Blood Glucose Device Market, Users Global Forecast 2022-2027, SMBG Components, Industry Trends, Growth, Insight, Impact of COVID-19, Company Analysis

Buy NowBlood Glucose Device Market Outlook

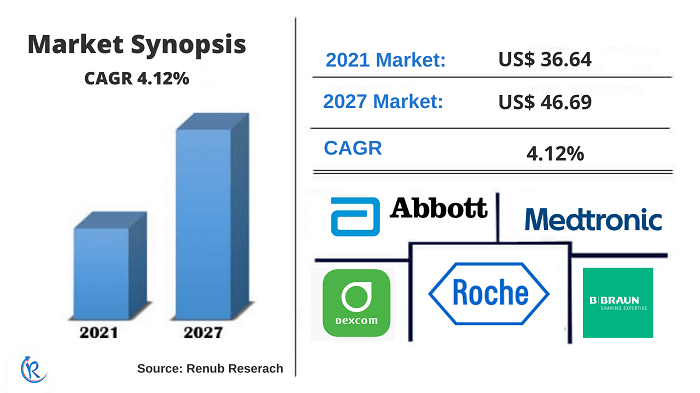

Self-Monitoring Blood Glucose Devices Market is expected to reach US$ 46.69 Billion in 2027. Over time, typical lab diagnostic tests have only served to assist physicians in diagnosing disease. Patients with more fluctuating glucose levels, on the other hand, need their levels monitored every day. Also, patients who use insulin need to regularly monitor their blood glucose levels. As a result, a current diabetes care approach involving blood glucose meters by patients to promptly check their glucose levels and provide an accurate assessment of capillary glucose concentration is known as self-monitoring blood glucose (SMBG). Additionally, blood glucose monitoring aids diabetic patients in making daily management decisions such as food consumption, insulin dosage, and physical activity.

Self-Monitoring Blood Glucose Devices Industry is anticipated to expand with a CAGR of 4.12% from 2021 to 2027:

The increased prevalence of diabetes is attributable to the market growth of self-monitoring blood glucose gadgets. Furthermore, lifestyle changes, food choices, increased smoking, and alcohol intake are likely to increase diabetes prevalence rates. Again, as people become more aware of home monitoring and the importance of regular diabetes treatment to lower the risk of hyperglycemia, demand for self-monitoring blood glucose monitors is increasing.

In addition, the government is launching several programs to raise public awareness about early diagnosis. The National Diabetes Education Program (NDEP) collaborated with the Centers for Disease Control and Prevention (CDC) and the NIH. The National Diabetes Education Program (NDEP) strives to lessen the prevalence of prediabetes by delivering diabetes-related education to an eclectic group of people, including hard-to-reach inhabitants, faith-based communities, ethnic minorities, community-based organizations, and healthcare providers.

COVID-19 Influence on Self-Monitoring Blood Glucose Devices Industry:

The COVID-19 epidemic has augmented the growth of the Self-Monitoring Blood Glucose Devices Market. Due to the pandemic, a few market participants reported an increase in diabetes care revenue. For example, Abbott claimed in June 2020 that their glucose monitoring device FreeStyleLibre accounted for 59.3 percent of the company's sales growth in the first quarter of 2020. With the increased risk of coronavirus transmission among diabetes patients, a new focus has been on home usage monitoring devices to help patients regulate their blood glucose levels. According to Renub Research, Self-Monitoring Blood Glucose Devices Market was US$ 36.64 Billion in 2021.

Global Self-Monitoring Blood Glucose Devices Market Segmentation:

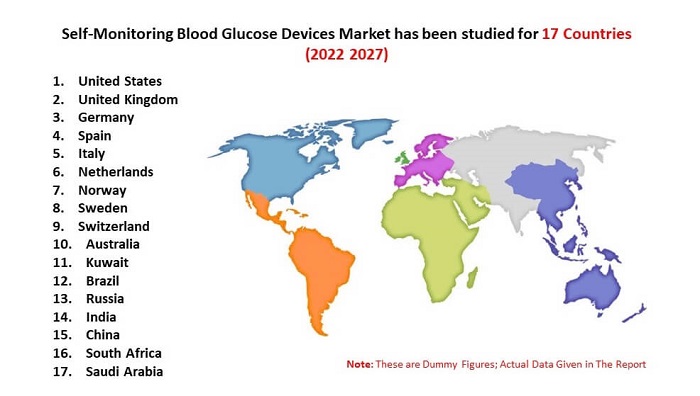

The self-monitoring blood glucose devices industry is categorized into Type 1 Diabetes and Type 2 Diabetes perspective for Diabetes Population, Blood Glucose Devices (SMBG) Market (Test Strips, Lancet, Glucose Meter), Blood Glucose Device (SMBG) Users and Reimbursement of Blood Glucose Devices of 17 Countries (United States, United Kingdom, Germany, Spain, Italy, Netherlands, Norway, Sweden, Switzerland, Australia, Kuwait, Brazil, Russia, India, China, South Africa, and Saudi Arabia)

