Alcoholic Beverages Market Size and Share Analysis - Growth Trends and Forecast Report 2025–2033

Buy NowAlcoholic Beverage Market Size and Forecast 2025-2033

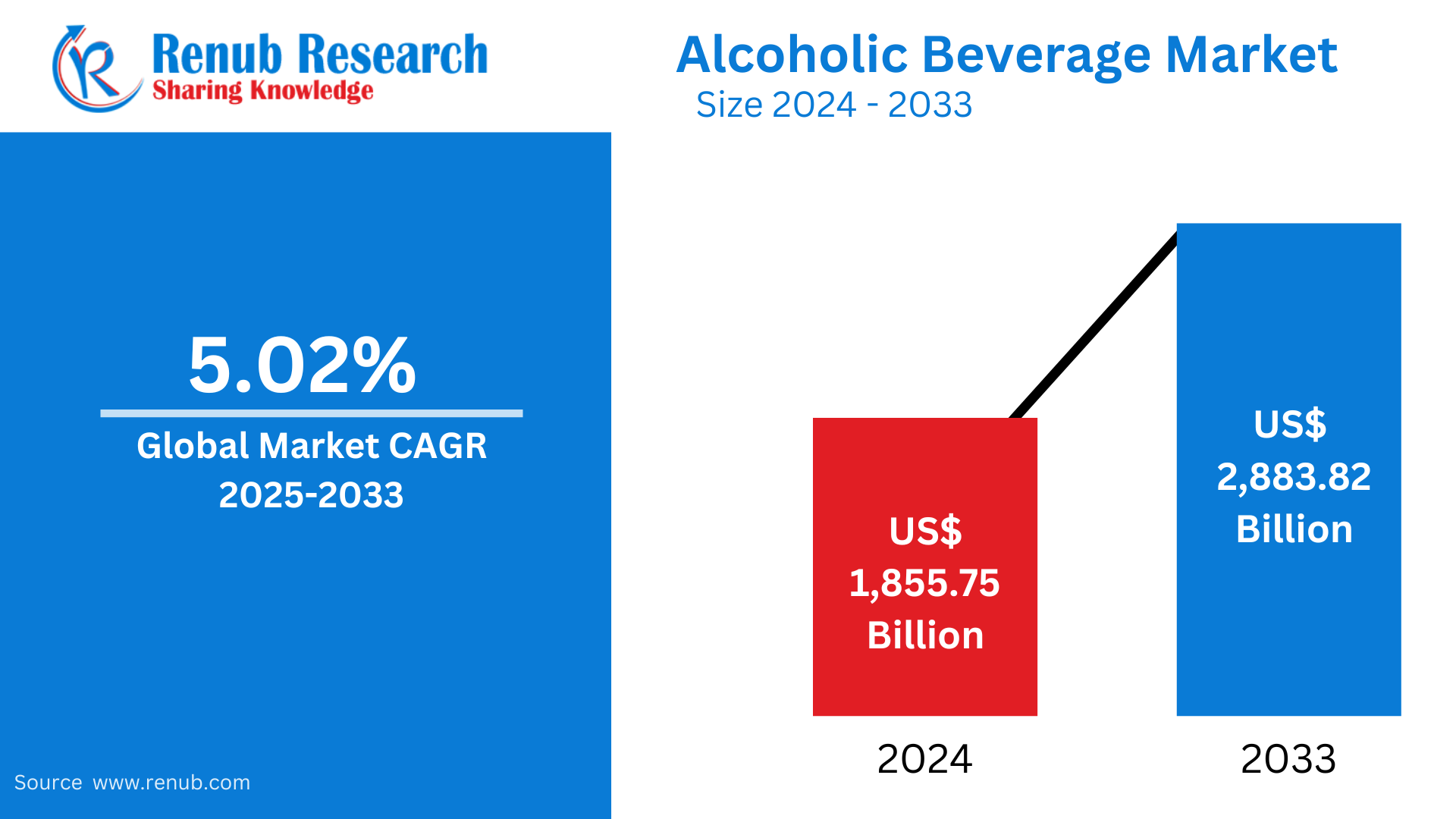

Global alcoholic beverages market was valued at US$ 1,855.75 billion in 2024 and is expected to grow at a CAGR of 5.02% during the period of 2025-2033, to reach US$ 2,883.82 billion by 2033.

