China In–Vitro Diagnostics (IVD) Market, By Diagnostics (Immunoassay, Microbiology, Molecular, SMBG, POCT & etc.) & Companies

Buy NowGet Free Customization in This Report

China In–Vitro Diagnostics (IVD) Market is projected to exceed US$ 12 Billion by the end of year 2024. China In–Vitro Diagnostics (IVD) Market is growing significantly and is expected to continue its ongoing trend during the forecast period as well, owing to rapidly increasing middle class population who is now willing to pay more for better healthcare services and aging population who are more vulnerable to contagious diseases. Also, Chinese aging population is experiencing an outburst of chronic diseases which includes cancer, diabetes and cardiovascular disease. All of these diseases can be diagnosed and monitored using IVD products.

In addition; some other factors which can be attributed to China IVD market include growing prevalence of chronic lifestyle and infectious diseases, public health awareness, transformation of medical models, increasing demand of tests from the rural areas and support from the Chinese government to provide better healthcare infrastructure throughout the nation.

Request a free sample copy of the report: https://www.renub.com/contactus.php

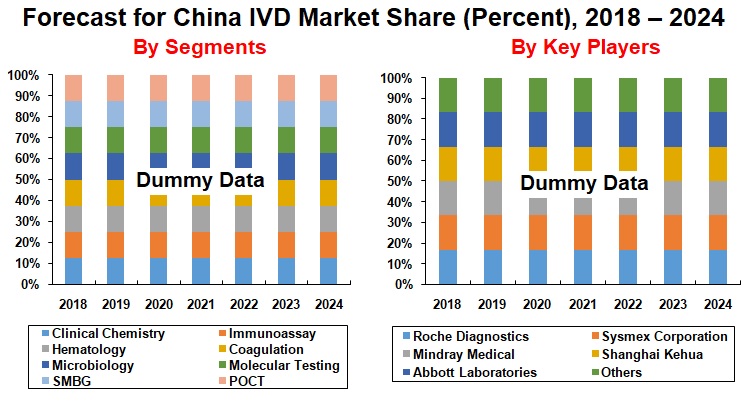

Renub Research report titled “China In–Vitro Diagnostics (IVD) Market, By Diagnostics [Clinical Chemistry, Immunoassay, Hematology, Coagulation, Microbiology, Molecular Testing, Self Monitoring of Blood Glucose (SMBG), Point of Care Testing (POCT)], Companies (Roche Diagnostics, Sysmex Corporation, Mindray Medical International Limited, Shanghai Kehua Bio-Engineering Co. Ltd., Abbott Laboratories & Others)” provides a complete analysis of China In–Vitro Diagnostics (IVD) Market.

By Segment – Immunoassay and Clinical Chemistry dominates the China IVD Market

The report studies the market of the following In–Vitro Diagnostics (IVD) segments: Clinical Chemistry, Immunoassay, Hematology, Coagulation, Microbiology, Molecular Testing, Self Monitoring of Blood Glucose (SMBG), and Point of Care Testing (POCT).

Companies Analysis

Roche Diagnostics, Sysmex Corporation, Mindray Medical International Limited, Shanghai Kehua Bio-Engineering Co. Ltd., Abbott Laboratories are some of the top companies operating in the China IVD Market; which has been studied thoroughly in the report.

The report China In–Vitro Diagnostics (IVD) Market has been studied from 7 viewpoints:

1) Market & Forecast

2) Segment Wise Market & Forecast

3) Development Environment & Regulatory Status in China IVD market

4) Company-wise IVD Sales & Forecast

5) Profiles of Private Clinical Labs and Diagnostic Services

6) Growth Drivers for China In-Vitro Diagnostics

7) Challenges for China In-Vitro Diagnostics

Client can purchase this report in sections through Purchase by Chapter Tab given above

This market research report provides a complete analysis of the China In-Vitro Diagnostics (IVD) Market, Growth Drivers, Challenges, and their projections for the upcoming years.