Competitive Landscape:

The leading worldwide self-monitoring blood glucose market players are Roche Diagnostic, Abbott Laboratories, Dexcom, Inc., Medtronic, B. Braun Melsungen AG, and DarioHealth Corp. According to our data, these firms have a global market presence and hold a significant portion of the market. At the same time, the remaining manufacturers are limited to other local or regional manufacturers. Recent mergers and acquisitions between the participants have aided the corporations in strengthening their market presence.

Renub Research latest report “Self-Monitoring Blood Glucose Devices Market, Global Forecast (Type 1 Diabetes and Type 2 Diabetes), (Diabetes Population, Blood Glucose Devices (SMBG) Market (Test Strips, Lancet, Glucose Meter), Blood Glucose Device (SMBG) Users and Reimbursement of Blood Glucose Devices), Countries (United States, United Kingdom, Germany, Spain, Italy, Netherlands, Norway, Sweden, Switzerland, Australia, Kuwait, Brazil, Russia, India, China, South Africa, and Saudi Arabia), Companies (Roche Diagnostic, Abbott Laboratories, Dexcom, Inc., Medtronic, B. Braun Melsungen AG, and DarioHealth Corp.)” provides a detailed analysis of Self-Monitoring Blood Glucose Devices Industry.

Self-Monitoring Blood Glucose Devices Market has been studied for 17 Countries:

1. United States

2. United Kingdom

3. Germany

4. Spain

5. Italy

6. Netherlands

7. Norway

8. Sweden

9. Switzerland

10. Australia

11. Kuwait

12. Brazil

13. Russia

14. India

15. China

16. South Africa

17. Saudi Arabia

Self-Monitoring Blood Glucose Devices Market for the above mentioned countries is categorized from 2 viewpoints:

1. Type 1 Diabetes

2. Type 2 Diabetes

Further, the market for Type 1 Diabetes and Type 2 Diabetes have been covered from 4 viewpoints:

1. Diabetes Population

2. Blood Glucose Devices (SMBG) Market

a) Test Strips

b) Lancet,

c) Glucose Meter

3. Blood Glucose Device (SMBG) Users

4. Reimbursement of Blood Glucose Devices

Report Details:

| Report Features | Details |

| Base Year | 2021 |

| Historical Period | 2017 - 2021 |

| Forecast Period | 2022 - 2027 |

| Market | US$ Billion |

| Segment Covered | Type 1 Diabetes Type 2 Diabetes |

| Region Covered | 17 Countries |

| Companies Covered | Roche Diagnostic, Abbott Laboratories, Dexcom, Inc., Medtronic, B. Braun Melsungen AG, and DarioHealth Corp. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequently Asked Questions:

1. What is the Diabetes population of Western Countries?

2. Which are the top companies in self-monitoring blood glucose devices market?

3. What are the key trends in the blood glucose monitoring devices market?

4. What is the CAGR of glucose test strips market?

5. What has been the COVID-19 impact on self-monitoring blood glucose devices industry?

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Blood Glucose (SMBG) Market and Users

