Austria Coffee Market Size, Share, Trends & Forecast 2025-2033

Buy NowAustria Coffee Market Size and Forecast (2025–2033)

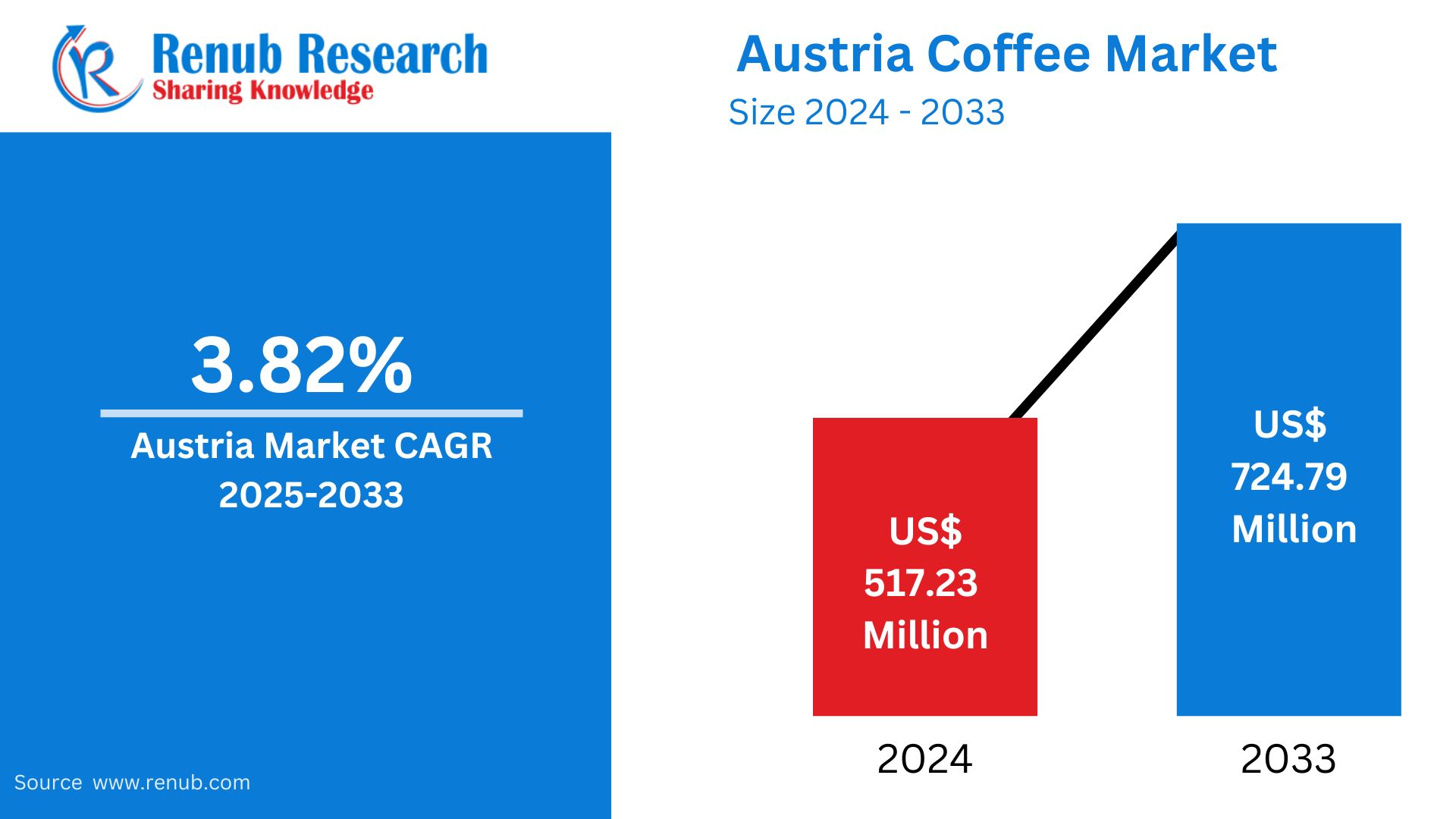

Austria Coffee Market is expected to reach US$ 724.79 million by 2033 from US$ 517.23 million in 2024, with a CAGR of 3.82% from 2025 to 2033. Premiumization, specialty brews, a robust café culture, health-conscious customer preferences, and convenience trends like pods and ready-to-drink forms that satisfy contemporary consumer needs are all factors contributing to Austria's coffee industry's growth.

Austria Coffee Market Report by Product Type (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsule), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail, Other Distribution Channels), Region (East Austria, West Austria, North Austria, South Austria) and Company Analysis, 2025-2033.

