China Online Grocery Market, by Segments (Packaged Food, Dairy, Sweet Biscuits, Snack Bars and Fruit Snacks, and Soup), by Channel, Company Analysis & Forecast

Buy NowGet Free Customization in this Report

China is one of the largest e-grocery markets in the world and is poised for explosive growth in the future too. With a population of 1.4 Billion, the potential value growth in the Chinese online grocery market is phenomenal. COVID-19 pandemic has boosted the online groceries market in China, with demand for home fulfilment soaring to record high. China’s two largest e-commerce companies Alibaba’s Tmall and JD.com, have a strong position in online grocery. Walmart via JD.com and Sun Art Retail are other key online grocery retailers in China. According to Renub Research analysis, the China Online Grocery Market will be US$ 219 Billion by the end of the year 2026.

Factors Driving the Online Grocery Market in China

The rapid urbanization, rising income, food safety, and healthy diet leads to the growth of the packaged food market in China. Usage of Internet and smartphone is also growing across China, which is driving the online grocery segment. China's demographics are changing too – there is growth in the number of the younger population.

The carbohydrates rich food such as rice, pasta, and noodles; confectionery, savoury snacks, baked goods, sweet biscuits are more consumed by younger generations as-well-as middle-income group peoples for changing the taste of tongue which drives the market growth. As the Chinese people are more alert towards their health; thus, they consume more protein-rich foods such as processed fruit and vegetables; processed meat and seafood etc.

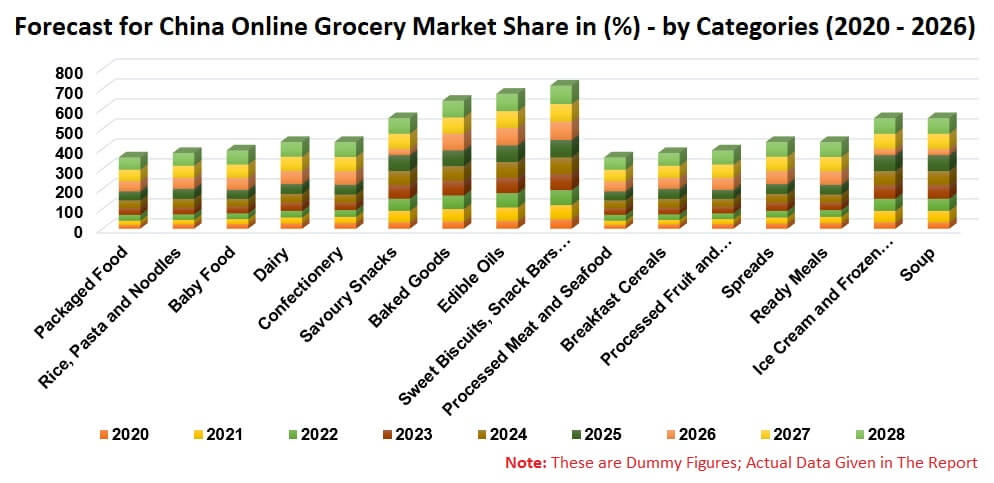

Changing Trends of China Online Grocery Industry

The smartphones are the top leading purchasing channel compared to a personal computer for ordering groceries in the Chinese economy. The Chinese brick-and-mortar retailers are shifting towards online channel after the outbreak of Covid-19 through online players, delivery partners, technology companies and payment solution providers. During the coronavirus period, the sales of grocery items through online mode have drastically surged as these are count as essential foods for surviving.

Renub Research report titled “China Online Grocery Market, by Segments (Packaged Food, Rice, Pasta and Noodles, Baby Food, Dairy, Confectionery, Savoury Snacks, Baked Goods, Edible Oils, Sweet Biscuits, Snack Bars and Fruit Snacks, Processed Meat and Seafood, Breakfast Cereals, Processed Fruit and Vegetables, Spreads, Ready Meals, Ice Cream and Frozen Desserts, and Soup), by Channel (Mobile, and Personal Computer), Company Analysis (Alibaba Group, JD, Tencent Holdings Ltd., Pinduoduo, Suning) & Forecast” provides an all-encompassing analysis on the China Online Grocery Market.