5.1 Blood Glucose Device Market (Type1 + Type 2) Diabetes

5.1.1 Type 1 Diabetes

5.1.2 Type 2 Diabetes

5.2 Test Strips Market and Forecast

5.2.1 Type 1 Diabetes

5.2.2 Type 2 Diabetes

5.3 Lancet Market and Forecast

5.3.1 Type 1 Diabetes

5.3.2 Type 2 Diabetes

5.4 Meter Market and Forecast

5.4.1 Type 1 Diabetes

5.4.2 Type 2 Diabetes

5.5 Global Diabetes Population (Type1 + Type 2)

5.5.1 Type 1 Diabetes Population

5.5.2 Type 2 Diabetes Population

5.6 Blood Glucose (SMBG) Device Users (Type1 + Type 2)

5.6.1 Type 1 Diabetes Blood Glucose (SMBG) Device Users

5.6.2 Type 2 Diabetes Blood Glucose (SMBG) Device Users

6. Share Analysis – Blood Glucose Device Market, Diabetes Population, SMBG User

6.1 SMBG Market Share

6.1.1 Total SMBG Market Share

6.1.1.1 Type 1

6.1.1.2 Type 2

6.1.2 Test Strips

6.1.2.1 Type 1

6.1.2.2 Type 2

6.1.3 Lancet

6.1.3.1 Type 1

6.1.3.2 Type 2

6.1.4 Blood Glucose Meter

6.1.4.1 Type 1

6.1.4.2 Type 2

6.1.5 Diabetes Population Share

6.1.5.1 Type 1 Diabetes

6.1.5.2 Type 2 Diabetes

6.1.6 Blood Glucose Device User Share & Forecast

6.1.6.1 Type 1 Diabetes

6.1.6.2 Type 2 Diabetes

7. United States

7.1 United States Diabetes Population

7.1.1 Type 1 Diabetes

7.1.2 Type 2 Diabetes

7.2 Blood Glucose Device (SMBG) Market

7.2.1 Test Strips (Diabetes) Market

7.2.1.1 Type 1

7.2.1.2 Type 2

7.2.2 Lancet (Diabetes) Market

7.2.2.1 Type 1

7.2.2.2 Type 2

7.2.3 Glucose Meter (Diabetes) Market

7.2.3.1 Type 1

7.2.3.2 Type 2

7.3 Blood Glucose (SMBG) (Diabetes) Users

7.3.1 Type 1

7.3.2 Type 2

7.4 Reimbursement of Blood Glucose Devices in United States

8. United Kingdom

8.1 United Kingdom Diabetes Population

8.1.1 Type 1 Diabetes

8.1.2 Type 2 Diabetes

8.2 Blood Glucose Device (SMBG) Market

8.2.1 Test Strips (Diabetes) Market

8.2.1.1 Type 1

8.2.1.2 Type 2

8.2.2 Lancet (Diabetes) Market

8.2.2.1 Type 1

8.2.2.2 Type 2

8.2.3 Glucose Meter (Diabetes) Market

8.2.3.1 Type 1

8.2.3.2 Type 2

8.3 Blood Glucose (SMBG) (Diabetes) Users

8.3.1 Type 1

8.3.2 Type 2

8.4 Reimbursement of Blood Glucose Devices in United Kingdom

9. Germany

9.1 Germany Diabetes Population

9.1.1 Type 1 Diabetes

9.1.2 Type 2 Diabetes

9.2 Blood Glucose Device (SMBG) Market

9.2.1 Test Strips (Diabetes) Market

9.2.1.1 Type 1

9.2.1.2 Type 2

9.2.2 Lancet (Diabetes) Market

9.2.2.1 Type 1

9.2.2.2 Type 2

9.2.3 Glucose Meter (Diabetes) Market

9.2.3.1 Type 1

9.2.3.2 Type 2

9.3 Blood Glucose (SMBG) (Diabetes) Users

9.3.1 Type 1

9.3.2 Type 2

9.4 Reimbursement of Blood Glucose Devices in Germany

10. Spain

10.1 Spain Diabetes Population

10.1.1 Type 1 Diabetes

10.1.2 Type 2 Diabetes

10.2 Blood Glucose Device (SMBG) Market

10.2.1 Test Strips (Diabetes) Market

10.2.1.1 Type 1

10.2.1.2 Type 2

10.2.2 Lancet (Diabetes) Market

10.2.2.1 Type 1

10.2.2.2 Type 2

10.2.3 Glucose Meter (Diabetes) Market

10.2.3.1 Type 1

10.2.3.2 Type 2

10.3 Blood Glucose (SMBG) (Diabetes) Users

10.3.1 Type 1

10.3.2 Type 2

10.4 Reimbursement of Blood Glucose Devices in Spain

11. Italy

11.1 Italy Diabetes Population

11.1.1 Type 1 Diabetes

11.1.2 Type 2 Diabetes

11.2 Blood Glucose Device (SMBG) Market

11.2.1 Test Strips (Diabetes) Market

11.2.1.1 Type 1

11.2.1.2 Type 2

11.2.2 Lancet (Diabetes) Market

11.2.2.1 Type 1

11.2.2.2 Type 2

11.2.3 Glucose Meter (Diabetes) Market

11.2.3.1 Type 1

11.2.3.2 Type 2

