Europe Biodiesel Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Biodiesel Market Trends & Summary

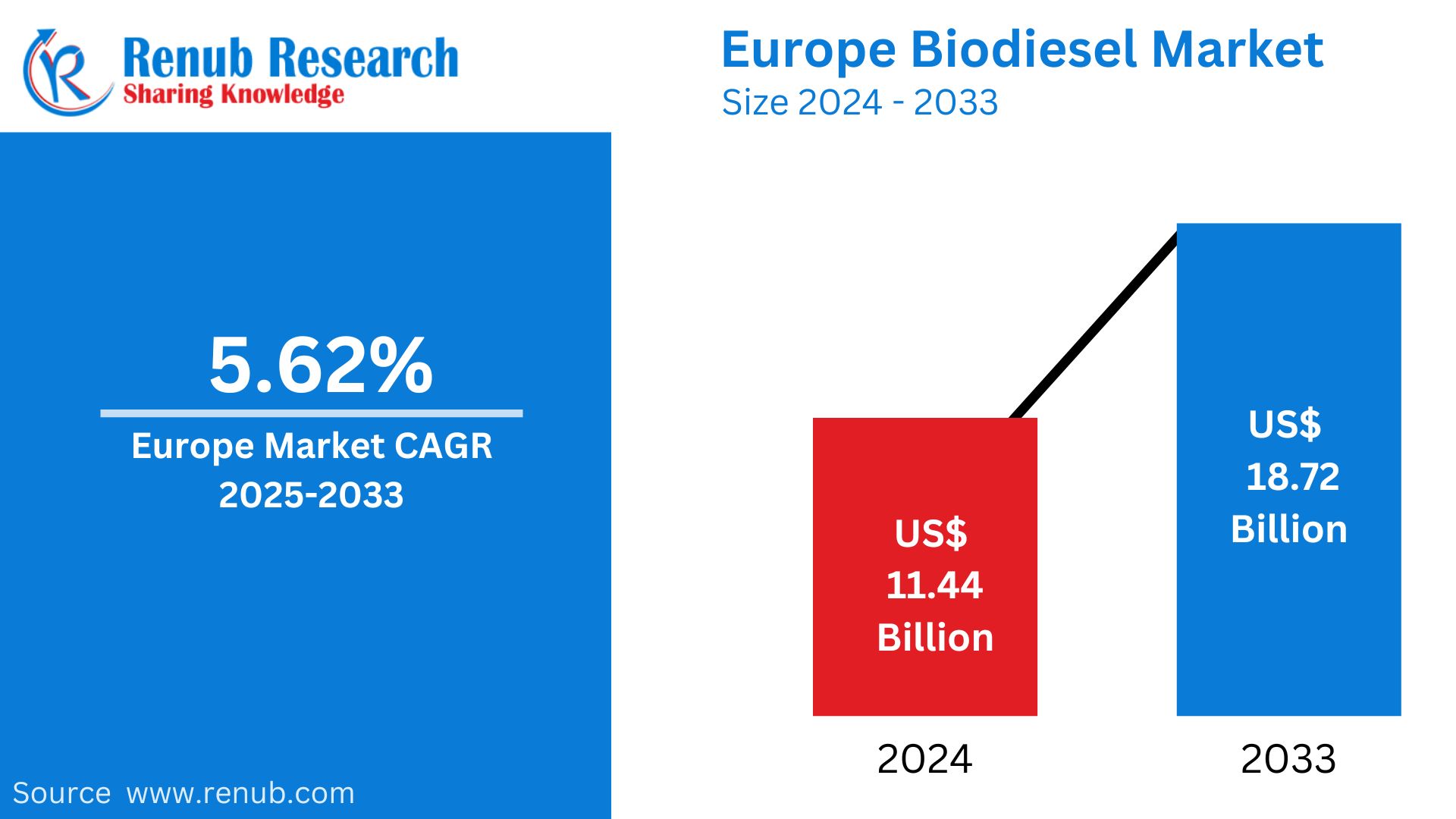

The size of the biodiesel market in Europe is estimated at around US$ 18.72 billion by 2033, following a growth from US$ 11.44 billion in 2024, with a compound annual growth rate (CAGR) of 5.62% during the period of 2025 to 2033. Such growth is primarily because of the increased energy adoption of the renewable source, government policies promoting sustainable fuels, and decreased greenhouse gas emission across the region as a whole.

The report Europe Biodiesel Market & Forecast covers by Application (Fuel, Power Generation, Others), Feedstock (Vegetable Oil, Animal Fats), Country and Company Analysis 2025-2033.

