China Home Appliances Market by Products (Refrigerators, Freezers, Dishwashing & Washing Machine, Cookers & Ovens, Vacuum Cleaners) by Distribution Channels, and Companies

Buy NowGet Free Customization in this Report

China home appliances market is growing at the highest growth rate around the world. With more, advance technology and easy availability of raw material in affordable prices in the nation is propelling home appliance market in China. Rapid urbanization, rise in disposable income and high demand for the home appliance in rural areas of China are the other factors for this growth. According to Renub Research analysis, China Home Appliance Market is forecasted to be more than US$ 130 Billion by the end of year 2026.

The use of advance technologies such as WI-FI and Bluetooth in the Chinese home appliance that can be accessed through smartphones and tablets are attracting tech-savvy consumers. Home appliances in China are becoming environmentally friendly and energy-efficient with new designs and advance features, the market of products like washing machines and refrigerators are growing due to premiumization trends in the country.

The contribution of ecommerce websites for the growth of home appliances in China is an added advantage with the comparison of products, competitive pricing, lucrative discount, and offers doorstep delivery. Moreover, Chinese manufacturing companies are producing quality products to fulfill local demand as they are ahead in technological innovation, have extensive distribution networks, and sell home appliance products in affordable pricing.

Subsidy by the Chinese Government

To boost the home appliances market, the Chinese government is providing subvention up to 13 percent of product price with a limit up to RMB 800 per product. This initiative was started in April 2019, for home appliances which meet the criterion for environmental and energy consumption. Some provincial government started this intuitive in January 2019, such as the Beijing municipal government provides subsidy from 8 percent to 20 percent for 15 different products.

Initiatives of Chinese Companies

Over that period, several local companies have risen, delivering accessible products to price-sensitive Chinese consumers, while also infusing the latest epoch of home appliances with intelligent connectivity to construct Internet of Things (IoT) ecosystems within the home. With the growing household market in China, Midea generated more than $ 40 billion revenue in the year 2019 with leading products, including residential and commercial air conditioners, along with dishwashers, washing machines, and refrigerators.

Midea’s smart home division focuses on linking entire sections of the home, with an intelligent health procedure to monitor air temperature and humidity, formaldehyde concentration, and other environmental factors. Another home appliance company Haier launched U+ App in June 2019. Through this mobile app, users can get information on water temperature and quality in a locality. The washing machine can provide customized washing solution by recognizing the brand and material of garments as well as brand and density of the washing liquid.

COVID-19 affecting China Home Appliances Market

Home appliances market in China has been affected due to the outbreak of the coronavirus epidemic; it has brought unprecedented defiance to China’s in lying demand and export orders. Home appliance companies have been resuming operation and then taking a break since March 2020. Pandemic COVID-19 has affected home appliances sales in China. The comprehensive analysis of COVID-19 effect on the China Home Appliances Market is provided in our research report.

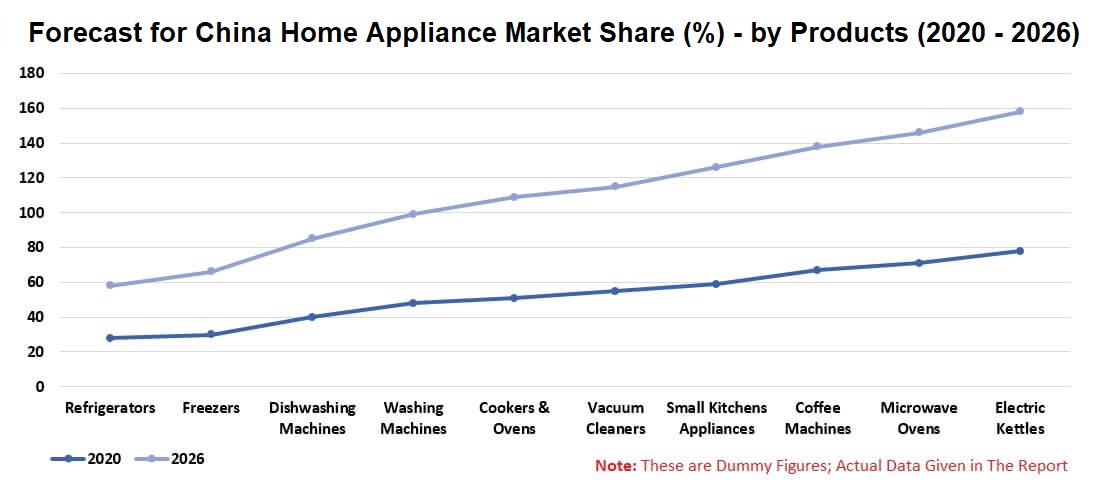

Renub Research report titled “China Home Appliances Market by Products (Refrigerators, Freezers, Dishwashing Machines, Washing Machine, Cookers & Ovens, Vacuum Cleaners, Small Kitchens Appliances, Coffee Machines, Microwave Ovens, Electric Kettles) by Distribution Channels (Online and Offline), and Company Analysis (LG Corp, Electrolux, Phillips, Haier Group Corporation, and Midea Group)” provides a complete analysis of the China Home Appliances Market and Volume.

