Global Insulin Pump Market, Users, Global Forecast 2022-2027, Industry Trends, Share, Growth, Insight, Impact of COVID-19, Company Analysis

Get 10% Free Customization in this Report

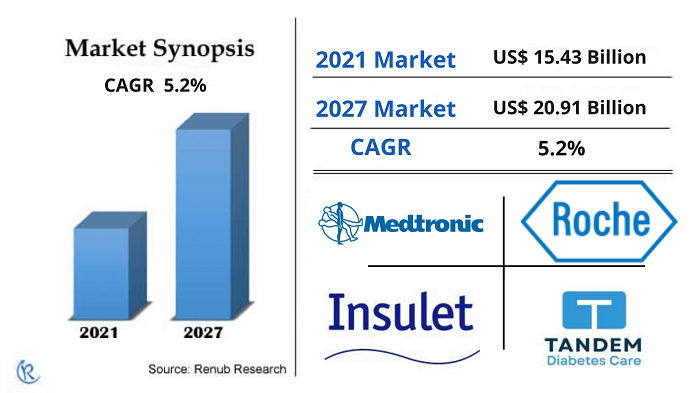

According to Renub Research, Global Insulin Pump Market is estimated to reach US$ 20.91 Billion by 2027. Insulin pumps are compact electronic medical devices that can be fastened to a belt, hidden in a pocket, or worn under clothing. Besides, to regulate the rise in blood glucose levels, the pump delivers controlled quantities of insulin into the body at regular intervals, based on the consumer's basal and bolus rates. Furthermore, it works with a needle and a flexible catheter to inject insulin straight into the fatty tissue, subsequently taped and fastened. In addition, insulin pumps help people with type 1 and type 2 diabetes by giving them more food options and eating schedule flexibility and reducing the number of injections they need.

Global Insulin Pump Market Size Is Expanding with a CAGR Of 5.20% During 2021-2027:

The rising prevalence of diabetes and increased health awareness have been prevalent. Furthermore, because diabetes can lead to other chronic illnesses, including kidney failure, stroke, paralysis, and blindness, manufacturers focus more on developing adaptable and economical technologies like insulin pumps. The demand for efficient insulin pumps has also increased due to the development of very accurate glucose sensors and blood monitoring systems. Furthermore, recent market expansion has been aided by factors such as rising per capita healthcare spending and increased research and development for improving the functionality of insulin pumps.

COVID-19 Impact Analysis on Global Insulin Pump Industry:

According to the IDF, diabetic people were more likely to get COVID-19 disease and experience severe symptoms. As a result, during the COVID-19 pandemic, demand for insulin pumps for at-home use skyrocketed. As a result of the epidemic, the homecare insulin pump business exploded worldwide. Moreover, demand for automated and efficient insulin pumps skyrocketed during the epidemic. Moreover, as per our analysis, Global Insulin Pump Market was US$ 15.43 Billion in 2021.

Segment Analysis in Global Insulin Pump Market:

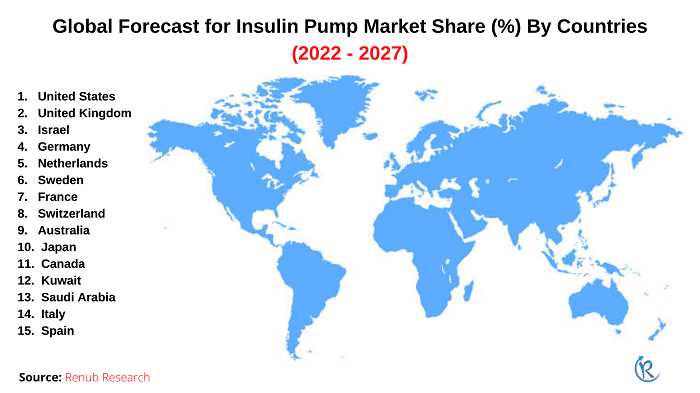

In our report, the Global Global Insulin Pump Market is studied for the market in the United States, United Kingdom, Israel, Germany, Netherlands, Sweden, France, Switzerland, Australia, Japan, Canada, Kuwait, Saudi Arabia, and Italy and Spain. Further, the market in detail is categorized based on Diabetes Population (Type 1 and Type 2), Insulin Pump Market Analysis (Insulin Pump User (Type 1 and Type 2) & Insulin Pump Market (Type 1 and Type 2)), and Reimbursement Policies on Insulin Pump.