Segments - This report Covers the 16 Markets by Segment

1. Packaged Food

2. Rice, Pasta and Noodles

3. Baby Food

4. Dairy

5. Confectionery

6. Savoury Snacks

7. Baked Goods

8. Edible Oils

9. Sweet Biscuits, Snack Bars and Fruit Snacks

10. Processed Meat and Seafood

11. Breakfast Cereals

12. Processed Fruit and Vegetables

13. Spreads

14. Ready Meals

15. Ice Cream and Frozen Desserts

16. Soup

Channel – Both the Channels are covered in the report

• Mobile

• Personal Computer

All the Five Companies have been studied from three points

• Overview

• Recent Developments

• Sales

Company Analysis

1. Alibaba Group

2. JD

3. Tencent Holdings Ltd.

4. Pinduoduo

5. Suning

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. China Online Grocery Market

6. Market Share – China Online Grocery

6.1 By Categories

6.2 By Channel

7. Market Categories – China Online Grocery

7.1 Packaged Food

7.2 Rice, Pasta and Noodles

7.3 Baby Food

7.4 Dairy

7.5 Confectionery

7.6 Savoury Snacks

7.7 Baked Goods

7.8 Edible Oils

7.9 Sweet Biscuits, Snack Bars and Fruit Snacks

7.10 Processed Meat and Seafood

7.11 Breakfast Cereals

7.12 Processed Fruit and Vegetables

7.13 Spreads

7.14 Ready Meals

7.15 Ice Cream and Frozen Desserts

7.16 Soup

8. Market by Channel – China Online Grocery

8.1 Mobile

8.2 Personal Computer (PC)

9. Company Analysis

9.1 Alibaba

9.1.1 Overview

9.1.2 Recent Developments

9.1.3 Sales

9.2 JD

9.2.1 Overview

9.2.2 Recent Developments

9.2.3 Sales

9.3 Tencent Holdings Ltd.

9.3.1 Overview

9.3.2 Recent Developments

9.3.3 Sales

9.4 Pinduoduo

9.4.1 Overview

9.4.2 Recent Developments

9.4.3 Sales

9.5 Suning

9.5.1 Overview

9.5.2 Recent Developments

9.5.3 Sales

List of Figures:

Figure-01: Penetration Rate of Internet Users in China from December 2015 to March 2020

Figure-02: China – Online Grocery Market (Million US$), 2015 – 2019

Figure-03: China – Forecast for Online Grocery Market (Million US$), 2020 – 2026

Figure-04: China – Online Grocery Market Share (%) by Channel, 2015 – 2019

Figure-05: China – Forecast for Online Grocery Market Share (%) by Channel, 2020 – 2026

Figure-06: China – Online Grocery Packaged Food Market (Million US$), 2015 – 2019

Figure-07: China – Forecast for Online Grocery Packaged Food Market (Million US$), 2020 – 2026

Figure-08: China – Online Grocery Rice, Noodles and Pasta Market (Million US$), 2015 – 2019

Figure-09: China – Forecast for Online Grocery Rice, Noodles and Pasta Market (Million US$), 2020 – 2026

Figure-10: China – Online Grocery Baby Food Market (Million US$), 2015 – 2019

Figure-11: China – Forecast for Online Grocery Baby Food Market (Million US$), 2020 – 2026

Figure-12: China – Online Grocery Dairy Product Market (Million US$), 2015 – 2019

Figure-13: China – Forecast for Online Grocery Dairy Products Market (Million US$), 2020 – 2026

Figure-14: China – Online Grocery Confectionery Market (Million US$), 2015 – 2019

Figure-15: China – Forecast for Online Grocery Confectionery Market (Million US$), 2020 – 2026

Figure-16: China – Online Grocery Savoury Snacks Market (Million US$), 2015 – 2019