The report Global Alcoholic Beverages Market & Forecast covers by Type (Beer, Distilled Spirits, Wine, Others), Packaging (Glass Bottle, Tin, Plastic Bottle), Distribution Channel (Convenience Stores, On Premises, Liquor Stores, Grocery Shops, Internet Retailing, Supermarkets), Country and Company Analysis 2025-2033

Alcoholic Beverage Market Overview

Alcoholic beverages contain ethanol (alcohol) and are generally consumed for recreation, socialization, or ritual purposes. They are made by fermenting or distilling fruits, grains, and sugars. Examples of alcoholic beverages include beer, wine, spirits (such as whiskey, vodka, and rum), and cocktails.

Alcoholic beverages consumption varies by region, culture, and individual preference. In Europe, for example, countries like France and Italy have a strong tradition of wine consumption, while beer is more prevalent in countries like Germany and the United Kingdom. In recent years, there has been a growing trend toward premium and craft alcoholic beverages as consumers seek unique flavors and higher-quality products. Health-conscious consumption has increased, with a rising interest in low-alcohol and non-alcoholic alternatives. Regulatory frameworks, cultural norms, and social occasions also significantly shape alcohol consumption patterns.

Growth Drivers in the Alcoholic Beverage Market

Growing Disposable Incomes and Premiumization

Rising disposable incomes and premiumization are growth drivers for premium alcoholic beverages. Consumers are increasingly seeking unique and craft options, including boutique wines, craft beers, and premium spirits, in pursuit of indulgence and experience-based consumption. Encouragement to innovate from luxury and exclusivity in offering luxury products, allowing premium alcoholic drinks to be accepted by a bigger number of populations. India is estimated to improve its GDP per capita from $2,268 in 2021 to about $5,140 in 2031. Of this population growth, it would be projected to have an estimated 191 million households that earned over US $5,000 per year growing from 26% to about 54%. This shift, as is widely expected to do elsewhere, is probably going to continue increasing consumption with a shape not significantly different from trends seen in China, Indonesia, or Thailand when incomes surpassed US$2,000 per capita.

New Trends in Preferences and Health Behaviors

People increasingly are turning to low and no-alcohol beverages and the broader trend away from overuse of alcohol on health grounds that will promote the growth of 'healthy' options in alcohol. Functional drinks and botanically infused spirits, for example, have gained popularity for catering to the emerging demand for healthy, lifestyle-centric alcohol. In Japan, guidelines for alcohol consumption were recommended by the Ministry of Health, Labour, and Welfare, focusing on health and safe drinking. A survey from GlobalData reveals that Q3 2024 saw increased interest in low-alcohol versions. This market's interest comes specifically from the consumers of younger ages, like 56% being between the age group of 25-34 and 49% within 18-24 years who were consuming low alcohol or no-alcohol beverages.

Development of E-commerce and Online Channels

The adoption of e-commerce and online media has highly helped the growth in the alcoholic beverages market. Consumers can now easily access a wide variety of alcoholic products through online retailers, subscription services, and delivery apps. This shift towards digital sales channels has made it easy for consumers to explore and purchase alcoholic beverages from anywhere, thus increasing market reach and sales. In May 2023, Cocktail Courier acquired Thirstie, an e-commerce company that helps alcohol brands establish direct-to-consumer channels while ensuring compliance with regulations. Cocktail Courier will now leverage the technology of Thirstie in its business.

Challenges in the Alcoholic Beverage Industry

Strict Regulatory and Licensing Requirements

The alcoholic beverage industry faces regulatory and licensing challenges. These include age restrictions, taxation, and marketing limitations. These regulations differ by region and may cause difficulties for manufacturers and distributors when dealing with international markets. Changing laws further increase operational costs and limit marketing.