Europe Biodiesel Market Outlooks

Biodiesel is a renewable fuel made from vegetable oils, animal fats, or recycled cooking oils by a process known as transesterification. The transesterification process transforms oils into FAME (fatty acid methyl esters), which can be used as a sustainable substitute for conventional diesel. Biodiesel can be used pure (B100) or mixed with fossil diesel in various blends, such as B7 (7% biodiesel) or B20 (20% biodiesel).

In Europe, biodiesel plays a crucial role in reducing greenhouse gas emissions and meeting renewable energy targets. The European Union promotes its use under the Renewable Energy Directive (RED II), which mandates increased use of renewable fuels in transportation. Biodiesel is extensively used in cars, buses, trucks, and trains as a cleaner alternative to traditional diesel. Biodiesel supports the agricultural sector by providing a market for crops like rapeseed, commonly used for its production. It is also utilized in heating systems and industrial machinery, enhancing energy sustainability across the continent.

Growth Drivers in the European Biodiesel Market

Renewable Energy Mandates

The European Union has set ambitious renewable energy targets, encouraging the use of biodiesel as a key component in reducing dependency on fossil fuels. These mandates ensure that biodiesel adoption increases across the continent, driving market growth through government support and regulatory policies. The EU has introduced specific mandates for the transportation sector, such as requiring a minimum of 14% renewable energy in transport fuels by 2030. Biodiesel is central to achieving these targets, reducing carbon emissions and promoting sustainable mobility.

Technological Advancements

Advancements in biodiesel production technology have improved efficiency, reduced costs, and expanded the range of feedstocks. This has led to greater acceptance and adoption of biodiesel by various industries, thereby fueling market expansion in Europe. Oct 2024, Argent Energy has launched Europe’s largest facility for producing biobased, technical-grade glycerin at its Port of Amsterdam site. The refinery will upgrade crude glycerin, a by-product of its waste-based biodiesel process, into 99.7% pure technical-grade glycerin.

Sustainability Focus

Europe is placing greater emphasis on sustainable and environmentally friendly solutions. Biodiesel helps meet these sustainability goals by lowering carbon emissions, promoting circular economies, and supporting a greener future, making it a preferred choice in the energy sector. Under RED II, the EU has set a binding target for renewable energy to constitute at least 32% of the total energy consumption by 2030. This includes contributions from all sectors, including transportation, heating, and power generation, with biodiesel playing a crucial role in reducing reliance on fossil fuels.

Challenges in the European Biodiesel Market

Supply Chain Limitations

The European biodiesel market is presently facing significant hurdles, particularly regarding the stability and availability of critical feedstocks such as vegetable oils and animal fats. Various factors, including unpredictable fluctuations in agricultural yields and increasing competition from different industries vying for these valuable resources, can severely impact the supply chain of essential raw materials required for biodiesel production. These dynamics create a challenging environment for producers, who must navigate the complexities of sourcing ingredients in a market where demand and availability are in constant flux.

Cost and Competition

The production of biodiesel continues to face significant financial hurdles, primarily because its production costs can often exceed those of traditional diesel fuels. This higher expense poses challenges for widespread adoption and market competitiveness. Furthermore, the landscape of renewable energy is becoming increasingly crowded, with rising competition from emerging alternatives such as hydrogen-based fuels and synthetic fuel technologies. These competing sources could potentially impact biodiesel's market position and hinder its overall growth trajectory.

European Biodiesel Fuel Market

The European biodiesel fuel market is witnessing significant expansion, fueled by a growing commitment to cleaner fuels in both the transportation and industrial sectors. This shift reflects a broader transition towards sustainable energy solutions across the continent, where government policies are increasingly aligning to support this transformation. As a result, biodiesel is emerging as a vital component of Europe’s diverse energy mix, playing a crucial role in reducing carbon emissions and promoting environmental sustainability. The heightened demand for biodiesel highlights its importance as a renewable energy source that not only meets regulatory standards but also resonates with the public's desire for greener alternatives.

European Biodiesel Power Generation Market

The use of biodiesel in power generation is increasingly gaining attention across Europe, as it presents a dependable and low-carbon alternative for producing electricity. As various regions recognize the potential of renewable energy, the market for biodiesel-powered generators is experiencing significant growth. These generators not only serve as a key component in initiatives aimed at promoting sustainable energy but also offer valuable backup power solutions during outages. The shift toward biodiesel reflects a broader commitment to reducing carbon emissions and enhancing energy security, making it an attractive option for both public and private sectors.

European Vegetable Oil Biodiesel Market

The European vegetable oil biodiesel market is experiencing significant growth, fueled by an increasing emphasis on sustainable feedstocks. Among these, rapeseed oil stands out as a key player, alongside various other vegetable oils that are sourced responsibly. This shift not only provides notable environmental advantages but also plays a crucial role in enhancing the overall sustainability of the biodiesel supply chain. By prioritizing these eco-friendly materials, the market is making strides toward reducing its carbon footprint and promoting a greener, more sustainable energy landscape.