11.3 Blood Glucose (SMBG) (Diabetes) Users

11.3.1 Type 1

11.3.2 Type 2

11.4 Reimbursement of Blood Glucose Devices in Italy

12. Netherlands

12.1 Netherlands Diabetes Population

12.1.1 Type 1 Diabetes

12.1.2 Type 2 Diabetes

12.2 Blood Glucose Device (SMBG) Market

12.2.1 Test Strips (Diabetes) Market

12.2.1.1 Type 1

12.2.1.2 Type 2

12.2.2 Lancet (Diabetes) Market

12.2.2.1 Type 1

12.2.2.2 Type 2

12.2.3 Glucose Meter (Diabetes) Market

12.2.3.1 Type 1

12.2.3.2 Type 2

12.3 Blood Glucose (SMBG) (Diabetes) Users

12.3.1 Type 1

12.3.2 Type 2

12.4 Reimbursement of Blood Glucose Devices in Netherlands

13. Norway

13.1 Norway Diabetes Population

13.1.1 Type 1 Diabetes

13.1.2 Type 2 Diabetes

13.2 Blood Glucose Device (SMBG) Market

13.2.1 Test Strips (Diabetes) Market

13.2.1.1 Type 1

13.2.1.2 Type 2

13.2.2 Lancet (Diabetes) Market

13.2.2.1 Type 1

13.2.2.2 Type 2

13.2.3 Glucose Meter (Diabetes) Market

13.2.3.1 Type 1

13.2.3.2 Type 2

13.3 Blood Glucose (SMBG) (Diabetes) Users

13.3.1 Type 1

13.3.2 Type 2

13.4 Reimbursement of Blood Glucose Devices in Norway

14. Sweden

14.1 Sweden Diabetes Population

14.1.1 Type 1 Diabetes

14.1.2 Type 2 Diabetes

14.2 Blood Glucose Device (SMBG) Market

14.2.1 Test Strips (Diabetes) Market

14.2.1.1 Type 1

14.2.1.2 Type 2

14.2.2 Lancet (Diabetes) Market

14.2.2.1 Type 1

14.2.2.2 Type 2

14.2.3 Glucose Meter (Diabetes) Market

14.2.3.1 Type 1

14.2.3.2 Type 2

14.3 Blood Glucose (SMBG) (Diabetes) Users

14.3.1 Type 1

14.3.2 Type 2

14.4 Reimbursement of Blood Glucose Devices in Sweden

15. Switzerland

15.1 Switzerland Diabetes Population

15.1.1 Type 1 Diabetes

15.1.2 Type 2 Diabetes

15.2 Blood Glucose Device (SMBG) Market

15.2.1 Test Strips (Diabetes) Market

15.2.1.1 Type 1

15.2.1.2 Type 2

15.2.2 Lancet (Diabetes) Market

15.2.2.1 Type 1

15.2.2.2 Type 2

15.2.3 Glucose Meter (Diabetes) Market

15.2.3.1 Type 1

15.2.3.2 Type 2

15.3 Blood Glucose (SMBG) (Diabetes) Users

15.3.1 Type 1

15.3.2 Type 2

15.4 Reimbursement of Blood Glucose Devices in Switzerland

16. Australia

16.1 Australia Diabetes Population

16.1.1 Type 1 Diabetes

16.1.2 Type 2 Diabetes

16.2 Blood Glucose Device (SMBG) Market

16.2.1 Test Strips (Diabetes) Market

16.2.1.1 Type 1

16.2.1.2 Type 2

16.2.2 Lancet (Diabetes) Market

16.2.2.1 Type 1

16.2.2.2 Type 2

16.2.3 Glucose Meter (Diabetes) Market

16.2.3.1 Type 1

16.2.3.2 Type 2

16.3 Blood Glucose (SMBG) (Diabetes) Users

16.3.1 Type 1

16.3.2 Type 2

16.4 Reimbursement of Blood Glucose Devices in Australia

17. Kuwait

17.1 Kuwait Diabetes Population

17.1.1 Type 1 Diabetes

17.1.2 Type 2 Diabetes

17.2 Blood Glucose Device (SMBG) Market

17.2.1 Test Strips (Diabetes) Market

17.2.1.1 Type 1

17.2.1.2 Type 2

17.2.2 Lancet (Diabetes) Market

17.2.2.1 Type 1

17.2.2.2 Type 2

17.2.3 Glucose Meter (Diabetes) Market

17.2.3.1 Type 1

17.2.3.2 Type 2

17.3 Blood Glucose (SMBG) (Diabetes) Users

17.3.1 Type 1

17.3.2 Type 2

17.4 Reimbursement of Blood Glucose Devices in Kuwait

18. Brazil

18.1 Brazil Diabetes Population

18.1.1 Type 1 Diabetes

18.1.2 Type 2 Diabetes

18.2 Blood Glucose Device (SMBG) Market

18.2.1 Test Strips (Diabetes) Market

18.2.1.1 Type 1

18.2.1.2 Type 2

18.2.2 Lancet (Diabetes) Market

18.2.2.1 Type 1

18.2.2.2 Type 2

18.2.3 Glucose Meter (Diabetes) Market

18.2.3.1 Type 1

18.2.3.2 Type 2

18.3 Blood Glucose (SMBG) (Diabetes) Users