Environmental Sustainability and Production Costs

Increasing sustainability has increased the problems for the alcoholic beverage industry. Manufacturers have to pay increasing costs through sustainable sourcing, eco-friendly packaging, and waste reduction. Furthermore, climate change-related factors like water scarcity and agricultural issues can influence the supply chain through ingredients, thereby forcing production costs upwards. To balance profitability with environmental standards is a significant challenge for the industry.

Distilled Spirits Alcoholic Beverage Market

The global market for distilled spirits alcoholic beverages is growing at a high rate, primarily due to the rising demand for premium and craft spirits. Whiskey, vodka, rum, gin, and tequila are popular products due to their versatility in cocktails and unique flavor profiles. Changing consumer preferences for higher-quality, artisanal, and sustainable spirits are influencing the market. Rising craft distilleries, innovation in products, infused, and botanical spirits are creating demand in the market. Significant growth is noticed in North America, Europe, and Asia as new channels of distribution have opened along with the popularity of home mixology.

Glass Bottle Alcoholic Beverage Market

The glass bottle alcoholic beverage market is steadily growing due to its widespread use in the packaging of spirits, wine, beer, and other alcoholic drinks. Glass bottles offer superior durability, protection, and aesthetic appeal, making them a popular choice for premium and artisanal products. They are preferred for their ability to maintain the quality and flavor of beverages and be recyclable and eco-friendly. Driving this demand for glass bottles is its use as a perceived more sustainable form of packaging, more so compared to plastic. Custom shapes and sizes of glass bottles are further making the market experience growth in light of the trend for premium or craft alcoholic drinks.

Convenience Stores Alcoholic Beverage Market

The convenience stores alcoholic beverage market is witnessing good growth. One of the most significant reasons driving consumer demand is fast, quick-on-the-go accessibility to alcoholic beverages. These stores offer a variety of products like beer, wine, spirits, and ready-to-drink (RTD) options to suit busy urban lifestyles. The convenience factor and extended store hours attract a wide range of customers, including young consumers and working professionals. The presence of single-serve options and affordable prices further expands the market. However, the competition from other retail channels and strict alcohol regulations hinder the growth of the market.

Liquor Stores Alcoholic Beverage Market

The liquor stores alcoholic beverage market is growing steadily with the rising demand for premium, craft, and specialty alcoholic beverages. The liquor stores are known for curating a range of wines, spirits, and imported beverages according to the taste of the consumer for quality and unique offerings. With the rise in home consumption and cocktail culture, the sales have been enhanced, and the customers look for variety and expertise in the selection of liquor. The growth of e-commerce and online liquor stores, for instance, expands access, whereas brick-and-mortar locations have remained popular in terms of personalized service and product discovery. However, regulatory challenges and competition from supermarkets and convenience stores act as recurrent issues for the market.

United States Alcoholic Beverage Market

The United States' alcoholic beverage market is one of the largest, most diverse around the world today, fueled by shifting consumer behavior, innovation, and an explosion in the demand for craft beverages. Beer and spirits continue to be the majority categories, along with craft beer, premium spirits, and healthier choices. The rise of home consumption, influenced by the COVID-19 pandemic, has accelerated sales of at-home cocktail kits and online alcohol delivery services. Additionally, the demand for low-alcohol and non-alcoholic options reflects changing health-conscious trends. The market is supported by a robust distribution network and increasing product innovation, while challenges include regulatory restrictions and market saturation in some segments. Feb-2024 Pernod Ricard's Altos Tequila Launches Ready-to-serve margarita in the market

