Anime Market Size - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Anime Market Forecast 2025–2033 | Renub Research

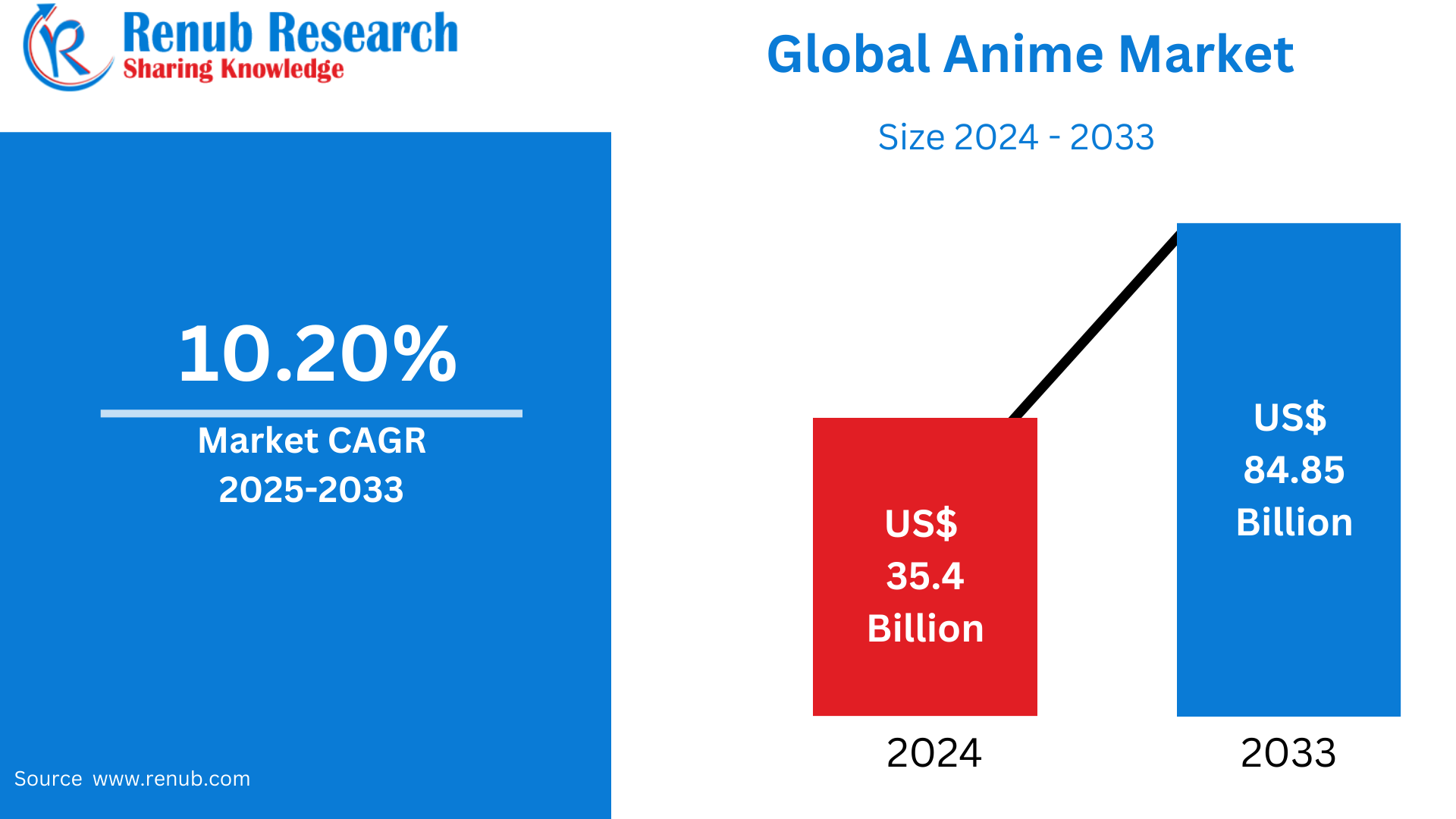

Global Anime Market was worth US$ 35.4 billion in 2024 and is expected to grow to US$ 84.85 billion in 2033 at a CAGR of 10.20% between 2025 and 2033. This is fueled by increasing popularity worldwide, online streaming services, merchandise sales and international licensing, and anime becoming a strong force within entertainment, pop culture, and cross-media storytelling globally.