18.3.1 Type 1

18.3.2 Type 2

18.4 Reimbursement of Blood Glucose Devices in Brazil

19. Russia

19.1 Russia Diabetes Population

19.1.1 Type 1 Diabetes

19.1.2 Type 2 Diabetes

19.2 Blood Glucose Device (SMBG) Market

19.2.1 Test Strips (Diabetes) Market

19.2.1.1 Type 1

19.2.1.2 Type 2

19.2.2 Lancet (Diabetes) Market

19.2.2.1 Type 1

19.2.2.2 Type 2

19.2.3 Glucose Meter (Diabetes) Market

19.2.3.1 Type 1

19.2.3.2 Type 2

19.3 Blood Glucose (SMBG) (Diabetes) Users

19.3.1 Type 1

19.3.2 Type 2

19.4 Reimbursement of Blood Glucose Devices in Russia

20. India

20.1 India Diabetes Population

20.1.1 Type 1 Diabetes

20.1.2 Type 2 Diabetes

20.2 Blood Glucose Device (SMBG) Market

20.2.1 Test Strips (Diabetes) Market

20.2.1.1 Type 1

20.2.1.2 Type 2

20.2.2 Lancet (Diabetes) Market

20.2.2.1 Type 1

20.2.2.2 Type 2

20.2.3 Glucose Meter (Diabetes) Market

20.2.3.1 Type 1

20.2.3.2 Type 2

20.3 Blood Glucose (SMBG) (Diabetes) Users

20.3.1 Type 1

20.3.2 Type 2

20.4 Reimbursement of Blood Glucose Devices in India

21. China

21.1 China Diabetes Population

21.1.1 Type 1 Diabetes

21.1.2 Type 2 Diabetes

21.2 Blood Glucose Device (SMBG) Market

21.2.1 Test Strips (Diabetes) Market

21.2.1.1 Type 1

21.2.1.2 Type 2

21.2.2 Lancet (Diabetes) Market

21.2.2.1 Type 1

21.2.2.2 Type 2

21.2.3 Glucose Meter (Diabetes) Market

21.2.3.1 Type 1

21.2.3.2 Type 2

21.3 Blood Glucose (SMBG) (Diabetes) Users

21.3.1 Type 1

21.3.2 Type 2

21.4 Reimbursement of Blood Glucose Devices in China

22. South Africa

22.1 South Africa Diabetes Population

22.1.1 Type 1 Diabetes

22.1.2 Type 2 Diabetes

22.2 Blood Glucose Device (SMBG) Market

22.2.1 Test Strips (Diabetes) Market

22.2.1.1 Type 1

22.2.1.2 Type 2

22.2.2 Lancet (Diabetes) Market

22.2.2.1 Type 1

22.2.2.2 Type 2

22.2.3 Glucose Meter (Diabetes) Market

22.2.3.1 Type 1

22.2.3.2 Type 2

22.3 Blood Glucose (SMBG) (Diabetes) Users

22.3.1 Type 1

22.3.2 Type 2

22.4 Reimbursement of Blood Glucose Devices in South Africa

23. Saudi Arabia

23.1 Saudi Arabia Diabetes Population

23.1.1 Type 1 Diabetes

23.1.2 Type 2 Diabetes

23.2 Blood Glucose Device (SMBG) Market

23.2.1 Test Strips (Diabetes) Market

23.2.1.1 Type 1

23.2.1.2 Type 2

23.2.2 Lancet (Diabetes) Market

23.2.2.1 Type 1

23.2.2.2 Type 2

23.2.3 Glucose Meter (Diabetes) Market

23.2.3.1 Type 1

23.2.3.2 Type 2

23.3 Blood Glucose (SMBG) (Diabetes) Users

23.3.1 Type 1

23.3.2 Type 2

23.4 Reimbursement of Blood Glucose Devices in Saudi Arabia

24. Company Analysis

24.1 Roche Diagnostic

24.1.1 Overview

24.1.2 Recent Developments

24.1.3 Revenue

24.2 Abbott Laboratories

24.2.1 Overview

24.2.2 Recent Developments

24.2.3 Revenue

24.3 Dexcom, Inc.

24.3.1 Overview

24.3.2 Recent Developments

24.3.3 Revenue

24.4 Medtronic

24.4.1 Overview

24.4.2 Recent Developments

24.4.3 Revenue

24.5 B. Braun Melsungen AG

24.5.1 Overview

24.5.2 Recent Developments

24.5.3 Revenue

24.6 DarioHealth Corp

24.6.1 Overview

24.6.2 Recent Developments

24.6.3 Revenue

List of Figures:

Figure-01: Global – Blood Glucose (SMBG) Device Market (Million US$), 2017 – 2021

Figure-02: Global – Forecast for Blood Glucose (SMBG) Device Market (Million US$), 2022 – 2027

Figure-03: Global – Blood Glucose Device Type 1 Market (Million US$), 2017 – 2021

Figure-04: Global – Forecast for Blood Glucose Device Type 1 Market (Million US$), 2022 – 2027

