Aerosol Paints Market Overview 2025–2033

Buy NowGlobal Aerosol Paints Market Forecast 2025–2033

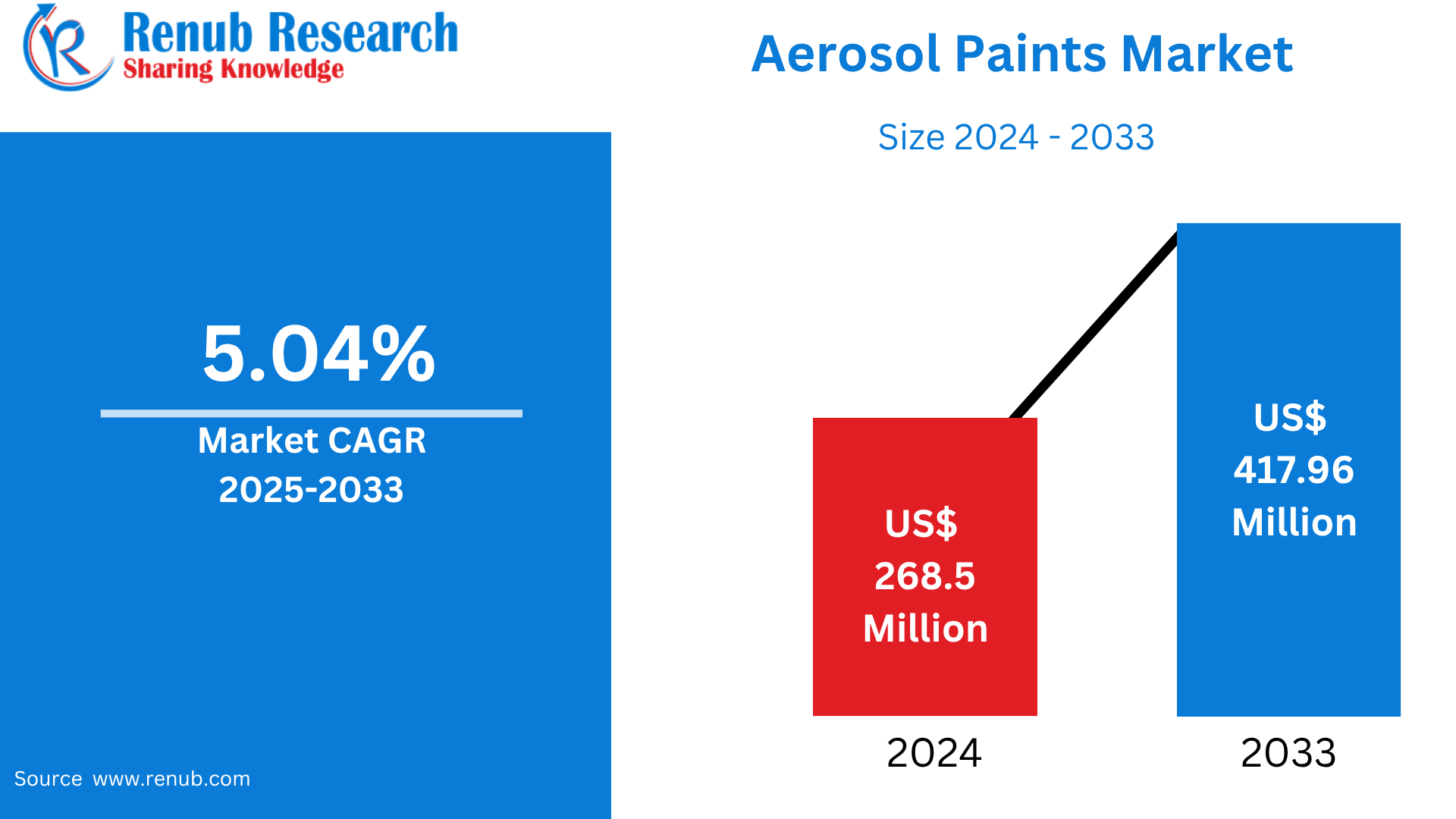

The Global Aerosol Paints Market was valued at USD 268.5 million in 2024 and is expected to reach USD 417.96 million by 2033, growing at a CAGR of 5.04% over the forecast period. Growth is fueled by increased demand from the automotive, construction, and DIY markets, as well as rising use in decorative coatings, street art, and protective coatings in residential, commercial, and industrial applications.

