsidies, research and development investments, and seafood promotion, further bolster the aquaculture industry expansion and drives fishmeal demand.

China, the largest global consumer of fishmeal, accounted consumption volume of less than 2 million metric tons in 2022, according to Renub Research. The country's thriving aquaculture industry, driven by increasing seafood demand, government support, and abundant resources, fuels its continuous expansion. Supportive government policies, such as subsidies, research investments, and seafood promotion, create a favourable environment for industry growth and contribute to the growing demand for fishmeal.

China is poised to retain its position as the largest importer of fishmeal globally, maintaining its significant role in the market for the foreseeable future.

By Import, the global fishmeal market is fragmented into China, EU-27, Turkey, Japan, Norway, Vietnam, Taiwan, Indonesia, United Kingdom, and the Republic of Korea. China, the largest global fishmeal importer, owes its position to rapid economic growth that has driven a surge in fishmeal demand, mainly for aquaculture purposes. Simultaneously, declining domestic fish stocks resulting from overfishing and environmental degradation have escalated the need for imports. To bolster the aquaculture industry, the Chinese government has implemented supportive policies, including subsidies for fishmeal imports. Moreover, China's advantageous geographic location near major fishmeal producers like Peru and Chile facilitates convenient and cost-effective importation.

Russian Federation is poised to flourish as a key player in the export segment of the global fish meal market in the coming years

By Export, the global fish meal market is divided into Peru, Chile, Vietnam, EU-27, Morocco, United States, Thailand, Russian Federation, Iceland, and Mexico. In 2022, the Russian Federation emerged as a notable player in fishmeal production and export, with an estimated 1.5 million metric tons shipped. This growth can be attributed to various factors, such as the availability of plentiful fish resources, the presence of advanced fish processing facilities, and government backing. The fishmeal industry in the country contributes significantly to the economy by generating employment opportunities, generating tax revenue, and bolstering export figures. It also plays a role in conserving fish stocks by alleviating the pressure on low-value fish species that are commonly used in fishmeal production.

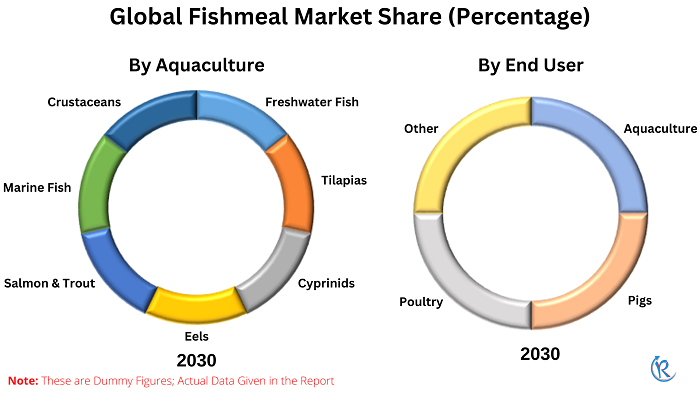

Crustaceans, such as shrimp, crab, and lobster, hold a dominant position in the global fishmeal market owing to their abundant availability and exceptional nutritional value

By Aquaculture, the global fishmeal market is categorized into Freshwater Fish, Tilapias, Cyprinids, Eels, Salmon & Trout, Marine Fish, and Crustaceans. Crustaceans provide a rich source of protein, essential fatty acids, and vitamins, making them valuable for aquaculture feed in fish and shrimp production. Their relatively easy harvesting process ensures a sustainable protein source with low environmental impact compared to other fishmeal production methods. As aquaculture gains popularity as an efficient seafood production method, the global demand for fishmeal is expected to increase. Crustaceans are well-positioned to maintain their market dominance due to their nutritional value, abundance, and ease of harvest.

Tilapia, a versatile freshwater fish, has significant potential in the global fishmeal market due to its adaptability, suitability for aquaculture in developing countries, and high protein content. The growing demand for aquaculture products and seafood as a protein source is driving the expansion of tilapia production. Its sustainability attributes and advancements in technology further boost its growth in the global fishmeal market.

Seafood demand increases and concerns over depleting wild fish stocks rise, the global fishmeal market expands alongside the growth of sustainable aquaculture practices

By end-users, the global fishmeal market is categorized into Aquaculture, Pigs, Poultry, and Others. Aquaculture offers an eco-friendly approach through closed systems and benefits from advancements in technology, leading to the expansion of aquaculture farms and higher demand for fishmeal. Government support in the form of subsidies, research funding, and favorable regulations further boosts aquaculture growth. So, the global aquaculture industry is expected to continue expanding, driving the demand for fishmeal, and positively impacting the global fishmeal market.

Competitive Landscape

FMC Corporation, Croda International Plc., Mukka Proteins Limited, FKS Multi Agro, and GC Rieber Oil are the companies prominent in the global fishmeal market.

- In February 2022, FMC announced that it had entered into a strategic partnership with Cargill to develop and commercialize new aquaculture nutrition products. This partnership will combine FMC's expertise in fishmeal and fish oil with Cargill's global reach and distribution network.