Figure-05: Global – Blood Glucose Device Type 2 Market (Million US$), 2017 – 2021

Figure-06: Global – Forecast for Blood Glucose Device Type 2 Market (Million US$), 2022 – 2027

Figure-07: Global – Test Strips Type 1 Market (Million US$), 2017 – 2021

Figure-08: Global – Forecast for Test Strips Type 1 Market (Million US$), 2022 – 2027

Figure-09: Global – Test Strips Type 2 Market (Million US$), 2017 – 2021

Figure-10: Global – Forecast for Test Strips Type 2 Market (Million US$), 2022 – 2027

Figure-11: Global – Lancet Type 1 Market (Million US$), 2017 – 2021

Figure-12: Global – Forecast for Lancet Type 1 Market (Million US$), 2022 – 2027

Figure-13: Global – Lancet Type 2 Market (Million US$), 2017 – 2021

Figure-14: Global – Forecast for Lancet Type 2 Market (Million US$), 2022 – 2027

Figure-15: Global – Glucometer Type 1 Market (Million US$), 2017 – 2021

Figure-16: Global – Forecast for Glucometer Type 1 Market (Million US$), 2022 – 2027

Figure-17: Global – Glucometer Type 2 Market (Million US$), 2017 – 2021

Figure-18: Global – Forecast for Glucometer Type 2 Market (Million US$), 2022 – 2027

Figure-19: Global – Diabetes Type 1 Population Volume (Thousand), 2017 – 2021

Figure-20: Global – Forecast for Diabetes Type 1 Population Volume (Thousand), 2022 – 2027

Figure-21: Global – Diabetes Type 2 Population Volume (Thousand), 2017 – 2021

Figure-22: Global – Forecast for Diabetes Type 2 Population Volume (Thousand), 2022 – 2027

Figure-23: Global – Blood Glucose Device Type 1 Users Volume (Thousand), 2017 – 2021

Figure-24: Global – Forecast for Blood Glucose Device Type 1 Users Volume (Thousand), 2022 – 2027

Figure-25: Global – Blood Glucose Device Type 2 Users Volume (Thousand), 2017 – 2021

Figure-26: Global – Forecast for Blood Glucose Device Type 2 Users Volume (Thousand), 2022 – 2027