United Kingdom Biodiesel Market

The biodiesel market in the UK is experiencing a robust and steady growth trajectory, fueled by a growing public consciousness about environmental issues and proactive government initiatives aimed at fostering the use of renewable energy sources. This expansion is particularly evident in the transportation and industrial sectors, where there is a pronounced shift towards biodiesel as a cleaner alternative to traditional fossil fuels. It is more than just a trend toward biodiesel; it presents an overarching commitment to significantly reducing greenhouse gas emissions and promoting sustainability across various industries. As businesses and consumers become increasingly cognizant of the environmental positive impacts, this market for biodiesel is likely to sustain its rising progression toward a greener future.

Germany Biodiesel Market

Germany continues to be a major force in the European biodiesel market, showcasing a strong commitment to developing sustainable fuel solutions. The nation's biodiesel sector is propelled by comprehensive regulatory frameworks that support environmental initiatives, as well as a growing demand for cleaner, low-emission energy alternatives. This synergy between policy and public demand fosters innovation and investment in the industry, positioning Germany at the forefront of the transition to renewable energy sources.

France Biodiesel Market

France's biodiesel market is experiencing significant growth as the country intensifies its efforts to lower carbon emissions and shift towards renewable energy sources. This expansion is particularly evident in the transportation sector, where biodiesel is increasingly being adopted for vehicles, as well as in agriculture and various industrial applications. The upward trend is bolstered by a range of government incentives designed to encourage the use of cleaner energy alternatives, alongside robust sustainability initiatives aimed at promoting environmentally friendly practices. As a result, biodiesel is becoming an integral part of France's strategy to foster a greener economy and combat climate change.

Spain Biodiesel Market

Spain's biodiesel market is experiencing significant growth as the nation actively works to diversify its energy sources and minimize its environmental footprint. In a concerted effort to reduce reliance on fossil fuels, biodiesel has emerged as an essential element of Spain's comprehensive renewable energy strategy. This shift not only highlights the country’s commitment to sustainability but also fosters innovation and investment in green technologies, paving the way for a cleaner, more sustainable energy future.

Italy Biodiesel Market

Italy’s biodiesel market is witnessing a promising upward trajectory, fueled by a rising demand for sustainable fuel alternatives within the transportation sector. The nation's proactive initiatives aimed at curbing carbon emissions, coupled with a strong commitment to promoting renewable energy sources, have significantly contributed to a marked increase in the adoption of biodiesel. As consumers and businesses become environmentally conscious, the use of such an eco-friendly fuel is becoming the new trend; Italy is certainly set for a greener future.

Europe Biodiesel Market Segments

Application – Market breakup in 3 viewpoints:

1. Fuel

2. Power Generation

3. Others

Feedstock – Market breakup in 2 viewpoints:

1. Vegetable Oil

2. Animal Fats

Countries – Market breakup in 9 viewpoints:

1. France

2. Germany

3. Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

9. Rest of Europe

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Archer Daniels Midland Company

2. Future Fuel

3. Neste’s

4. Renewable Energy Group, Inc.

5. Bunge Global SA

6. Wilmar

7. Shell

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Feedstock, and Countries |

| Countries Covered |

1. France |

| Companies Covered |

1. Archer Daniels Midland Company |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the estimated size of the Europe biodiesel market by 2033?

-

What is the expected compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

What are the primary drivers of growth in the European biodiesel market?

-

How does the European Union's Renewable Energy Directive (RED II) impact biodiesel demand?

-

What are the major challenges facing the European biodiesel market?

-

Which countries in Europe are leading in biodiesel production and consumption?

-

What are the key applications of biodiesel in Europe?

-

Which feedstocks are primarily used for biodiesel production in Europe?

-

What are some major companies operating in the European biodiesel market?

-

How is technological advancement influencing biodiesel production and adoption in Europe?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Biodiesel Market

6. Market Share

6.1 Application

6.2 Feedstock

6.3 Country

7. Application

7.1 Fuel

7.2 Power Generation

7.3 Others

8. Feedstock

8.1 Vegetable Oil

8.2 Animal Fats

9. Country

9.1 France

9.2 Germany

9.3 Italy

9.4 Spain

9.5 United Kingdom

9.6 Belgium

9.7 Netherlands

9.8 Turkey

9.9 Rest of United States

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Archer Daniels Midland Company

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 FutureFuel

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Neste’s

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Renewable Energy Group, Inc.

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Bunge Global SA

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Wilmar

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Shell

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com