Global Aerosol Paints Market Outlooks

Aerosol paints, also referred to as spray paints, are paints that come in pressurized cans and are dispensed via a spray nozzle. They provide a handy, portable, and even application method without the use of brushes or rollers. Aerosol paints have extensive professional and hobby uses because of their portability and quick-drying nature.

They are widely used in several industries, such as automotive (touch-ups and detailing), construction (markings and finishes), home improvement (furniture restoration and DIY projects), and art (murals and graffiti). Their property of giving smooth, uniform coats on several surfaces, such as metal, wood, plastic, and concrete, makes them very versatile. Aerosol paints have also become increasingly popular among crafters and hobbyists for their accuracy and ease of use in a broad color palette and finishes. With increased interest in DIY culture and the art world, combined with technological advances like low-VOC and eco-friendly formulations, aerosol paints are still seeing on-going global demand.

Growth Drivers in the Global Aerosol Paints Market

DIY & Customization Culture Boom

Worldwide growth of DIY home decor, crafting, and customizing activities has driven sales for aerosol paints. Spray paint is used by consumers more and more to achieve quick, professional finishes on furniture, vehicle parts, and art. With a wide range of colors and finishes available—from metallics to mattes and high-gloss—aerosol paint is highly precise and convenient. Social media and online instructions have further enabled consumers to experiment with spray techniques at home, pushing the market from professional use to lifestyle and leisure segments. In 2022, PPG announced the introduction of a new series of water-based aerosol paints. The new series of paints are created to address the increased demand for environmentally friendly aerosol paints.

Growth in Automotive Repair and Customization

The automotive industry is a significant impetus for aerosol paints, particularly for vehicle repair work, detailing, and customization. Rapid spot repair, touch-ups, and specialty finishes are effectively handled using aerosol cans, precluding full-body shop procedures. Custom hobbyists and small automotive shops utilize aerosol products for trim, engine parts, and even complete panels. Portability, precision, and rapid drying characteristics make aerosols suitable for localized touch-ups. As car customizing becomes more popular—and the world's auto fleet ages—spray paint repair and custom work continue to be in demand. Apr 2024, Nippon Paint, Asia-Pacific's number one paints and coatings company, has introduced its first consumer-oriented automotive body and paint repair service brand, Mastercraft.

Growth in Industrial and Construction Markets

Industrial product marking, equipment maintenance, and construction finishes are major users of aerosol paint. Contractors, maintenance crews, and industrial plant operators need quick and dependable marking instruments for piping, structures, safety areas, and equipment. Aerosol paint with high-durability or corrosion-resistant properties is the preferred choice because it is portable and easy to apply, even in isolated worksites. Growth in industrial infrastructure—including manufacturing facilities, refineries, and mines—coupled with city development projects is fuelling steady demand for industrial-strength aerosol products. In April 2022, AkzoNobel India, a top paints and coatings player, made its entry into the increasing Do-It-Yourself (DIY) paints segment. Having found success in Europe, India leads the DIY trends for AkzoNobel as the first country in South Asia to introduce the 'Dulux Simply Refresh' product line.

Gaps in the Global Aerosol Paints Market

Environmental and Regulatory Pressures

Aerosol paints are conventionally based on volatile organic compounds (VOCs) and propellants, for example, hydrocarbons or compressed gases, to drive the paint. Growing regulatory pressure over air quality and climate change is compelling companies to reformulate using low-VOC or waterborne alternatives. These alternatives, however, tend to increase costs or necessitate new production methods. Meeting more stringent standards in countries like the EU and North America is adding to the regulatory burden. Though reformulations are in process, sustaining performance and shelf life is a technical and cost hurdle.