Figure-27: United States – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-28: United States – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-29: United States – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-30: United States – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-31: United States – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-32: United States – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-33: United States – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-34: United States – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-35: United States – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-36: United States – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-37: United States – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-38: United States – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-39: United States – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-40: United States – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-41: United States – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-42: United States – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-43: United States – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-44: United States – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-45: United States – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-46: United States – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-47: United Kingdom – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-48: United Kingdom – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-49: United Kingdom – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-50: United Kingdom – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-51: United Kingdom – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-52: United Kingdom – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-53: United Kingdom – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-54: United Kingdom – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-55: United Kingdom – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-56: United Kingdom – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-57: United Kingdom – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-58: United Kingdom – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-59: United Kingdom – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-60: United Kingdom – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-61: United Kingdom – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-62: United Kingdom – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-63: United Kingdom – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-64: United Kingdom – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-65: United Kingdom – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-66: United Kingdom – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-67: Germany – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-68: Germany – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-69: Germany – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-70: Germany – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-71: Germany – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-72: Germany – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-73: Germany – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-74: Germany – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-75: Germany – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-76: Germany – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-77: Germany – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-78: Germany – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-79: Germany – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-80: Germany – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-81: Germany – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-82: Germany – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-83: Germany – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-84: Germany – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-85: Germany – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-86: Germany – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-87: Spain – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-88: Spain – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-89: Spain – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-90: Spain – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-91: Spain – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-92: Spain – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-93: Spain – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-94: Spain – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-95: Spain – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-96: Spain – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-97: Spain – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-98: Spain – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-99: Spain – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-100: Spain – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-101: Spain – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-102: Spain – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-103: Spain – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-104: Spain – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-105: Spain – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-106: Spain – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-107: Italy – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-108: Italy – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-109: Italy – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-110: Italy – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-111: Italy – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-112: Italy – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-113: Italy – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-114: Italy – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-115: Italy – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-116: Italy – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-117: Italy – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-118: Italy – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-119: Italy – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-120: Italy – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-121: Italy – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-122: Italy – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-123: Italy – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-124: Italy – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-125: Italy – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-126: Italy – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-127: Netherlands – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-128: Netherlands – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-129: Netherlands – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-130: Netherlands – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-131: Netherlands – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-132: Netherlands – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-133: Netherlands – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-134: Netherlands – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-135: Netherlands – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-136: Netherlands – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-137: Netherlands – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-138: Netherlands – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-139: Netherlands – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-140: Netherlands – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-141: Netherlands – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-142: Netherlands – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-143: Netherlands – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-144: Netherlands – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-145: Netherlands – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-146: Netherlands – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-147: Norway – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-148: Norway – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-149: Norway – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-150: Norway – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-151: Norway – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-152: Norway – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-153: Norway – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-154: Norway – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-155: Norway – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-156: Norway – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-157: Norway – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-158: Norway – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-159: Norway – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-160: Norway – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-161: Norway – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-162: Norway – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-163: Norway – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-164: Norway – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-165: Norway – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-166: Norway – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-167: Sweden – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-168: Sweden – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-169: Sweden – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-170: Sweden – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-171: Sweden – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-172: Sweden – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-173: Sweden – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-174: Sweden – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-175: Sweden – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-176: Sweden – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-177: Sweden – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-178: Sweden – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-179: Sweden – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-180: Sweden – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-181: Sweden – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-182: Sweden – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-183: Sweden – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-184: Sweden – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-185: Sweden – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-186: Sweden – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-187: Switzerland – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-188: Switzerland – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-189: Switzerland – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-190: Switzerland – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-191: Switzerland – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-192: Switzerland – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-193: Switzerland – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-194: Switzerland – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-195: Switzerland – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-196: Switzerland – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-197: Switzerland – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-198: Switzerland – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-199: Switzerland – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-200: Switzerland – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-201: Switzerland – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-202: Switzerland – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-203: Switzerland – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-204: Switzerland – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-205: Switzerland – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-206: Switzerland – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-207: Australia – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-208: Australia – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-209: Australia – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-210: Australia – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-211: Australia – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-212: Australia – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-213: Australia – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-214: Australia – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-215: Australia – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-216: Australia – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-217: Australia – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-218: Australia – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-219: Australia – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-220: Australia – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-221: Australia – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-222: Australia – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-223: Australia – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-224: Australia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-225: Australia – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-226: Australia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-227: Kuwait – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-228: Kuwait – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-229: Kuwait – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-230: Kuwait – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-231: Kuwait – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-232: Kuwait – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-233: Kuwait – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-234: Kuwait – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-235: Kuwait – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-236: Kuwait – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-237: Kuwait – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-238: Kuwait – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-239: Kuwait – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-240: Kuwait – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-241: Kuwait – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-242: Kuwait – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-243: Kuwait – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-244: Kuwait – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-245: Kuwait – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-246: Kuwait – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-247: Brazil – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-248: Brazil – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-249: Brazil – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-250: Brazil – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-251: Brazil – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-252: Brazil – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-253: Brazil – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-254: Brazil – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-255: Brazil – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-256: Brazil – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-257: Brazil – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-258: Brazil – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-259: Brazil – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-260: Brazil – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-261: Brazil – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-262: Brazil – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-263: Brazil – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-264: Brazil – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-265: Brazil – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-266: Brazil – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-267: Russia – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-268: Russia – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-269: Russia – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-270: Russia – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-271: Russia – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-272: Russia – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-273: Russia – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-274: Russia – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-275: Russia – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-276: Russia – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-277: Russia – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-278: Russia – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-279: Russia – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-280: Russia – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-281: Russia – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-282: Russia – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-283: Russia – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-284: Russia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-285: Russia – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-286: Russia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-287: India – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-288: India – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-289: India – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-290: India – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-291: India – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-292: India – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-293: India – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-294: India – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-295: India – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-296: India – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-297: India – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-298: India – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-299: India – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-300: India – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-301: India – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-302: India – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-303: India – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-304: India – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-305: India – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-306: India – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-307: China – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-308: China – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-309: China – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-310: China – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-311: China – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-312: China – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-313: China – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-314: China – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-315: China – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-316: China – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-317: China – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-318: China – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-319: China – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-320: China – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-321: China – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-322: China – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-323: China – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-324: China – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-325: China – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-326: China – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-327: South Africa – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-328: South Africa – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-329: South Africa – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-330: South Africa – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-331: South Africa – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-332: South Africa – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-333: South Africa – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-334: South Africa – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-335: South Africa – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-336: South Africa – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-337: South Africa – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-338: South Africa – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-339: South Africa – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-340: South Africa – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-341: South Africa – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-342: South Africa – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-343: South Africa – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-344: South Africa – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-345: South Africa – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-346: South Africa – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-347: Saudi Arabia – Diabetes Type 1 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-348: Saudi Arabia – Forecast for Diabetes Type 1 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-349: Saudi Arabia – Diabetes Type 2 Diabetes Population Volume (Thousand), 2017 – 2021

Figure-350: Saudi Arabia – Forecast for Diabetes Type 2 Diabetes Population Volume (Thousand), 2022 – 2027