Global Anime Market Outlooks

Anime is a form of animation that originated in Japan and has become a worldwide known and admired means of visual storytelling. Known for its vibrant visuals, fantastical settings, and emotionally rich stories, anime covers many genres such as action, romance, science fiction, and slice of life. In contrast to traditional Western cartoons, anime is enjoyed by both children and adults, frequently dealing with mature themes and philosophical concepts.

In addition to entertainment, anime is utilized in other industries and cultures. In Japan, it is applied as an instrument for education, advertising, and public information campaigns. Internationally, anime drives fashion, music, gaming, and even tourism, with consumers making pilgrimages to Japan to see the locales featured in their beloved shows. Merchandise sales, cosplay events, and conventions add substantially to the international economy. With the development of streaming platforms, anime has gained wider reach, drawing international diversity in their audiences and cementing its position not only as a source of entertainment, but as a vibrant cultural export.

Drives towards growth in the international anime market

Development of Streaming Platforms

The emergence of digital streaming platforms such as Netflix, Crunchyroll, Hulu, and Amazon Prime has transformed anime distribution internationally. Such platforms are heavily investing in original anime content and regionally localized subtitles or dubbing, bringing anime within reach of more people. With the removal of geographical restraints and global simultaneous releases, streaming services have pushed international fandom at a fast pace. On-demand viewing ease and algorithm-driven suggestions also make binge-watching and fan culture a norm. Since these sites vie for rights to license, the anime studios receive more financing, exposure, and international presence—feeding steady growth in the market and drawing new audiences in various areas and demographics. January 2025, Crunchyroll revealed at Sony Group Corporation's CES press conference that it will release a new digital manga app titled Crunchyroll Manga later this year. This app will be a premium add-on to subscribers of Crunchyroll and will be offered as a separate application on iOS and Android, with a future plan for web browser support.

Cross-Media Integration and Merchandising

Anime is no longer relegated to TV or movies—it flourishes across media platforms, from video games and mobile apps to novels, music, and merchandise. The characters and properties become cultural icons, fueling toy, apparel, collectible, and partner brand demand with big-name global companies. This integration solidifies fan affiliation and generates ongoing revenue streams off the screen. Intellectual property (IP) management is key to profit-making for the content, particularly in Japan where anime-themed pachinko machines, amusement parks, and temporary stores are de rigueur. As international audiences crave immersive experiences, the commercial landscape around anime IP continues growing strongly, driving overall market expansion. August 2022, Toei Animation Co. Ltd. partnered with Epic Games, Inc. to add Dragon Ball Z characters as playable avatars in the hit Fortnite video game. This alliance invited in additional players to the game and also introduced the anime to those who had no prior knowledge of it.

Growing Global Cultural Acceptance

Anime has grown from a subculture interest to a worldwide accepted and enjoyed art form. International film festivals, academic programs, and museum displays now include anime as a valid art form of expression. Younger viewers, particularly Gen Z and Millennials, are connected to its emotional resonance, mature narratives, and varied genres. Social media platforms such as TikTok, YouTube, and Instagram have increased anime's cultural penetration, allowing fan-generated content, cosplaying, and debate to flourish online. Such cultural mainstreaming has led broadcasters and brands to incorporate anime into mainstream programming and advertising, creating wider appeal and more investment in international anime production and licensing. August 2024, Discotek Media announced 25 new releases at its panel at Otakon, a three-day anime convention and live stream event, showcasing a representative roster of anime and tokusatsu releases, further increasing the diversity offered to American consumers. These include popular franchises like Lupin III and Digimon, in addition to niche titles like Kiss×sis and the various tokusatsu movies.