Competitive Landscape:

The Global Insulin Pump Market is highly competitive, competing with only a few companies. Medtronic, Insulet Corporation, Tandem Diabetes Care, and Roche are the critical players profiled in our analysis. These companies control a large percentage of the worldwide market. In addition, they are constantly expanding into new markets to generate new revenue streams and enhance old ones. The acts of these market participants will create a competitive environment, forcing businesses to experiment with the latest technology to keep their products unique. Companies are also collaborating to expand their technological understanding and reduce the time it takes to develop a product.

Renub Research latest report “Global Insulin Pump Market, Global Forecast, By Differentiation Points, Products (Medtronic 530G with Enlite, InsuletOmniPod, Tandem t:slim and Roche Accu-Chek Combo), By Countries (United States, United Kingdom, Israel, Germany, Netherlands, Sweden, France, Switzerland, Australia, Japan, Canada, Kuwait, Saudi Arabia, Italy and Spain), Country Insights (Diabetes Population (Type 1 and Type 2), Insulin Pump Market Analysis (Insulin Pump User (Type 1 and Type 2) & Insulin Pump Market (Type 1 and Type 2)) and Reimbursement Policies on Insulin Pump), Companies (Medtronic, Insulet Corporation, Tandem Diabetes Care and Roche)” provides a detailed analysis of Global Insulin Pump Industry.

The above-mentioned countries have been covered from 3 viewpoints:

1. Diabetes Population

- Type 1

- Type 2

2. Insulin Pump Analysis

- Insulin Pump User (Type 1 and Type 2)

- Insulin Pump Market (Type 1 and Type 2)

3. Reimbursement Policies on Insulin Pump

Countries – Insulin Pump Market & Users, Diabetes Type 1 & 2 Population of all the 15 Countries Covered in the Report

- United States

- United Kingdom

- Israel

- Germany

- Netherlands

- Sweden

- France

- Switzerland

- Australia

- Japan

- Canada

- Kuwait

- Saudi Arabia

- Italy

- Spain

Differentiation Points, Products Available Worldwide have been covered from 4 viewpoints:

- Medtronic 530G with Enlite

- InsuletOmniPod

- Tandem t:slim

- Roche Accu-Chek Combo

Company Insights:

- Overview

- Recent Development

- Revenue

Companies Covered:

- Medtronic

- Insulet Corporation

- Tandem Diabetes Care

- Roche

| Report Features | Details |

| Base Year | 2021 |

| Historical Period | 2017 - 2021 |

| Forecast Period | 2022 - 2027 |

| Market | US$ Billion |

| Segment Covered | Type, Countries |

| Country Covered | United States, United Kingdom, Israel, Germany, Netherlands, Sweden, France, Switzerland, Australia, Japan, Canada, Kuwait, Saudi Arabia, Italy and Spain |

| Companies Covered | Medtronic, Insulet Corporation, Tandem Diabetes Care and Roche |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequently Asked Questions:

- What is the market size of Insulin Pump Market in 2022?

- What is the Insulin Pump Market growth globally?

- What are the factors driving the Insulin Pump Market?

- Who are the key players in the worldwide Insulin Pump Market?

- What has been the COVID-19 impact on the Insulin Pump Industry?