Safety and Health Issues

Spray application subjects users—particularly in home or industrial operations—to respiratory and skin risks. Inhalation of solvents, drift of aerosols, and flammability are primary safety hazards, and use of personal protective equipment (PPE), proper ventilation, and specific training or labeling are required to make it safe. Uncontrolled or unregulated use may enhance the chances of exposure by accident. While professional users enhance their safety protocols, DIY users can neglect protective procedures and thus raise the stakes for injury and liability. Adherence to safety standards (e.g., REACH, OSHA) is critical, but bridging awareness and safe use is a challenge in the market.

Global Acrylic Aerosol Paints Market

Acrylic aerosol paints are water-based, all-purpose paints that dry quickly, have low odor, and intense colors. They are widely used in arts, crafts, and architectural coatings and are popular among graffiti artists, hobbyists, and DIYers for smooth and clean application with sharp edges. Because they are resistant to fading and UV light, they are used for indoor and outdoor applications. Environmental advantages—reduced VOCs and simpler clean-up with soap and water—also make them attractive. With ongoing growth of the creative industries and growing acceptability of street art, acrylic aerosol paints are increasingly a mainstream option in consumer and professional markets.

Global Epoxy Aerosol Paints Market

Epoxy aerosol paints are made up of two elements—a resin and a curing agent—with outstanding adhesion, chemical resistance, and durability. They are applied to industrial maintenance, automotive undercarriage application, and equipment coating. Epoxy aerosols do need shake-and-spray activation and safe handling. Suitable for metal surfaces exposed to abrasion, corrosion, and heat, they are used in severe environments like marine, oil and gas, and manufacturing. Though more expensive and harder to handle, they are a necessity where high performance is needed without the use of bulk coating systems.

Global Solvent-Borne Aerosol Paints Market

Solvent-borne aerosol paints rely on hydrocarbons or other solvents to effectively dissolve pigments and resins. They provide excellent gloss, coverage, and fast drying from a single-stage formula. They are extensively applied in automotive refinishing, metal restoration, tool coating, and craft finishes and shine where weather resistance and finish consistency are important. Because of high VOC content, though, they are increasingly regulated. Current efforts involve reformulation with low-VOC solvents or a switch to water-based systems. Nevertheless, solvent-borne aerosols continue to dominate heavy-duty applications needing strong film formation and adhesion.

Global Automotive Aerosol Paints Market

The automotive market is a significant user of aerosol paints, particularly for touch-up, detailing, and restoring body panels. Car owners, workshops, and detailing shops employ aerosol sprays to fix scratches, paint trims, or personalize interiors and exteriors. These paints are convenient to use, dry quickly, and have a smooth finish, making them suitable for localized application. Due to the increase in vehicle personalization and aging fleets of cars, the demand for automobile-grade aerosol paints is increasing. Additionally, the move towards do-it-yourself car maintenance by enthusiasts serves as an additional source of growth, especially in economies like the U.S., Europe, and Southeast Asia.

Industrial Coatings Aerosol Paints Market

Industrial aerosol paints are extensively used for equipment marking, labeling pipelines, surface protection, and corrosion control across industries like manufacturing, energy, and marine. Industrial aerosol paints provide quick and effective coverage in harsh environments without the requirement of large spraying systems. They have long-lasting finishes, heat resistance, and anti-rust properties, which suit maintenance and safety operations. With growing industrial activity in Asia-Pacific, Latin America, and the Middle East, demand for specialty aerosol coatings is on the rise. New products are coming up with formulations to achieve the industrial level while minimizing VOC emissions and adhering to safety standards.