Challenges in the Global Anime Market

Overproduction and Quality Issues

As worldwide demand for anime increases, studios are under pressure to churn out more material in a short time. This usually means overproduction, and it can lead to a decrease in animation quality, tiresome storylines, and creator burnout. Small studios do not have the capability to keep up with deadlines, while creators are subjected to poor working conditions and compensation. These issues in quality control potentially drive away committed fans and harm new titles' reputations. Moreover, excessive content complicates it for series to differentiate, and thus oversaturates the market. Better production practices and better labor conditions become more and more pressing issues for the industry to solve.

Licensing and Regional Limitations

Irrespective of increasing global interest, licensing complications and regional limitations complicate worldwide availability of anime. Several popular series are not available for immediate export outside Japan because of postponed licensing agreements or exclusivity arrangements with local platforms. Followers resort to piracy or unauthorized streaming, cutting into creators' and studios' income. Additionally, censorship laws in some nations impact the portrayal of anime about violence, gender orientation, or faith, constraining creative expression. These legal and cultural issues might impede the speed of international growth. To counter this, studios and distributors have to streamline licensing operations and remaster content without diluting artistic core values.

Global Merchandising Anime Market

Merchandising is the backbone of anime's business success, involving merchandise such as figurines, clothing, keychains, posters, and interior design. These highly popular franchises like Pokémon, One Piece, and Demon Slayer make billions of dollars from the sale of merchandise alone. Due to the growing e-commerce websites, it has become convenient for anime fans from across the globe to buy original anime merchandise. Limited edition collectibles, fashion collaborations, and subscription boxes fuel repeat business and consumer enthusiasm. Merchandising pulls the shelf life of anime IPs past broadcast cycles, providing a crucial and expanding market. Worldwide conventions and pop-up events further increase exposure and revenue.

Worldwide Pachinko Anime Market

Anime pachinko machines in Japan are an unusual source of entertainment and revenue in the country. These machines usually have popular characters, scenes, and music from top anime shows, giving a gamified experience that combines storytelling with chance-based gaming. This crossover attracts both anime enthusiasts and traditional pachinko players. While pachinko is largely a Japanese phenomenon, its impact on the anime market is substantial, giving studios a steady revenue stream through licensing. Although the segment is niche internationally, its financial influence within the Japanese market makes it an interesting part of anime's larger business model.

Global Anime Video Market

The global anime video market encompasses digital downloads, sales of Blu-ray/DVDs, and video-on-demand (VOD) viewing. Although physical media sales are in decline worldwide, collector editions, limited releases, and bundled content are still popular with loyal fans. Digital video formats are convenient and have become the prevalent mode of consumption. With simulcasts and original content being provided by streaming platforms, fan allegiance moves to digital subscriptions. Global dubbing and subtitling services have increased accessibility. With changing viewing patterns, the video segment remains at the core of monetization, particularly for studios looking for global audiences and long-term fan support through binge-watching content.

Global Anime Sci-Fi Fantasy Market

Sci-fi and fantasy are two of the most popular genres in anime, with top-rated shows like Attack on Titan, Neon Genesis Evangelion, and Sword Art Online showing the way. These genres provide possibilities for intricate world-building, philosophical subject matter, and visually stunning animation. Viewers around the world tune into the imagination and depth of emotion that these genres provide. Streaming services massively popularize fantasy and sci-fi anime because of their universal appeal and considerable re-watch value. With a constant stream of new titles and adaptations of light novels or manga, the category is rapidly expanding, particularly among younger adult audiences around the world.

World Sports Anime Market

Sports anime, like Haikyuu!!, Kuroko no Basket, and Blue Lock, mix competition with perseverance, friendship, and self-improvement themes. These series have broad appeal, attracting viewers who may not traditionally follow anime. Their high-energy animation, emotional storytelling, and relatable characters resonate with diverse audiences. The popularity of real-world sports boosts viewership, and partnerships with sports brands or events offer additional marketing channels. Sports anime also inspire fan engagement through cosplay, merchandise, and fan art. As increasingly global audiences look for inspiring and action-driven material, the sports anime category continues to be a rising and emotionally engaging niche.