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Insulin Pump Analysis

5.1 Market

5.2 User

6. Global Insulin Pump Market & Volume Share Analysis

6.1 Country

6.2 User Share

7. Training Model for Patients & HCP – of Medtronic, Insulet Corp & Tandem Diabetes Care

7.1 Medtronic

7.1.1 Training Guidelines for Insulin Pump Therapy to New Patients

7.1.2 Training Model for HCP (HealthCare Professional)

7.2 Insulet Corporation

7.2.1 Training Structure for New Patients - Insulet Corporation

7.3 Tandem Diabetes Care

8. Differentiation Points of Insulin Pump Products Available Worldwide

8.1 Medtronic 530G with Enlite

8.2 InsuletOmniPod

8.3 Tandem t:slim

8.4 Roche Accu-Chek Combo

9. United States

9.1 Diabetes Population

9.1.1 Type 1

9.1.2 Type 2

9.2 United States – Insulin Pump Market Analysis

9.2.1 Insulin Pump User

9.2.1.1 Type 1

9.2.1.2 Type 2

9.2.2 Insulin Pump Market

9.2.2.1 Type 1

9.2.2.2 Type 2

9.3 Reimbursement Policies on Insulin Pump

10. United Kingdom

10.1 Diabetes Population

10.1.1 Type 1

10.1.2 Type 2

10.2 Insulin Pump Analysis

10.2.1 Insulin Pump Users

10.2.1.1 Type 1

10.2.1.2 Type 2

10.2.2 Insulin Pump Market

10.2.2.1 Type 1

10.2.2.2 Type 2

10.3 Reimbursement Policies on Insulin Pump

11. Israel

11.1 Diabetes Population

11.1.1 Type 1

11.1.2 Type 2

11.2 Insulin Pump Analysis

11.2.1 Insulin Pump Users

11.2.1.1 Type 1

11.2.1.2 Type 2

11.2.2 Insulin Pump Market

11.2.2.1 Type 1

11.2.2.2 Type 2

11.3 Reimbursement Policies on Insulin Pump

12. Germany

12.1 Diabetes Population

12.1.1 Type 1

12.1.2 Type 2

12.2 Insulin Pump Analysis

12.2.1 Insulin Pump Users

12.2.1.1 Type 1

12.2.1.2 Type 2

12.2.2 Insulin Pump Market

12.2.2.1 Type 1

12.2.2.2 Type 2

12.3 Reimbursement Policies on Insulin Pump

13. Netherlands

13.1 Diabetes Population

13.1.1 Type 1

13.1.2 Type 2

13.2 Insulin Pump Analysis

13.2.1 Insulin Pump Users

13.2.1.1 Type 1

13.2.1.2 Type 2

13.2.2 Insulin Pump Market

13.2.2.1 Type 1

13.2.2.2 Type 2

13.3 Reimbursement Policies on Insulin Pump

14. Sweden

14.1 Diabetes Population

14.1.1 Type 1

14.1.2 Type 2

14.2 Insulin Pump Analysis

14.2.1 Insulin Pump Users

14.2.1.1 Type 1

14.2.1.2 Type 2

14.2.2 Insulin Pump Market

14.2.2.1 Type 1

14.2.2.2 Type 2

14.3 Reimbursement Policies on Insulin Pump

15. France

15.1 Diabetes Population

15.1.1 Type 1

15.1.2 Type 2

15.2 Insulin Pump Analysis

15.2.1 Insulin Pump Users

15.2.1.1 Type 1

15.2.1.2 Type 2

15.2.2 Insulin Pump Market

15.2.2.1 Type 1

15.2.2.2 Type 2

15.3 Reimbursement Policies on Insulin Pump

16. Switzerland

16.1 Diabetes Population

16.1.1 Type 1

16.1.2 Type 2

16.2 Insulin Pump Analysis

16.2.1 Insulin Pump Users

16.2.1.1 Type 1

16.2.1.2 Type 2

16.2.2 Switzerland Insulin Pump Market

16.2.2.1 Type 1

16.2.2.2 Type 2

16.3 Reimbursement Policies on Insulin Pump

17. Australia

17.1 Diabetes Population

17.1.1 Type 1

17.1.2 Type 2

17.2 Insulin Pump Analysis

17.2.1 Insulin Pump Users

17.2.1.1 Type 1

17.2.1.2 Type 2

17.2.2 Insulin Pump Market

17.2.2.1 Type 1

17.2.2.2 Type 2

17.3 Reimbursement Policies on Insulin Pump

18. Japan

18.1 Diabetes Population

18.1.1 Type 1

18.1.2 Type 2

18.2 Insulin Pump Analysis

18.2.1 Insulin Pump Users

18.2.1.1 Type 1

18.2.1.2 Type 2

18.2.2 Insulin Pump Market

18.2.2.1 Type 1

18.2.2.2 Type 2

18.3 Reimbursement Policies on Insulin Pump

19. Canada

19.1 Diabetes Population

19.1.1 Type 1

19.1.2 Type 2

19.2 Insulin Pump Analysis

19.2.1 Insulin Pump Users

19.2.1.1 Type 1

19.2.1.2 Type 2

19.2.2 Insulin Pump Market

19.2.2.1 Type 1

19.2.2.2 Type 2

19.3 Reimbursement Policies on Insulin Pump

20. Kuwait

20.1 Diabetes Population

20.1.1 Type 1

20.1.2 Type 2

20.2 Insulin Pump Analysis

20.2.1 Insulin Pump Users

20.2.1.1 Type 1

20.2.1.2 Type 2

20.2.2 Insulin Pump Market

20.2.2.1 Type 1

20.2.2.2 Type 2

20.3 Reimbursement Policies on Insulin Pump

21. Saudi Arabia

21.1 Diabetes Population

21.1.1 Type 1

21.1.2 Type 2

21.2 Insulin Pump Analysis

21.2.1 Insulin Pump Users

21.2.1.1 Type 1

21.2.1.2 Type 2

21.2.2 Insulin Pump Market

21.2.2.1 Type 1

21.2.2.2 Type 2

21.3 Reimbursement Policies on Insulin Pump

22. Italy

22.1 Diabetes Population

22.1.1 Type 1

22.1.2 Type 2

22.2 Insulin Pump Analysis

22.2.1 Insulin Pump Users

22.2.1.1 Type 1

22.2.1.2 Type 2

22.2.2 Insulin Pump Market

22.2.2.1 Type 1

22.2.2.2 Type 2

22.3 Reimbursement Policies on Insulin Pump

23. Spain

23.1 Diabetes Population

23.1.1 Type 1

23.1.2 Type 2

23.2 Insulin Pump Analysis

23.2.1 Insulin Pump Users

23.2.1.1 Type 1

23.2.1.2 Type 2

23.2.2 Insulin Pump Market

23.2.2.1 Type 1

23.2.2.2 Type 2

23.3 Reimbursement Policies on Insulin Pump

24. Company Analysis

24.1 Medtronic

24.1.1 Overview

24.1.2 Recent Development

24.1.3 Revenue

24.2 Insulet Corporation

24.2.1 Overview

24.2.2 Recent Development

24.2.3 Revenue

24.3 Tandem Diabetes Care

24.3.1 Overview

24.3.2 Recent Development

24.3.3 Revenue

24.4 Roche

24.4.1 Overview

24.4.2 Recent Development

24.4.3 Revenue

List of Figures:

Figure-01: Global – Insulin Pump Market (Million US$), 2017 – 2021

Figure-02: Global – Forecast for Insulin Pump Market (Million US$), 2022 – 2027

Figure-03: Global – Insulin Pump User (Thousand), 2017 – 2021

Figure-04: Global – Forecast for Insulin Pump User (Thousand), 2022 – 2027

Figure-05: United States – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-06: United States – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-07: United States – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-08: United States – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-09: United States – Type 1 Insulin Pump User (Thousand), 2017 – 2021

Figure-10: United States – Forecast for Type 1 Insulin Pump User (Thousand), 2022 – 2027

Figure-11: United States – Type 2 Insulin Pump User (Thousand), 2017 – 2021

Figure-12: United States – Forecast for Type 2 Insulin Pump User (Thousand), 2022 – 2027