By Products - China Appliances Market and Volume Insights

In this research report, the market and volume analysis of Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Cookers & Ovens, Vacuum Cleaners, Small Kitchens Appliances, Coffee Machines, Microwave Ovens and Electric Kettles are covered.

By Distribution Channels - China Appliances Market and Volume Insights

• Online

• Offline

Products covered in the Report

• Refrigerators

• Freezers

• Dishwashing Machines

• Washing Machines

• Cookers & Ovens

• Vacuum Cleaners

• Small Kitchens Appliances

• Coffee Machines

• Microwave Ovens

• Electric Kettles

All the Companies have been covered from 3 Viewpoints

• Overview

• Recent Initiatives

• Sales Analysis

Companies Covered in the Report

• LG Corp

• Electrolux

• Phillips

• Haier Group Corporation

• Midea Group

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Driver

4.2 Challenges

5. China Home Appliance Market & Volume

5.1 Market

5.2 Volume

6. China Home Appliance Market Share Analysis

6.1 By Products

6.2 By Distribution Channels

6.3 By Company Share

7. China Home Appliance Volume Share Analysis

7.1 By Products

7.2 By Distribution Channels

8. Products - China Home Appliance Market and Volume

8.1 Refrigerators

8.1.1 Market

8.1.2 Volume

8.2 Freezers

8.2.1 Market

8.2.2 Volume

8.3 Dishwashing Machines

8.3.1 Market

8.3.2 Volume

8.4 Washing Machine

8.4.1 Market

8.4.2 Volume

8.5 Cookers & Ovens

8.5.1 Market

8.5.2 Volume

8.6 Vacuum Cleaners

8.6.1 Market

8.6.2 Volume

8.7 Small Kitchens Appliances

8.7.1 Market

8.7.2 Volume

8.8 Coffee Machines

8.8.1 Market

8.8.2 Volume

8.9 Microwave Ovens

8.9.1 Market

8.9.2 Volume

8.10 Electric Kettles

8.10.1 Market

8.10.2 Volume

9. Distribution Channels - China Home Appliance Volume

9.1 Market

9.1.1 Online

9.1.2 Offline

9.2 Volume

9.2.1 Online

9.2.2 Offline

10. Merger & Acquisitions

11. Company Analysis

11.1 LG Corp

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Sales Analysis

11.2 Electrolux

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Sales Analysis

11.3 Phillips

11.3.1 Overview

11.3.2 Recent Development

11.3.3 Sales Analysis

11.4 Haier Group Corporation

11.4.1 Overview

11.4.2 Recent Development

11.4.3 Sales Analysis

11.5 Midea Group

11.5.1 Overview

11.5.2 Recent Development

11.5.3 Sales Analysis

List of Figures:

Figure-01: China Appliances Market (Billion US$), 2019 – 2026

Figure-02: China Appliances Volume (Million), 2019 – 2026

Figure-03: Internet Retailing Platform in China Q4 2019

Figure-04: Number of Internet Users in China (In Million 2015 – 2025)

Figure-05: Annual Population Growth Rate in China 2010-2026

Figure-06: China Households Debt to GDP in Percent (July -17 to Apr -20)

Figure-07: China Appliances Market (Billion US$), 2015 – 2019

Figure-08: Forecast for China Appliances Market (Billion US$), 2020 – 2026

Figure-09: China Appliances Volume (Million), 2015 – 2019

Figure-10: Forecast for China Appliances Volume (Million), 2020 – 2026

Figure-11: China Appliances Market Share Analysis by Distribution Channels (Percent), 2015 – 2019

Figure-12: Forecast for China Appliances Market Share Analysis by Distribution Channels (Percent), 2020 – 2026

Figure-13: China Refrigerators Market (Billion US$), 2015 – 2019

Figure-14: Forecast for China Refrigerators Market (Billion US$), 2020 – 2026

Figure-15: China Refrigerators Volume (Million), 2015 – 2019

Figure-16: Forecast for China Refrigerators Volume (Million), 2020 – 2026

Figure-17: China Freezers Market (Billion US$), 2015 – 2019

Figure-18: Forecast for China Freezers Market (Billion US$), 2020 – 2026

Figure-19: China Freezers Volume (Million), 2015 – 2019

Figure-20: Forecast for China Freezers Volume (Million), 2020 – 2026

Figure-21: China Dishwashing Machines Market (Billion US$), 2015 – 2019

Figure-22: Forecast for China Dishwashing Machines Market (Billion US$), 2020 – 2026