By Segment

1. Clinical Chemistry

2. Immunoassay

3. Hematology

4. Coagulation

5. Microbiology

6. Molecular Testing

7. Self Monitoring of Blood Glucose (SMBG)

8. Point of Care Testing (POCT)

Companies Covered in the Report:

1. Roche Diagnostics

2. Sysmex Corporation

3. Mindray Medical International Limited

4. Shanghai Kehua Bio-Engineering Co. Ltd.

5. Abbott Laboratories

6. Others

Profiles of Private Clinical Labs and Diagnostic Services Companies in China

• Zhejiang Di’an Diagnostics Technology Co., Ltd

• ADICON Clinical Laboratories

• Guangzhou Kingmed Diagnostics Center Co. Ltd.

• Kindstar Global (Privately held)

• BGI-Shenzhen (Privately held)

• OriGene Technologies (Privately held)

1. Executive Summary

2. China IVD Market (2007 – 2024)

3. Market Share – China In Vitro Diagnostics (IVD) (2011 – 2024)

3.1 Segments – China IVD

3.2 Companies – China IVD

4. Segments – China IVD Market (2007 – 2024)

4.1 Clinical Chemistry Market

4.2 Immunoassay Market

4.3 Hematology Market

4.4 Coagulation Market

4.5 Microbiology Market

4.6 Molecular Diagnostic Market

4.7 Self Monitoring of Blood Glucose (SMBG) Market

4.8 Point of Care Testing (POCT) Market

5. Development Environment of Chinese IVD Industry

5.1 Healthcare Reforms

5.2 Improving Quality at Grass-Root Level

5.3 Embracing Technology

6. China: Health Insurance and Reimbursement Policies

6.1 Health Insurance System

6.1.1 Basic Medical Insurance

6.1.2 Insurance for Other Groups

6.1.3 Rural Medical Insurance

6.1.4 Private Health Insurance

6.2 Reimbursement Rules

6.2.1 Device Reimbursement

6.2.2 Reimbursement for In-Vitro Diagnostics (IVDs)

7. Registration of In Vitro Diagnostic Reagents in China

7.1 Registration and Filing

7.2 Filing Obligation for Clinical Trials

7.3 Clinical Trial Institutions

7.4 Elimination of IVD Loophole for Research

7.5 Change of Manufacturing Address

7.6 Change of Main Supplier of an Antigen or Antibody

7.7 Update on China In-Vitro Diagnostics Registration

7.7.1 IVD Product Registration in China

7.7.2 China IVD Type Testing Process

7.7.3 Clinical Trials for IVD Products in China

8. Medical Devices and Reagents Class Registration in China

8.1 Process of Medical Device Registration in China

8.2 Classification of In-vitro Diagnostic Reagents in China

8.2.1 Class III: Highest Risk

8.2.2 Class II: Medium Risk

8.2.3 Class I: Lower Risk

8.3 China In-Vitro Diagnostics Reagents

8.3.1 Blood Screening Reagents — Drug Administration

8.3.2 Varieties of Blood Screening Reagents

8.3.3 Blood Screening Reagent Test

8.3.4 Nucleic Acid Detection Kits for Blood Screening

8.3.5 Radioactive Reagents — Drug Administration

8.3.6 Diagnostic Reagents - Medical Devices Management

9. China IVD Industry Drivers

9.1 Increasing Demand from Middle Class for High Quality Healthcare Products

9.2 Rising Incidences of Lifestyle Diseases in China

9.3 Growth in Private Hospitals & Independent Diagnostic Centers

9.3.1 Increasing the Number of Hospital Beds across all Medical Institutions

10. China IVD Industry Challenges

10.1 Chinese Local Firms Lack of Expertise in Advanced Technology

10.2 Cost Factor Restricts the Contribution of Global IVD Companies in the Chinese IVD Market

10.3 Reimbursement Rates varies from Province to Province in China

10.3.1 Chinese Government Regulating Laboratory Testing in China

11. Company Sales Analysis (2011 – 2024)

11.1 Roche Diagnostics - China IVD Sales & Forecast

11.2 Sysmex Corporation - China IVD Sales & Forecast

11.3 Mindray Medical International Limited - China IVD Sales & Forecast

11.4 Shanghai Kehua Bio-Engineering Co. Ltd. - China IVD Sales & Forecast