Renub Research report titled “Global Fishmeal Market by Production (Peru, Vietnam, EU-27, Chile, China, Thailand, United States, Norway, Japan, and Morocco), Consumption (China, EU-27, Vietnam, Japan, Norway, Thailand, Turkey, United States, Chile, and Taiwan, Province of China), Export (Peru, Chile, Vietnam, EU-27, Morocco, United States, Thailand, Russian Federation, Iceland, and Mexico), Import (China, EU-27, Turkey, Japan, Norway, Vietnam, Taiwan, Province of China, Indonesia, United Kingdom, and the Republic of Korea), Aquaculture (Freshwater Fish, Tilapias, Cyprinids, Eels, Salmon & Trout, Marine Fish, and Crustaceans), End-User (Aquaculture, Pigs, Poultry, and Others), Company Analysis (FMC Corporation, Croda International Plc., Mukka Proteins Limited, FKS Multi Agro, and GC Rieber Oil)" provides complete study of the Global Fishmeal Market.

Global Fishmeal Market & Volume break up in 10 viewpoints

1. China

2. EU-27

3. Vietnam

4. Japan

5. Norway

6. Thailand

7. Turkey

8. United States

9. Chile

10. Taiwan

Production – Global Fishmeal Market break up in 10 viewpoints

1. Peru

2. Vietnam

3. EU-27

4. Chile

5. China

6. Thailand

7. United States

8. Norway

9. Japan

10. Morocco

Export – Global Fishmeal Market break up in 10 viewpoints

1. Peru

2. Chile

3. Vietnam

4. EU-27

5. Morocco

6. United States

7. Thailand

8. Russian Federation

9. Iceland

10. Mexico

Import – Global Fishmeal Market break up in 11 viewpoints.

1. China

2. EU-27

3. Turkey

4. Japan

5. Norway

6. Vietnam

7. Taiwan

8. Province of China

9. Indonesia

10. United Kingdom

11. Republic of Korea

Aquaculture – Global Fishmeal Market break up in 7 viewpoints.

1. Freshwater Fish

2. Tilapias

3. Cyprinids

4. Eels

5. Salmon & Trout

6. Marine Fish

7. Crustaceans

End-User – Global Fishmeal Market break up in 4 viewpoints.

1. Aquaculture

2. Pigs

3. Poultry

4. Others

Company has been covered from 3 Viewpoints:

• Overview

• Recent Developments

• Revenue

Company Analysis:

1. FMC Corporation

2. Croda International Plc.

3. Mukka Proteins Limited

4. FKS Multi Agro

5. GC Rieber Oil

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 – 2022 |

| Forecast Period | 2023 – 2030 |

| Market | US$ Billion |

| Segment Covered | Consumption, Production, Export, Import, Aquaculture, & End Users |

| Companies Covered | FMC Corporation, Croda International Plc., Mukka Proteins Limited, FKS Multi Agro, and GC Rieber Oil |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. Global Fishmeal Market

6. Share Analysis - Global Fishmeal Volume

6.1 By Production

6.2 By Consumption

6.3 By Import

6.4 By Export

7. Share Analysis

7.1 By Aquaculture

7.2 By End Users

8. Global Fishmeal Market and Volume

8.1 China

8.1.1 Market

8.1.2 Volume

8.2 EU-27

8.2.1 Market

8.2.2 Volume

8.3 Vietnam

8.3.1 Market

8.3.2 Volume

8.4 Japan

8.4.1 Market

8.4.2 Volume

8.5 Norway

8.5.1 Market

8.5.2 Volume

8.6 Thailand

8.6.1 Market

8.6.2 Volume

8.7 Turkey

8.7.1 Market

8.7.2 Volume

8.8 United States

8.8.1 Market

8.8.2 Volume

8.9 Chile

8.9.1 Market

8.9.2 Volume

8.10 Taiwan

8.10.1 Market

8.10.2 Volume

9. Producing Countries – Global Fishmeal Volume

9.1 Peru

9.2 Vietnam

9.3 Eu-27

9.4 Chile

9.5 China

9.6 Thailand

9.7 United States

9.8 Norway

9.9 Japan

9.10 Morocco

10. Importing Countries – Global Fishmeal Volume

10.1 China

10.2 Eu-27

10.3 Turkey

10.4 Japan

10.5 Norway

10.6 Vietnam

10.7 Taiwan, Province Of China

10.8 Indonesia

10.9 United Kingdom

10.10 Republic Of Korea

11. Exporting Countries - Global Fishmeal Volume

11.1 Peru

11.2 Chile

11.3 Vietnam

11.4 Eu-27

11.5 Morocco

11.6 United States

11.7 Thailand

11.8 Russian Federation

11.9 Iceland

11.10 Mexico

12. Aquaculture

12.1 Freshwater Fish

12.2 Tilapias

12.3 Cyprinids

12.4 Eels

12.5 Salmon & Trout

12.6 Marine Fish

12.7 Crustaceans

13. End Users

13.1 Aquaculture

13.2 Pigs

13.3 Poultry

13.4 Other

14. Key Players Analysis

14.1 FMC Corporation

14.1.1 Business Overview

14.1.2 Sales Analysis

14.1.3 Recent Development

14.1.4 SWOT Analysis

14.2 Croda International Plc.

14.2.1 Business Overview

14.2.2 Sales Analysis

14.2.3 Recent Development

14.2.4 SWOT Analysis

14.3 Mukka Proteins Limited

14.3.1 Business Overview

14.3.2 Sales Analysis

14.3.3 Recent Development

14.3.4 SWOT Analysis

14.4 FKS Multi Agro

14.4.1 Business Overview

14.4.2 Sales Analysis

14.4.3 Recent Development

14.4.4 SWOT Analysis

14.5 GC Rieber Oil

14.5.1 Business Overview

14.5.2 Sales Analysis

14.5.3 Recent Development

14.5.4 SWOT Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com