Eyewear Market Size, Forecast 2025-2033

Buy NowEyewear Market Trends & Summary

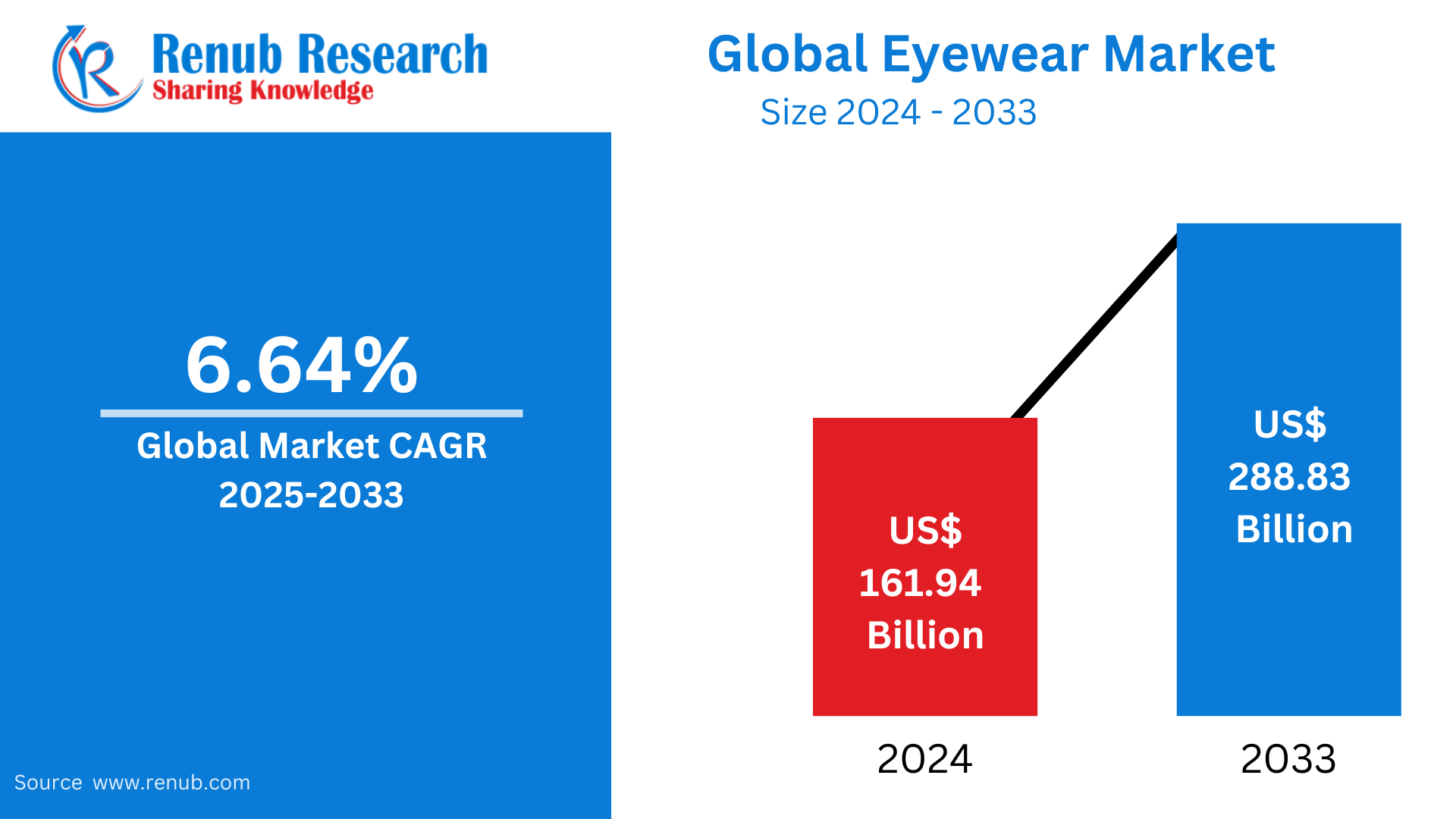

The eyewear market is anticipated to expand considerably, reaching US$ 288.83 billion by 2033 from US$ 161.94 billion in 2024, with a remarkable CAGR of 6.64% during the period 2025-2033. The increase in vision problems, rising fashion trends, and enhanced use of sophisticated eyewear technologies are major drivers of this growth, establishing the market as a crucial segment in the global retail and healthcare sectors.

Global Eyewear Market Report by Product (Spectacles, Sunglasses, Contact Lenses) End User (Men, Women, Children) Distribution Channel (Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores) Countries and Company Analysis, 2025-2033.

Eyewear Market Outlook

Eyewear is defined as accessories meant for vision correction, eye protection, or fashion. It encompasses products like eyeglasses, contact lenses, and sunglasses. Prescription glasses are widely utilized to correct vision issues such as myopia, hyperopia, and astigmatism. Contact lenses provide a substitute for conventional glasses, offering convenience and beauty. Sunglasses are well-liked for shielding eyes from damaging ultraviolet (UV) rays and cutting down on glare and also being used as a fashion accessory.