Figure-351: Saudi Arabia – Test Strips (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-352: Saudi Arabia – Forecast for Test Strips (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-353: Saudi Arabia – Test Strips (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-354: Saudi Arabia – Forecast for Test Strips (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-355: Saudi Arabia – Lancet (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-356: Saudi Arabia – Forecast for Lancet (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-357: Saudi Arabia – Lancet (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-358: Saudi Arabia – Forecast for Lancet (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-359: Saudi Arabia – Glucose Meter (Diabetes) Type 1 Market (Million US$), 2017 – 2021

Figure-360: Saudi Arabia – Forecast for Glucose Meter (Diabetes) Type 1 Market (Million US$), 2022 – 2027

Figure-361: Saudi Arabia – Glucose Meter (Diabetes) Type 2 Market (Million US$), 2017 – 2021

Figure-362: Saudi Arabia – Forecast for Glucose Meter (Diabetes) Type 2 Market (Million US$), 2022 – 2027

Figure-363: Saudi Arabia – Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2017 – 2021

Figure-364: Saudi Arabia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 1 Users Volume (Thousand), 2022 – 2027

Figure-365: Saudi Arabia – Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2017 – 2021

Figure-366: Saudi Arabia – Forecast for Blood Glucose (SMBG) (Diabetes) Type 2 Users Volume (Thousand), 2022 – 2027

Figure-367: Roche Diagnostic – Global Revenue (Million US$), 2017 – 2021

Figure-368: Roche Diagnostic – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-369: Abbott Laboratories – Global Revenue (Million US$), 2017 – 2021

Figure-370: Abbott Laboratories – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-371: Dexcom, Inc. – Global Revenue (Million US$), 2017 – 2021

Figure-372: Dexcom, Inc. – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-373: Medtronic – Global Revenue (Million US$), 2017 – 2021

Figure-374: Medtronic – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-375: B. Braun Melsungen AG – Global Revenue (Million US$), 2017 – 2021

Figure-376: B. Braun Melsungen AG – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-377: DarioHealth Corp – Global Revenue (Million US$), 2017 – 2021

Figure-378: DarioHealth Corp – Forecast for Global Revenue (Million US$), 2022 – 2027

List of Tables:

Table-01: Global – SMBG Market Share (Percent), 2017 – 2021

Table-02: Global – Forecast for SMBG Market Share (Percent), 2022 – 2027

Table-03: Global – SMBG Type 1 Market Share (Percent), 2017 – 2021

Table-04: Global – Forecast for SMBG Type 1 Market Share (Percent), 2022 – 2027

Table-05: Global – SMBG Type 2 Market Share (Percent), 2017 – 2021

Table-06: Global – Forecast for SMBG Type 2 Market Share (Percent), 2022 – 2027

Table-07: Global – Test Strips Type 1 Market Share (Percent), 2017 – 2021

Table-08: Global – Forecast for Test Strips Type 1 Market Share (Percent), 2022 – 2027

Table-09: Global – Test Strips Type 2 Market Share (Percent), 2017 – 2021

Table-10: Global – Forecast for Test Strips Type 2 Market Share (Percent), 2022 – 2027

Table-11: Global – Lancet Type 1 Market Share (Percent), 2017 – 2021

Table-12: Global – Forecast for Lancet Type 1 Market Share (Percent), 2022 – 2027

Table-13: Global – Lancet Type 2 Market Share (Percent), 2017 – 2021

Table-14: Global – Forecast for Lancet Type 2 Market Share (Percent), 2022 – 2027

Table-15: Global – Glucose Meter Type 1 Market Share (Percent), 2017 – 2021

Table-16: Global – Forecast for Glucose Meter Type 1 Market Share (Percent), 2022 – 2027

Table-17: Global – Glucose Meter Type 2 Market Share (Percent), 2017 – 2021

Table-18: Global – Forecast for Glucose Meter Type 2 Market Share (Percent), 2022 – 2027

Table-19: Global – Diabetes Population Type 1 Volume Share (Percent), 2017 – 2021

Table-20: Global – Forecast for Diabetes Population Type 1 Volume Share (Percent), 2022 – 2027

Table-21: Global – Diabetes Population Type 2 Volume Share (Percent), 2017 – 2021

Table-22: Global – Forecast for Diabetes Population Type 2 Volume Share (Percent), 2022 – 2027

Table-23: Global – Blood Glucose Device Type 1 User Volume Share (Percent), 2017 – 2021

Table-24: Global – Forecast for Blood Glucose Device Type 1 User Volume Share (Percent), 2022 – 2027

Table-25: Global – Blood Glucose Device Type 2 User Volume Share (Percent), 2017 – 2021

Table-26: Global – Forecast for Blood Glucose Device Type 2 User Volume Share (Percent), 2022 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com