Overview of the Coffee Market in Austria

Austria's coffee business, which has its roots in the nation's cultural legacy, is a vibrant fusion of modern innovation and tradition. Austrian coffee consumption has long been influenced by the Viennese coffeehouse culture, which has been identified by UNESCO as an intangible cultural property. It is not just a beverage; it is a social and cultural event. Coffee shops continue to be important gathering places for social interaction, recreation, and community life, perpetuating this distinctive history. Even if classic espresso-based beverages like the Melange are still well-liked, shifting consumer tastes are also having an impact on market dynamics.

Specialty coffee and premiumization have been increasingly popular in recent years. High-quality, artisanal, and ethically sourced coffee products are becoming more and more popular among Austrian consumers. As a result, third-wave coffee shops and neighborhood roasters that use single-origin beans and creative brewing methods have grown in popularity. Health and sustainability are also major motivators; demand for low-caffeine and additive-free products is rising, and organic and fair-trade certifications are becoming increasingly significant. Brands are responding to growing customer awareness by using eco-friendly packaging and open sourcing methods. In keeping with larger shifts in lifestyle, there is also a rise in interest in plant-based milk substitutes.

The increase in convenience-driven consumption also helps the Austrian coffee market. In order to meet the demands of time-pressed consumers who need café-quality coffee at home or on the move, ready-to-drink coffee, single-serve pods, and expensive home brewing equipment are growing in popularity. Regional regions are also progressively embracing new ideas, even if urban places like Vienna are at the forefront of innovation and niche offers. Independent cafés coexist with national and international coffee chains, creating a competitive and varied industry. Austria's coffee business is anticipated to develop gradually in the future due to a mix of its cultural heritage, changing consumer tastes, and a strong emphasis on sustainability and quality.

Growth Drivers for the Austria Coffee Market

Premiumization and Specialty Coffee

Specialty coffee and premiumization are two key factors propelling Austria's changing coffee industry. High-end, artisanal coffee experiences that highlight origin, workmanship, and taste complexity are becoming more and more popular. This change reflects a wider interest in single-origin beans, specialty brews, and cutting-edge brewing techniques like cold brew and pour-over. Independent roasters and third-wave coffee shops are becoming more well-known because they provide carefully chosen experiences that appeal to discriminating coffee consumers. Transparency and sustainability are crucial in addition to quality; many buyers increasingly favor fair-trade and ethically sourced goods. Due to this demand, both small and major companies have been compelled to improve their products, creating a complex and competitive coffee market that is constantly changing how Austrians drink their coffee every day.

Health and Wellness Trends

Trends in health and wellbeing are having a big impact on how Austrian coffee consumers behave. More customers are looking for coffee choices that support their wellness objectives as a result of increased knowledge of lifestyle-related health concerns. This includes favoring fair trade, organic, and sugar-free or low-sugar products. As people move toward dairy-free diets, plant-based milk substitutes like oat, almond, and soy are also growing in popularity in coffee drinks. Additionally, there is a growing desire, particularly among health-conscious people, for low-caffeine and additive-free choices. In order to appeal to this market, both independent cafés and well-known coffee companies are changing their product lines to include clean ingredients, ethical sourcing, and general health advantages without sacrificing flavor.

Convenience and Innovation

Two major factors influencing the expansion of the coffee market in Austria are convenience and innovation. The need for quick, simple, and high-quality coffee solutions that work with hectic schedules is growing as people lead busier lives. Single-serve pods and capsules are a popular option for usage at home and in the workplace since they provide a constant taste and require no preparation time. In a similar vein, ready-to-drink (RTD) coffee drinks are becoming more popular, particularly with younger customers looking for choices that they can enjoy on the move. These goods, which frequently include specialty mixes or distinctive flavor characteristics, combine quality and convenience. The user experience is being improved by technological developments in packaging and brewing equipment. When taken as a whole, these developments help meet the changing demands of contemporary coffee consumers and add to the market's competitive and dynamic environment.

Challenges in the Austria Coffee Market

Changing Consumer Preferences

The coffee industry in Austria is changing due to shifting customer tastes, which offers firms both possibilities and problems. There is a discernible trend toward healthier options, such organic or additive-free coffee, plant-based milk substitutes, and low-sugar drinks. Younger customers are also looking for contemporary and distinctive coffee experiences, such as nitro coffee, cold brew, and specialty beverages with international flavors. Cafés and coffee businesses must constantly develop and modify their products to satisfy these changing needs if they want to remain relevant. It's a tricky balance to achieve this without offending regular customers who like traditional Austrian coffee methods and the coffeehouse's cultural experience. It takes ingenuity, consumer awareness, and careful menu diversity to successfully negotiate this dynamic and satisfy both traditional and modern tastes.

Labor and Operational Costs

Austria's coffee business has a lot of challenges due to rising labor and operating expenses, especially for traditional coffee shops that prioritize atmosphere and service quality. Maintaining profitability becomes more challenging, particularly for smaller, independent operations, as salaries rise and demands for skilled workers stay high. These companies frequently depend on individualized care and a well-planned client experience, both of which require more expensive overhead and trained staff. Furthermore, operating budgets are being further strained by rising rent, electricity, and raw material expenses. The inability of small cafés to absorb these costs without boosting prices, in contrast to bigger chains that may take advantage of economies of scale, may drive away price-conscious patrons. To be competitive in the face of this financial strain, effective management and creative approaches are required.