Construction Aerosol Paints Market

In construction, aerosol paints find application in on-site marking, touch-ups on concrete surfaces, color coding, and temporary signboards. Their portability and ready application make them perfect for fast-construction work and layout marking out. Surveyors and engineers utilize fluorescent aerosol paints for road work, excavation areas, and utility marking. As global infrastructure projects increase—particularly in the emerging economies—their use in construction continues to increase. Long-lasting, weather-resistant types are in demand. Moreover, contractors prefer low-VOC products to meet environmental regulations and provide worker safety on occupied worksites.

United States Aerosol Paints Market

The United States is still the largest contributor to the aerosol paints market globally, led by common DIY culture, automotive repair, and industrial upkeep. Home repair trends and internet tutorials have stimulated consumer spray paint use for ornamentation, repairs, and art. Major retail chains, such as Home Depot, Walmart, and Lowe’s, stock a wide variety of aerosol brands. Additionally, robust demand from the construction and manufacturing sectors sustains the development of professional-grade applications. Stringent EPA regulations are driving innovation in low-VOC and eco-friendly aerosol formulations. The U.S. market continues to lead in product innovation, brand competition, and usage diversity. As per the United States Census Bureau, construction value in the nation stood at USD 1,978.7 billion during 2023, which is well over 7% increase from the last year, i.e., 2022. This increase is due to the need for infrastructure development and overhaul projects. Additionally, privately owned housing units approved by building permits stood at 1,518,000 units, which were up 2.4% from February 2023, for February 2024.

Germany Aerosol Paints Market

Germany's market for aerosol paints is backed by its robust auto industry, effective construction sector, and increasing demand for sustainable consumer products. As there are rigorous environmental laws in the country, there is an increased demand for low-emission, solvent-free aerosol paints. The country also uses aerosol paints intensively in industrial maintenance, engineering, and manufacturing processes. Artistic and urban creative movements—such as graffiti and public murals—also bring steady consumption. German producers focus strongly on R&D and environmental compliance, making Germany the clean, high-performance aerosol paint leader. Retail channel distribution is well established via hardware stores, art specialty suppliers, and online. April 2024, Nano-Care Deutschland AG, specialist of innovative surface finishes, is pleased to introduce its new product range, which is dedicated to the "next generation products." The new line is designed to deliver optimal performance while focusing on sustainability and environmental compatibility.

China Aerosol Paints Market

The Chinese aerosol paints market is booming thanks to the growth of its auto aftermarket, strong construction activity, and growing industrial production. The market is supported by a mass consumer base carrying out DIY home renovates and small business activities. Locally manufactured items are cost-effective, though international brands increasingly contest the market with green and high-performance-based formulations. China is also spending on automation and industrial maintenance, where aerosol paint is of particular importance. Environmental regulation is, however, tightening, leading to a move toward more environmentally friendly formulations. Urban art and youth culture are also fueling demand for decorative and creative uses.

Saudi Arabia Aerosol Paints Market

Saudi Arabia's aerosol paints market is spurred by increasing infrastructure growth, industrial development, and car care. The government's Vision 2030 program has spurred the construction and industrial investment, triggering demand for quick-drying, weather-resistant finishes. Automotive detailing and customizing are also on the rise, spurred by increased disposable incomes and an expanding car culture. While still dependent on imports, domestic production is beginning to expand. Hot weather conditions stimulate demand for high-heat and UV-resistance paints. With changing environmental standards, demand for compliant and safer aerosol products will increase, with opportunities for innovation and global alliances.

Market Segmentation

Raw Material

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Silicone

- Others

Technology

- Solvent-borne

- Water-borne

Application

- Construction

- Automotive

- Wooden Furniture

- Architectural Coatings

- Industrial Coatings

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Nippon Paint Holdings Co. Ltd.

- Aeroaids Corporation

- Valspar Corporation

- Kobra Spray Paint

- LA-CO Industries Inc.

- Masco Corporation

- Ppg Industries Inc

- Rust-Oleum (RPM International Inc.)

- Montana Colors S.L.