United Kingdom Alcoholic Beverage Market

The UK is one of the largest markets for alcoholic beverages in Europe with a strong consumption culture for beers, wines, and spirits. It is experiencing robust growth in the craft and premium segment due to consumer preferences that emphasize quality and diversity. The industry is transforming with the advent of gin, craft beer, and low-alcohol alternatives and growing interest in sustainable and responsible production. On the other hand, e-commerce and online channels are also widening the access for alcoholic beverages. However, obstacles such as a high tax base, changes in regulations, and saturation in mainstream markets hinder further growth. Maharaja Drinks has now launched in the UK. The online drinks retailer aims to take Indian drinks internationally. The company's portfolio spans alcoholic and non-alcoholic friends, including Indian-made beer, wine, and spirits. Its ranges include Maki Di, a Goan craft beer; wines from Reveilo and Good Earth; and whiskies from Rampur and Indri. It also supplies tea, coffee, and kombucha.

India Alcoholic Beverage Market

The Indian alcoholic beverage market is growing rapidly because of increasing urbanization, increased disposable incomes, and changing consumer preferences towards premium and craft products. The primary segments include beer, spirits, and wine, though demand for craft beers, flavored spirits, and ready-to-drink (RTD) beverages have witnessed a high growth rate. Expansion in the market is fueled by the rising younger population and trends in socialization, especially within urban areas. Developing e-commerce and modern retail channels further increases access to a wide range of alcoholic beverages. However, regulatory restrictions, high taxes, and cultural taboos regarding alcohol consumption are still some challenges to the market's growth. January 2024, Coca-Cola India is making a notable entry into the alcoholic beverage market in India by introducing Lemon-Dou, a lime-flavored cocktail. This is just one of many moves by the beverage giant Coca-Cola towards a diversified portfolio of products - historically known only for nonalcoholic beverages.

Brazil Alcoholic Beverage Market

The alcoholic beverages market in Brazil is growing considerably. Beer sales continue to rule, mainly attributed to its massive popularity at sporting events and get-togethers. Increasing incomes and the resultant expansion of the middle class support premium and foreign alcoholic beverages purchases. In addition, the availability of products is improved by increasing the number of retail channels, which include convenience stores and e-commerce sites. The growing demand for craft beers and craft spirits is appealing to the young, health-conscious consumer. Taxes are still very high, and regulatory issues are another significant challenge for market growth. July 2024 Bosque Gin launches in Brazil. Argentinian brand Bosque Gin expands its South America distribution to Brazil after a pre-launch.

Alcoholic Beverage Market Segments

Type – Market breakup in 4 viewpoints:

- Beer

- Distilled Spirits

- Wine

- Others

Packaging – Market breakup in 3 viewpoints:

- Glass Bottle

- Tin

- Plastic Bottle

Distribution Channel – Market breakup in 6 viewpoints:

- Convenience Stores

- On Premises

- Liquor Stores

- Grocery Shops

- Internet Retailing

- Supermarkets

Country – Market breakup of 25 Countries:

- United States

- Canada

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

- Brazil

- Mexico

- Argentina

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Anheuser-Busch InBev SA/NV

- Carlsberg Group

- Constellation Brands Inc.

- Heineken N.V.

- Molson Coors Beverage Company

- Pernod Ricard SA

- Suntory Holdings Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Packaging, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

1. Anheuser-Busch InBev SA/NV |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Alcoholic Beverages Market

6. Market Share

6.1 Type

6.2 Packaging

6.3 Distribution Channel

6.4 Country

7. Type

7.1 Beer

7.2 Distilled Spirits

7.3 Wine

7.4 Others

8. Packaging

8.1 Glass Bottle

8.2 Tin

8.3 Plastic Bottle

9. Distribution Channel

9.1 Convenience Stores

9.2 On Premises

9.3 Liquor Stores

9.4 Grocery Shops

9.5 Internet Retailing

9.6 Supermarkets

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.4.4 Middle East & Africa

10.4.5 Saudi Arabia

10.4.6 UAE

10.4.7 South Africa

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players

13.1 Anheuser-Busch InBev SA/NV

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Carlsberg Group

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Constellation Brands Inc

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Heineken N.V.

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Molson Coors Beverage Company

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

13.6 Pernod Ricard SA

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue

13.7 Suntory Holdings Limited

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com