Figure-17: China – Forecast for Online Grocery Savoury Snacks Market (Million US$), 2020 – 2026

Figure-18: China – Online Grocery Baked Goods Market (Million US$), 2015 – 2019

Figure-19: China – Forecast for Online Grocery Baked Goods Market (Million US$), 2020 – 2026

Figure-20: China – Online Grocery by Edible Oil Market (Million US$), 2015 – 2019

Figure-21: China – Forecast for Online Grocery Edible Oil Market (Million US$), 2020 – 2026

Figure-22: China – Online Grocery Sweet Biscuits, Snack Bars, and Fruit Snacks Market (Million US$), 2015 – 2019

Figure-23: China – Forecast for Online Grocery Sweet Biscuits, Snack Bars, and Fruit Snacks Market (Million US$), 2020 – 2026

Figure-24: China – Online Grocery Processed Meat and Seafood Market (Million US$), 2015 – 2019

Figure-25: China – Forecast for Online Grocery Processed Meat and Seafood Market (Million US$), 2020 – 2026

Figure-26: China – Online Grocery Breakfast Cereals Market (Million US$), 2015 – 2019

Figure-27: China – Forecast for Online Grocery Breakfast Cereals Market (Million US$), 2020 – 2026

Figure-28: China – Online Grocery Processed Fruits and Vegetables Market (Million US$), 2015 – 2019

Figure-29: China – Forecast for Online Grocery Processed Fruits and Vegetables Market (Million US$), 2020 – 2026

Figure-30: China – Online Grocery Processed Spreads Market (Million US$), 2015 – 2019

Figure-31: China – Forecast for Online Grocery Spreads Market (Million US$), 2020 – 2026

Figure-32: China – Online Grocery Ready Meal Market (Million US$), 2015 – 2019

Figure-33: China – Forecast for Online Grocery Ready Meals Market (Million US$), 2020 – 2026

Figure-34: China – Online Grocery Ice Cream and Frozen Desserts Market (Million US$), 2015 – 2019

Figure-35: China – Forecast for Online Grocery Ice Cream and Frozen Desserts Market (Million US$), 2020 – 2026

Figure-36: China – Online Grocery Soup Market (Million US$), 2015 – 2019

Figure-37: China – Forecast for Online Grocery Soup Market (Million US$), 2020 – 2026

Figure-38: China – Smartphone Penetration Rate 2015 - 2023

Figure-39: China – Online Grocery Mobile Channel Market (Million US$), 2015 – 2019

Figure-40: China – Forecast for Online Grocery Mobile Channel Market (Million US$), 2020 – 2026

Figure-41: China – Online Grocery Personal Computer Channel Market (Million US$), 2015 – 2019

Figure-42: China – Forecast for Online Grocery Personal Computer Channel Market (Million US$), 2020 – 2026

Figure-43: Alibaba Group – Revenue (Billion US$), 2015 – 2019

Figure-44: Alibaba Group – Forecasted Revenue (Billion US$), 2020 – 2026

Figure-45: JD.com – Revenue (Billion US$), 2015 – 2019

Figure-46: JD.com – Forecasted Revenue (Billion US$), 2020 – 2026

Figure-47: Tencent Holdings Ltd. – Revenue (Billion US$), 2015 – 2019

Figure-48: Tencent Holdings Ltd. – Forecasted Revenue (Billion US$), 2020 – 2026

Figure-49: Pinduoduo – Revenue (Billion US$), 2016 – 2019

Figure-50: Pinduoduo – Forecasted Revenue (Billion US$), 2020 – 2026

Figure-51: Suning.com – Revenue (Billion US$), 2015 – 2019

Figure-52: Suningo.com – Forecasted Revenue (Billion US$), 2020 – 2026

List of Tables:

Table-01: China – Online Grocery Market Share (%) by Segment, 2015 – 2019

Table-02: China – Forecast for Online Grocery Market Share (%) by Segment, 2020 – 2026

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com