11.5 Abbott Laboratories - China IVD Sales & Forecast

11.6 Others - China IVD Sales & Forecast

12. Profiles of Select Private Clinical Labs and Diagnostic Services Companies

12.1 Zhejiang Di’an Diagnostics Technology Co., Ltd.

12.1.1 Products and Services Offered by Di’an

12.2 ADICON Clinical Laboratories (Privately held)

12.2.1 Products and Services Offered by ADICON

12.3 Guangzhou Kingmed Diagnostics Center Co. Ltd.

12.3.1 Products and Services Offered by Kingmed

12.4 Kindstar Global (Privately held)

12.4.1 Products and Services Offered by Kindstar

12.5 BGI-Shenzhen

12.5.1 BGI’s Innovative Approach

12.6 OriGene Technologies

12.6.1 Products and Services Offered by OriGene

List of Figures:

Figure 2‑1: China – IVD Market (Billion US$), 2007 – 2017

Figure 2‑2: China – Forecast for IVD Market (Billion US$), 2018 – 2024

Figure 3‑1: China – IVD Market Share (Percent), 2011 – 2017

Figure 3‑2: China – Forecast for IVD Market Share (Percent), 2018 – 2024

Figure 3‑3: China – IVD Market Players Share (Percent), 2011 – 2017

Figure 3‑4: China – Forecast for IVD Market Players Share (Percent), 2018 – 2024

Figure 4‑1: China – Clinical Chemistry Market (Million US$), 2007 – 2017

Figure 4‑2: China – Forecast for Clinical Chemistry Market (Million US$), 2018 – 2024

Figure 4‑3: China – Immunoassay Market (Million US$), 2007 – 2017

Figure 4‑4: China – Forecast for Immunoassay Market (Million US$), 2018 – 2024

Figure 4‑5: China – Hematology Market (Million US$), 2007 – 2017

Figure 4‑6: China – Forecast for Hematology Market (Million US$), 2018 – 2024

Figure 4‑7: China – Coagulation Market (Million US$), 2007 – 2017

Figure 4‑8: China – Forecast for Coagulation Market (Million US$), 2018 – 2024

Figure 4‑9: China – Microbiology Market (Million US$), 2007 – 2017

Figure 4‑10: China – Forecast for Microbiology Market (Million US$), 2018 – 2024

Figure 4‑11: China – Molecular Diagnostic Market (Million US$), 2007 – 2017

Figure 4‑12: China – Forecast for Molecular Diagnostic Market (Million US$), 2018 – 2024

Figure 4‑13: China – SMBG Market (Million US$), 2007 – 2017

Figure 4‑14: China – Forecast for SMBG Market (Million US$), 2018 – 2024

Figure 4‑15: China – POCT Market (Million US$), 2007 – 2017

Figure 4‑16: China – Forecast for POCT Market (Million US$), 2018 – 2024

Figure 8‑1: Process of Medical Device Registration in China

Figure 8‑2: In-vitro Diagnostic System Applied for Market Approval in China

Figure 9‑1: China – Healthcare Spending (Billion US$), 2011 & 2020

Figure 11‑1: Roche Diagnostics – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑2: Roche Diagnostics – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 11‑3: Sysmex Corporation – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑4: Sysmex Corporation – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 11‑5: Mindray Medical – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑6: Mindray Medical – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 11‑7: Shanghai Kehua – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑8: Shanghai Kehua – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 11‑9: Abbott Laboratories – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑10: Abbott Laboratories – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 11‑11: Others – China IVD Revenue (Million US$), 2011 - 2017

Figure 11‑12: Others – Forecast for China IVD Revenue (Million US$), 2018 - 2024

Figure 12‑1: Kindstar – Collaboration with hospitals in China (Number), 2006-2013

List of Table:

Table 7‑1: Registration Type, 2016

Table 8‑1: Number of hospital beds for every 1,000 people

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com