Figure-23: China Dishwashing Machines Volume (Million), 2015 – 2019

Figure-24: Forecast for China Dishwashing Machines Volume (Million), 2020 – 2026

Figure-25: China Washing Machine Market (Billion US$), 2015 – 2019

Figure-26: Forecast for China Washing Machine Market (Billion US$), 2020 – 2026

Figure-27: China Washing Machine Volume (Million), 2015 – 2019

Figure-28: Forecast for China Washing Machine Volume (Million), 2020 – 2026

Figure-29: China Cookers & Ovens Market (Billion US$), 2015 – 2019

Figure-30: Forecast for China Cookers & Ovens Market (Billion US$), 2020 – 2026

Figure-31: China Cookers & Ovens Volume (Million), 2015 – 2019

Figure-32: Forecast for China Cookers & Ovens Volume (Million), 2020 – 2026

Figure-33: China Vacuum Cleaners Market (Billion US$), 2015 – 2019

Figure-34: Forecast for China Vacuum Cleaners Market (Billion US$), 2020 – 2026

Figure-35: China Vacuum Cleaners Volume (Million), 2015 – 2019

Figure-36: Forecast for China Vacuum Cleaners Volume (Million), 2020 – 2026

Figure-37: China Small Kitchens Appliances Market (Billion US$), 2015 – 2019

Figure-38: Forecast for China Small Kitchens Appliances Market (Billion US$), 2020 – 2026

Figure-39: China Small Kitchens Appliances Volume (Million), 2015 – 2019

Figure-40: Forecast for China Small Kitchens Appliances Volume (Million), 2020 – 2026

Figure-41: China Coffee Machines Market (Million US$), 2015 – 2019

Figure-42: Forecast for China Coffee Machines Market (Million US$), 2020 – 2026

Figure-43: China Coffee Machines Volume (Million), 2015 – 2019

Figure-44: Forecast for China Coffee Machines Volume (Million), 2020 – 2026

Figure-45: China Microwave Ovens Market (Million US$), 2015 – 2019

Figure-46: Forecast for China Microwave Ovens Market (Million US$), 2020 – 2026

Figure-47: China Microwave Ovens Volume (Million), 2015 – 2019

Figure-48: Forecast for China Microwave Ovens Volume (Million), 2020 – 2026

Figure-49: China Electric Kettles Market (Million US$), 2015 – 2019

Figure-50: Forecast for China Electric Kettles Market (Million US$), 2020 – 2026

Figure-51: China Electric Kettles Volume (Million), 2015 – 2019

Figure-52: Forecast for China Electric Kettles Volume (Million), 2020 – 2026

Figure-53: China Online Distribution Market (Billion US$), 2015 – 2019

Figure-54: Forecast for China Online Distribution Market (Billion US$), 2020 – 2026

Figure-55: China Online Distribution Volume (Million), 2015 – 2019

Figure-56: Forecast for China Online Distribution Volume (Million), 2020 – 2026

Figure-57: China Offline Distribution Market (Billion US$), 2015 – 2019

Figure-58: Forecast for China Offline Distribution Market (Billion US$), 2020 – 2026

Figure-59: China Offline Distribution Volume (Million), 2015 – 2019

Figure-60: Forecast for China Offline Distribution Volume (Million), 2020 – 2026

Figure-61: Global - LG Electronics Sales (Billion US$), 2015 - 2019

Figure-62: Global - Forecast for LG Electronics Sales (Billion US$), 2020 - 2026

Figure-63: Global - Electrolux AB Sales (Billion US$), 2015 - 2019

Figure-64: Global - Forecast for Electrolux AB Sales (Billion US$), 2020 - 2026

Figure-65: Global – Philips Group Sales (Billion US$), 2015 - 2019

Figure-66: Global – Forecast for Philips Group (Billion US$), 2020 - 2025

Figure-67: Global – Haier Group Corporation Sales (Billion US$), 2015 - 2019

Figure-68: Global – Forecast for Haier Group Corporation (Billion US$), 2020 - 2026

Figure-69: Global – Midea Group Sales (Billion US$), 2015 - 2019

Figure-70: Global – Forecast for Midea Group (Billion US$), 2020 - 2026

List of Tables:

Table-01: China Appliances Market Share Analysis by Products (Percent), 2015 – 2019

Table-02: Forecast for China Appliances Market Share Analysis by Products (Percent), 2020 – 2026

Table-03: China Appliances Volume Share Analysis by Products (Percent), 2015 – 2019

Table-04: Forecast for China Appliances Volume Share Analysis by Products (Percent), 2020 – 2026

Table-05: Acquisition by Electrolux AB

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com