- Southfield Paints Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Raw Material, Technology, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Aerosol Paints Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Raw Material

6.2 By Technology

6.3 By Application

6.4 By Countries

7. Raw Material

7.1 Acrylic

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Alkyd

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Epoxy

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Polyurethane

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Silicone

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

7.6 Others

7.6.1 Market Analysis

7.6.2 Market Size & Forecast

8. Technology

8.1 Solvent-borne

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Water-borne

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

9. Application

9.1 Construction

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Automotive

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Wooden Furniture

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Architectural Coatings

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Industrial Coatings

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

9.6 Others

9.6.1 Market Analysis

9.6.2 Market Size & Forecast

10. Countries

10.1 North America

10.1.1 United States

10.1.1.1 Market Analysis

10.1.1.2 Market Size & Forecast

10.1.2 Canada

10.1.2.1 Market Analysis

10.1.2.2 Market Size & Forecast

10.2 Europe

10.2.1 France

10.2.1.1 Market Analysis

10.2.1.2 Market Size & Forecast

10.2.2 Germany

10.2.2.1 Market Analysis

10.2.2.2 Market Size & Forecast

10.2.3 Italy

10.2.3.1 Market Analysis

10.2.3.2 Market Size & Forecast

10.2.4 Spain

10.2.4.1 Market Analysis

10.2.4.2 Market Size & Forecast

10.2.5 United Kingdom

10.2.5.1 Market Analysis

10.2.5.2 Market Size & Forecast

10.2.6 Belgium

10.2.6.1 Market Analysis

10.2.6.2 Market Size & Forecast

10.2.7 Netherlands

10.2.7.1 Market Analysis

10.2.7.2 Market Size & Forecast

10.2.8 Turkey

10.2.8.1 Market Analysis

10.2.8.2 Market Size & Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Analysis

10.3.1.2 Market Size & Forecast

10.3.2 Japan

10.3.2.1 Market Analysis

10.3.2.2 Market Size & Forecast

10.3.3 India

10.3.3.1 Market Analysis

10.3.3.2 Market Size & Forecast

10.4 South Korea

10.4.1.1 Market Analysis

10.4.1.2 Market Size & Forecast

10.4.2 Thailand

10.4.2.1 Market Analysis

10.4.2.2 Market Size & Forecast

10.4.3 Malaysia

10.4.3.1 Market Analysis

10.4.3.2 Market Size & Forecast

10.4.4 Indonesia

10.4.4.1 Market Analysis

10.4.4.2 Market Size & Forecast

10.4.5 Australia

10.4.5.1 Market Analysis

10.4.5.2 Market Size & Forecast

10.4.6 New Zealand

10.4.6.1 Market Analysis

10.4.6.2 Market Size & Forecast

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Market Analysis

10.5.1.2 Market Size & Forecast

10.5.2 Mexico

10.5.2.1 Market Analysis

10.5.2.2 Market Size & Forecast

10.5.3 Argentina

10.5.3.1 Market Analysis

10.5.3.2 Market Size & Forecast

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.1.1 Market Analysis

10.6.1.2 Market Size & Forecast

10.6.2 UAE

10.6.2.1 Market Analysis

10.6.2.2 Market Size & Forecast

10.6.3 South Africa

10.6.3.1 Market Analysis

10.6.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Nippon Paint Holdings Co. Ltd.

14.2 Aeroaids Corporation

14.3 Valspar Corporation

14.4 Kobra Spray Paint

14.5 LA-CO Industries Inc.

14.6 Masco Corporation

14.7 Ppg Industries Inc

14.8 Rust-Oleum (RPM International Inc.)

14.9 Montana Colors S.L.

14.10 Southfield Paints Ltd.

15. Key Players Analysis

15.1 Nippon Paint Holdings Co. Ltd.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Aeroaids Corporation

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Valspar Corporation

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Kobra Spray Paint

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 LA-CO Industries Inc.

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Masco Corporation

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Ppg Industries Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Rust-Oleum (RPM International Inc.)

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Montana Colors S.L.

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Southfield Paints Ltd.

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com