Figure-13: United States – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-14: United States – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-15: United States – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-16: United States – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-17: United Kingdom – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-18: United Kingdom – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-19: United Kingdom – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-20: United Kingdom – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-21: United Kingdom – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-22: United Kingdom – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-23: United Kingdom – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-24: United Kingdom – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-25: United Kingdom – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-26: United Kingdom – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-27: United Kingdom – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-28: United Kingdom – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-29: Israel – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-30: Israel – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-31: Israel – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-32: Israel – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-33: Israel – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-34: Israel – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-35: Israel – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-36: Israel – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-37: Israel – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-38: Israel – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-39: Israel – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-40: Israel – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-41: Germany – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-42: Germany – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-43: Germany – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-44: Germany – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-45: Germany – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-46: Germany – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-47: Germany – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-48: Germany – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-49: Germany – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-50: Germany – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-51: Germany – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-52: Germany – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-53: Netherlands – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-54: Netherlands – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-55: Netherlands – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-56: Netherlands – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-57: Netherlands – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-58: Netherlands – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-59: Netherlands – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-60: Netherlands – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-61: Netherlands – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-62: Netherlands – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-63: Netherlands – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-64: Netherlands – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-65: Sweden – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-66: Sweden – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-67: Sweden – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-68: Sweden – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-69: Sweden – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-70: Sweden – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-71: Sweden – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-72: Sweden – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-73: Sweden – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-74: Sweden – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-75: Sweden – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-76: Sweden – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-77: France – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-78: France – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-79: France – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-80: France – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-81: France – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-82: France – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-83: France – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-84: France – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-85: France – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-86: France – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-87: France – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-88: France – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-89: Switzerland – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-90: Switzerland – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-91: Switzerland – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-92: Switzerland – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-93: Switzerland – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-94: Switzerland – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-95: Switzerland – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-96: Switzerland – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-97: Switzerland – Type 1 Switzerland Insulin Pump Market (Million US$), 2017 – 2021

Figure-98: Switzerland – Forecast for Type 1 Switzerland Insulin Pump Market (Million US$), 2022 – 2027