East Austria Coffee Market

The coffee market in Eastern Austria reflects the wider national trends, which are defined by a fusion of new consumer habits and old tastes. Due in large part to Vienna's historic coffee culture, the area continues to have a great love for traditional coffeehouse experiences. However, due to changing lifestyles and worldwide trends, there is a discernible movement towards current coffee consumption habits.

Specialty coffees are becoming more and more popular in Eastern Austria as consumers look for better beans and unusual brewing techniques. This transition is obvious in the expanding number of specialty coffee shops and micro-roasters in metropolitan areas. Additionally, in order to meet the fast-paced lifestyles of many locals, there is an increasing desire for convenient coffee solutions, such as single-serve pods and ready-to-drink drinks. The market is changing, but traditional coffee shops are still doing well, particularly in places like Vienna. International coffee chains and local startups are among the newcomers that are increasing the range of products that customers may choose from. For companies looking to serve a wide range of coffee lovers in Eastern Austria, this changing environment offers both possibilities and problems.

West Austria Coffee Market

A combination of traditional coffeehouse culture and a growing interest in specialty coffee define the coffee market in Western Austria. Historic coffeehouses that function as cultural centers and provide a range of coffee beverages are well-known in places like Innsbruck and Salzburg. For example, Innsbruck's Café Central creates a genuinely atmospheric experience by fusing the elegance of an old Viennese coffeehouse with a prime location and superb food.

Specialty coffee has been increasingly popular in the area in recent years. With their single-origin beans and creative brewing techniques, third-wave coffee cafes and micro-roasters are becoming more and more well-liked. The family-run roastery and café 220 Grad in Salzburg, for instance, has established a reputation for producing freshly roasted highland coffee. Businesses in the coffee sector in Western Austria face both possibilities and problems as a result of this changing environment. Even while conventional coffee shops are still doing well, the growing demand for specialty coffee necessitates innovation and adaptability to satisfy the wide range of consumer tastes.

Austria Coffee Market Segments

Product Type –Market breakup in 4 viewpoints:

- Whole Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsule

Distribution Channel –Market breakup in 4 viewpoints:

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail

- Other Distribution Channels

Region –Market breakup in 4 viewpoints:

- East Austria

- West Austria

- North Austria

- South Austria

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Revenue

Company Analysis:

- Nestlé S.A.

- JAB Holding Company

- The Kraft Heinz Company

- J.J. Darboven GmbH & Co. KG

- Strauss Group Ltd

- Melitta Group

- Starbucks Corporation

- Krüger GmbH & Co. KG

- Luigi Lavazza SpA

- Maxingvest AG (Tchibo)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.2.1 Top-down Approach

2.2.2 Bottom-up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Austria Coffee Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Distribution Channel

6.3 By Region

7. Product Type

7.1 Whole Bean

7.1.1 Historical Market Trends

7.1.2 Market Forecast

7.2 Ground Coffee

7.2.1 Historical Market Trends

7.2.2 Market Forecast

7.3 Instant Coffee

7.3.1 Historical Market Trends

7.3.2 Market Forecast

7.4 Coffee Pods and Capsule

7.4.1 Historical Market Trends

7.4.2 Market Forecast

8. Distribution Channel

8.1 Supermarkets/Hypermarkets

8.1.1 Historical Market Trends

8.1.2 Market Forecast

8.2 Convenience/Grocery Stores

8.2.1 Historical Market Trends

8.2.2 Market Forecast

8.3 Online Retail

8.3.1 Historical Market Trends

8.3.2 Market Forecast

8.4 Other Distribution Channels

8.4.1 Historical Market Trends

8.4.2 Market Forecast

9. Region

9.1 East Austria

9.2 West Austria

9.3 North Austria

9.4 South Austria

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Nestlé S.A.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Product Portfolio

12.1.5 Revenue

12.2 JAB Holding Company

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Product Portfolio

12.2.5 Revenue

12.3 The Kraft Heinz Company

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Product Portfolio

12.3.5 Revenue

12.4 J.J. Darboven GmbH & Co. KG

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio

12.4.5 Revenue

12.5 Strauss Group Ltd

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio

12.5.5 Revenue

12.6 Melitta Group

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio

12.6.5 Revenue

12.7 Starbucks Corporation

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio

12.7.5 Revenue

12.8 Krüger GmbH & Co. KG

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Product Portfolio

12.8.5 Revenue

12.9 Luigi Lavazza SpA

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development & Strategies

12.9.4 Product Portfolio

12.9.5 Revenue

12.10 Maxingvest AG (Tchibo)

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development & Strategies

12.10.4 Product Portfolio

12.10.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com