United States Anime Market

The United States is the largest overseas market for anime, fueled by a huge fan base, widespread streaming access, and high cultural impact. Anime is mostly popular across all ages, with shows available on platforms such as Crunchyroll, Netflix, and Hulu. Large cities like Los Angeles and Washington, D.C., host massive anime conventions including Anime Expo and Otakon, where like-minded people congregate and merchandise sales skyrocket. Domestic production houses increasingly partner with Japanese studios to produce original work. Fashion, music, and even education draw influence from anime. With anime rising to mainstream status, the United States continues to drive the growth, innovation, and international exposure for the entire industry. Bioworld Merchandising, Inc. declared in July 2024 that it had acquired Packed Party, a Texas company that focused on party and lifestyle accessories. With the use of Bioworld's worldwide presence and infrastructure to expand Packed Party's channels of distribution and product lineup, this partnership is expected to enhance product growth and innovation for both companies.

Germany Anime Market

Germany is one of Europe's foremost anime markets, boasting a keen fan base and frequent television airings of dubbed anime on stations such as ProSieben MAXX and RTL II. Fans in Germany enjoy the emotional drama and visual aesthetics of anime, with fantasy, action, and romance genres proving especially popular. DVD and Blu-ray sales are still robust, and events such as AnimagiC and DoKomi draw thousands. Streaming services have further pushed anime's exposure in the nation. With increasing passion for Japanese culture, Germany continues to be an important part of the European anime market, with a growing demand for localized titles.

India Anime Market

India's anime market is also growing at a fast pace, driven by youth interest, internet penetration, and access to smartphones. Although dominated traditionally by Western cartoons, Indian audiences are increasingly using anime on platforms such as Netflix, YouTube, and Crunchyroll. Fan groups are thriving, with growing popularity for shows like Naruto, Demon Slayer, and Death Note. Demand for Hindi and local language dubs is encouraging platforms to localize. Anime-centered events and cosplay culture are beginning to emerge in city centers. With a huge Gen Z base and growing digital consumption, India is an emergent high-growth market for international anime makers.

Saudi Arabia Anime Market

Anime experienced a significant increase in popularity in Saudi Arabia due to a youth population, higher cultural receptivity, and robust internet penetration. Platforms such as the Riyadh Season have included anime zones, concerts, and movie screenings, emphasizing government promotion of entertainment diversification. Streaming sites provide subtitled and dubbed anime, which makes it more accessible to Arabic-speaking communities. Familiar titles strike a chord because they tap into universal themes of family, honor, and heroism. Merchandise and cosplay around anime are also gaining popularity. With Saudi Arabia expanding its entertainment industry, anime features prominently in terms of appealing to young people and fostering cultural exchange.

Anime Market Segmentation

Type

- Merchandising

- Internet Distribution

- Pachinko

- T.V.

- Live Entertainment

- Video

- Movie

- Music

Genre

- Action & Adventure

- Sci-Fi Fantasy

- Romance & Drama

- Sports

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Pierrot Co. Ltd.

- Production I.G Inc.

- Studio Ghibli, Inc.

- Bioworld Merchandising Inc.

- Toei Animation Co. Ltd.

- Bones Inc.

- Kyoto Animation Co. Ltd.

- MADHOUSE Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Genre and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Anime Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Anime Market Share Analysis

6.1 By Type

6.2 By Genre

6.3 By Countries

7. Type

7.1 Merchandising

7.2 Internet Distribution

7.3 Pachinko

7.4 T.V.

7.5 Live Entertainment

7.6 Video

7.7 Movie

7.8 Music

8. Genre

8.1 Action & Adventure

8.2 Sci-Fi Fantasy

8.3 Romance & Drama

8.4 Sports

8.5 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Pierrot Co., Ltd.

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Production I.G, Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Studio Ghibli, Inc.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Bioworld Merchandising, Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Toei Animation Co., Ltd.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Bones Inc.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Kyoto Animation Co., Ltd.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 MADHOUSE, Inc.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com