Eyewear plays a significant role in the management of visual impairments, increasing clarity, and enhancing the quality of life for those with vision problems. Protective eyewear, including safety goggles and sports glasses, is important in protecting eyes from possible injuries in industries, sports, and dangerous settings. Blue light glasses have also become popular for mitigating digital eye strain resulting from extensive screen use. With developments in designs and materials, eyewear is now a fusion of functionality and fashion, becoming an integral aspect of everyday life for millions of people across the globe.

Drivers of Growth in the Global Eyewear Market

Rising Incidence of Vision Disorders

The rising incidence of vision disorders such as myopia, hyperopia, and astigmatism is one of the main drivers of the global eyewear market. Reasons like overuse of screens, aging populations, and genetic factors drive the increasing need for corrective eyewear. As vision health awareness grows, more people undergo professional eye care and buy prescription glasses or contact lenses, propelling long-term growth in the market. August 2023, Globally, more than 2.2 billion individuals have vision impairment, with almost half (1 billion) of these being preventable. The major reasons for distance vision loss are cataracts (94 million), refractive error (88.4 million), age-related macular degeneration (8 million), glaucoma (7.7 million), and diabetic retinopathy (3.9 million). The main reason for near vision loss is presbyopia (826 million).

Fashion and Lifestyle Trends on the Upswing

Fashion eyewear has transformed from an essential utility item to a stylish accessory. Consumers are increasingly looking for fashionable and branded eyewear that suits their fashion sense, resulting in a boom in demand for designer frames, sunglasses, and luxury eyewear. Fashion brand-eyewear company collaborations also enhance consumer demand, fueling growth in premium and value product segments. In February 2025, Canada Goose, the luxury outerwear and apparel company, introduced its first eyewear collection with Marchon Eyewear, designed and engineered to perform in any environment.

Technology and Materials Advances

Advances in technology, including light materials, anti-glare finishes, and intelligent glasses, are revolutionizing the eyewear industry. Products such as blue light-blocking lenses meet contemporary lifestyle requirements, while augmented reality (AR) and virtual reality (VR) glasses open up the market to the technology industry. Tech-conscious consumers are drawn to such developments, which improve market appeal and open up new growth possibilities. Oct 14, 2024, Innovative Eyewear, the company behind ChatGPT-powered smart eyewear brands Lucyd®, Nautica®, Eddie Bauer®, and Reebok®, has produced the first generative AI fashion show for eyewear. AI-driven models feature the most recent smart glasses collections from Lucyd, including collaborations with Eddie Bauer, Reebok, and Nautica.

Obstacles in the Global Eyewear Industry

High Price Sensitivity and Competition

The eyewear industry across the globe is extremely competitive with several players in the market selling a variety of products. Price consciousness of customers, particularly in developing economies, acts as a hindrance to premium players. Domestic and unbranded eye-wear makers provide inexpensive alternatives, creating difficulties for market leaders in maintaining market share at the cost of pricing strategies.

Limited Access to Eye Care in Developing Regions

Availability of quality, affordable eye care remains limited in most developing countries. Limited awareness of vision health and unsuitable distribution channels for eyewear products limit market penetration in rural and disadvantaged regions. These barriers limit the growth prospects of eyewear firms, particularly in emerging economies.

Spectacles Eyewear Market

The spectacles segment leads the world eyewear market, fueled by the growing incidence of vision defects. Spectacles provide a low-cost and convenient means of correcting refractive defects such as myopia and presbyopia. New frame designs, light materials, and coatings such as anti-reflective and UV protection boost consumer attraction. Increased awareness of eye care and frequent eye check-ups fuel the demand for prescription glasses, driving this segment's growth.

Contact Lenses Eyewear Market

The market for contact lenses is expanding continuously as consumers prefer unobtrusive vision correction and convenience. Contact lenses come in several forms, i.e., daily disposables, extended wear, and colored lenses, suiting different consumer preferences. They are favored by young customers and those who desire something other than spectacles. Improvements in technology, like silicone hydrogel lenses and astigmatism or presbyopia lenses, also fuel market growth.

Men Eyewear Market

The men's eyewear market is growing as male consumers look for fashionable and practical choices. This category comprises prescription eyewear, sunglasses, and sports eyewear designed to meet men's tastes. Growing demand for branded and luxury frames and greater awareness of UV protection and eye care fuel demand. Advances in frame styles and materials, including light metals and tough plastics, also fuel the market.

Eyewear Optical Stores Market

Optical stores continue to be a prominent distribution channel for eyewear with a variety of prescription glasses, sunglasses, and contact lenses. Customers opt for optical stores due to professional eye exams, tailored fittings, and extensive choices in brands and designs. Advanced diagnostic equipment and personalizations are also provided by several stores to augment the customer experience. The combination of online and in-store services, including virtual try-ons, increases the significance of optical stores further. In June 2024, Titan Company has opened its premium sunglasses retail brand, RUNWAY, in Bengaluru. Runway, which is fashion-inspired, carries more than 20 leading international sunglasses brands.