Figure-99: Switzerland – Type 2 Switzerland Insulin Pump Market (Million US$), 2017 – 2021

Figure-100: Switzerland – Forecast for Type 2 Switzerland Insulin Pump Market (Million US$), 2022 – 2027

Figure-101: Australia – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-102: Australia – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-103: Australia – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-104: Australia – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-105: Australia – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-106: Australia – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-107: Australia – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-108: Australia – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-109: Australia – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-110: Australia – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-111: Australia – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-112: Australia – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-113: Japan – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-114: Japan – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-115: Japan – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-116: Japan – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-117: Japan – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-118: Japan – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-119: Japan – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-120: Japan – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-121: Japan – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-122: Japan – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-123: Japan – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-124: Japan – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-125: Canada – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-126: Canada – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-127: Canada – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-128: Canada – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-129: Canada – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-130: Canada – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-131: Canada – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-132: Canada – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-133: Canada – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-134: Canada – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-135: Canada – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-136: Canada – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-137: Kuwait – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-138: Kuwait – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-139: Kuwait – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-140: Kuwait – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-141: Kuwait – Type 1 Insulin Pump Users (Number), 2017 – 2021

Figure-142: Kuwait – Forecast for Type 1 Insulin Pump Users (Number), 2022 – 2027

Figure-143: Kuwait – Type 2 Insulin Pump Users (Number), 2017 – 2021

Figure-144: Kuwait – Forecast for Type 2 Insulin Pump Users (Number), 2022 – 2027

Figure-145: Kuwait – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-146: Kuwait – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-147: Kuwait – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-148: Kuwait – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-149: Saudi Arabia – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-150: Saudi Arabia – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-151: Saudi Arabia – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-152: Saudi Arabia – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-153: Saudi Arabia – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-154: Saudi Arabia – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-155: Saudi Arabia – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-156: Saudi Arabia – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-157: Saudi Arabia – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-158: Saudi Arabia – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-159: Saudi Arabia – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-160: Saudi Arabia – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-161: Italy – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-162: Italy – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-163: Italy – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-164: Italy – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-165: Italy – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-166: Italy – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-167: Italy – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-168: Italy – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-169: Italy – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-170: Italy – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-171: Italy – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-172: Italy – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-173: Spain – Type 1 Diabetes Population (Thousand), 2017 – 2021

Figure-174: Spain – Forecast for Type 1 Diabetes Population (Thousand), 2022 – 2027

Figure-175: Spain – Type 2 Diabetes Population (Thousand), 2017 – 2021

Figure-176: Spain – Forecast for Type 2 Diabetes Population (Thousand), 2022 – 2027

Figure-177: Spain – Type 1 Insulin Pump Users (Thousand), 2017 – 2021

Figure-178: Spain – Forecast for Type 1 Insulin Pump Users (Thousand), 2022 – 2027

Figure-179: Spain – Type 2 Insulin Pump Users (Thousand), 2017 – 2021

Figure-180: Spain – Forecast for Type 2 Insulin Pump Users (Thousand), 2022 – 2027

Figure-181: Spain – Type 1 Insulin Pump Market (Million US$), 2017 – 2021

Figure-182: Spain – Forecast for Type 1 Insulin Pump Market (Million US$), 2022 – 2027

Figure-183: Spain – Type 2 Insulin Pump Market (Million US$), 2017 – 2021

Figure-184: Spain – Forecast for Type 2 Insulin Pump Market (Million US$), 2022 – 2027

Figure-185: Medtronic – Global Revenue Market (Million US$), 2017 – 2021

Figure-186: Medtronic – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-187: Insulet Corporation – Global Revenue Market (Million US$), 2017 – 2021

Figure-188: Insulet Corporation – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-189: Tandem Diabetes Care – Global Revenue Market (Million US$), 2017 – 2021

Figure-190: Tandem Diabetes Care – Forecast for Global Revenue Market (Million US$), 2022 – 2027

Figure-191: Roche – Global Revenue Market (Million US$), 2017 – 2021

Figure-192: Roche – Forecast for Global Revenue Market (Million US$), 2022 – 2027

List of Tables:

Table-01: Global – Insulin Pump Market Share by Country (Percentage), 2017 – 2021

Table-02: Global – Forecast for Insulin Pump Market Share by Country (Percentage), 2022 – 2027

Table-03: Global – Insulin Pump Volume Share by Country (Percentage), 2017 – 2021

Table-04: Global – Forecast for Insulin Pump Volume Share by Country (Percentage), 2022 – 2027

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com