Eyewear Independent Brand Showrooms Market

Independent brand showrooms are an important part of eyewear with the offering of exclusive, high-quality products and an individualized shopping experience. Independent showrooms target consumers who look for premium or niche eyewear brands, delivering personalized services and expert advice. Independent showrooms focus on design, craftsmanship, and brand narrative, targeting fashion-oriented buyers. Their capacity to present limited-edition collections and innovative designs propels growth in this segment.

United States Eyewear Market

The United States is one of the world's largest eyewear markets, fueled by high vision impairment rates and sophisticated eye care facilities. High demand for prescription glasses, contact lenses, and sunglasses defines the market. The growing use of digital equipment has seen a heightened adoption of blue light-blocking lenses. Online stores and popularity of designer and luxury eyewear also drive the growth of the U.S. market. February 2024, ZEISS acquired an IP portfolio from Mitsui Chemicals on electronic eyewear, reinforcing its dedication to innovation.

Germany Eyewear Market

Germany's eyewear market is a top business in Europe due to an ageing population and the growing awareness of eye health. Germans are enthusiastic about high-end products, creating a robust demand for premium brands of eyewear. Technological innovations, such as progressive lenses and light weight materials, have a high acceptance among consumers. The nation also boasts a highly established network of optical shops and independent opticians, providing consistent access to eyewear products. Amazon formally entered the German prescription eyewear market in January 2025 by beginning the sale of prescription eyeglasses through its subsidiary.

India Eyewear Market

India's eyewear market is expanding rapidly owing to growing urbanization, improved disposable incomes, and increasing awareness of vision health. Mass-market products and affordable pricing lead, but premium and branded eyewear are making headway with urban consumers. Online websites are another driving force, providing easy access to a broad palette of eyewear. Government programs for vision health, like free eye check-ups, further promote market growth. Nov 24, LensKart, which bought a majority stake in Japanese eyewear company OWNDAYS for approximately $400 million, has introduced OWNDAYS products in India. The move is to increase LensKart's portfolio and offer international products to Indian consumers.

Saudi Arabia Eyewear Market

The Saudi Arabian eyewear market is growing because of increasing awareness of eye health and increasing demand for high-end products. Sunglasses are most sought after, spurred by the country's warm climate and high demand for luxury brands. Rising usage of corrective glasses and investments in healthcare infrastructure by the government aid expansion. Online shopping and social media have raised consumer consciousness and access to international eyewear brands. February 2024, Lenskart is pleased to launch its fourth store in Riyadh and fifth in Saudi Arabia, signaling its focus on bringing superior eyewear solutions to the country.

Global Eyewear Market Segments

Product – Market breakup in 3 viewpoints:

- Spectacles

- Sunglasses

- Contact Lenses

End User – Market breakup in 3 viewpoints:

- Men

- Women

- Children

Distribution Channel – Market breakup in 4 viewpoints:

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Recent Development & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Company Analysis:

1. Burberry Group

2. Essilor Luxottica

3. Hoya Corporation

4. Carl Zeiss Group's

5. Prada

6. Tesco

7. Louis Vuitton

8. Cooper Vision

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By End User, By Distribution Channel and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Eyewear Market

6. Market Share

6.1 Product

6.2 End User

6.3 Distribution Channel

6.4 By Country

7. Product

7.1 Spectacles

7.2 Sunglasses

7.3 Contact

8. End User

8.1 Men

8.2 Women

8.3 Children

9. Distribution Channel

9.1 Optical Stores

9.2 Independent Brand Showrooms

9.3 Online Stores

9.4 Retail Stores

10. By Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Burberry Group

13.1.1 Overview

13.1.2 Key persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio & Product Launch in Last 1 Year

13.1.5 Revenue

13.2 Essilor Luxottica

13.2.1 Overview

13.2.2 Key persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio & Product Launch in Last 1 Year

13.2.5 Revenue

13.3 Hoya Corporation

13.3.1 Overview

13.3.2 Key persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio & Product Launch in Last 1 Year

13.3.5 Revenue

13.4 Carl Zeiss Group's

13.4.1 Overview

13.4.2 Key persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio & Product Launch in Last 1 Year

13.4.5 Revenue

13.5 Prada

13.5.1 Overview

13.5.2 Key persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio & Product Launch in Last 1 Year

13.5.5 Revenue

13.6 Tesco

13.6.1 Overview

13.6.2 Key persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio & Product Launch in Last 1 Year

13.6.5 Revenue

13.7 Louis Vuitton

13.7.1 Overview

13.7.2 Key persons

13.7.3 Recent Development & Strategies

13.7.4 Product Portfolio & Product Launch in Last 1 Year

13.7.5 Revenue

13.8 Cooper Vision

13.8.1 Overview

13.8.2 Key persons

13.8.3 Recent Development & Strategies

13.8.4 Product Portfolio & Product Launch in Last 1 Year

13.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com