India Snacks Market, Size, Forecast 2023-2028, Industry Trends, Growth, Impact of Inflation, Opportunity Company Analysis

Indian Snack Market Outlook

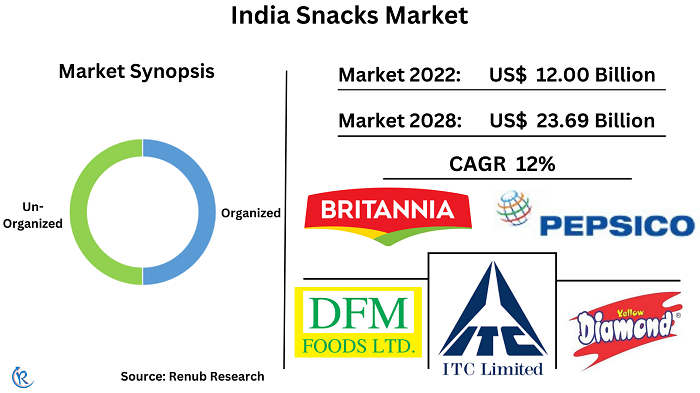

Indian Snack Market will reach US$ 23.69 Billion in 2028 and it will expand at a CAGR of 12% from 2023 to 2028, according to Renub Research. India has become one of the five fastest-growing economies in the world. With rising urbanization, changing consumption patterns, and a vast domestic market to cater the opportunities for various products and their individual needs. As a result, the snack industry is expanding fast, with the snacks market in India growing multi-fold yearly. Snack market hyper-growth has led to hyper-competition among snacks companies, which now focus on innovative product development, ramping up a distribution network, and price promotions to stay ahead of the game.

Snacks also act as impulse purchases for consumers for snack foods available at retail shops and serve as snacks whenever they shop for groceries or purchase snacks from convenience stores. Snack manufacturers create new snack products by slightly changing the ingredients, packaging, shape, or form of an existing snack product.

The effect of COVID-19 pandemic had far-reaching economic consequences apart from its devastating on healthcare sectors. As Indian people start treating health sacredly, the future of the healthy snacking industry looks promising. Baked or fried are prepared from various ingredients, including corn, potatoes, grains, nuts, oil, and vegetables. Snacks are widely available in salty, sweet, sour, and spicy tastes. Some snacks in India are chips, popcorn, salted peanuts, and fryums. In addition, the growing popularity of snacks with ethnic flavours, such as banana chips, papad, and samosas, based on the diversified food culture of the country, is acting as a significant growth-inducing factor. According to this research report Indian snack Market was at US$ 12 Billion in 2022.

A rapid shift in Consumer Preferences towards on-the-go Healthy Snacks

On-the-go snacking is becoming extremely popular, especially among working-class people, teenage children, people living in hostels, and bachelors due to their hectic lifestyles. Moreover, on-the-go snacking concept is closely associated with the easy consumption and handling of products that snack bars offer. Thus, the demand for snack bars is increasing due to the linked convenience of consumption. Furthermore, with an increase in health consciousness and a rise in per-capita expenditure towards premium food, the market for snack bars in India is forecasted to grow at an increasing rate.

Brands and Start-ups breathing into the Indian Snack Industry

Indian snacks market is classified into organized and unorganized; currently, the unorganized sector holds more than half of the market share. The unorganized market is so huge that it remains undocumented. Given the Indian outreach and the organized snack industry potential, many brands made a name for themselves in the market in their early days. The brands have not only achieved local but global footprint as well. DFM Foods, PepsiCo India, Haldiram, Bikanerwala, Balaji Wafers, and Prataap Snacks (Yellow Diamond), among others, are some of the organized companies in India.

India's Traditional Snacks are losing their Market Share to the Western-influenced

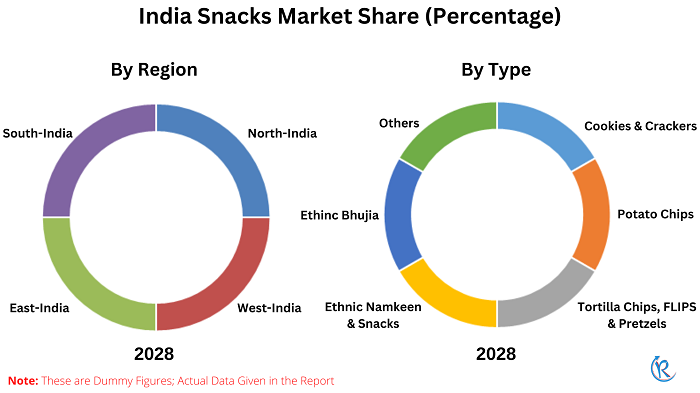

Indian snacks market is divided into Ethnic Snacks, Ethnic Bhujia, and Western Snacks. With increased penetration and movement from Indian ethnic to Western snacks, regional players compete with established Indian and international players. The changes in customer preference for India traditional snacks like Aloo Bhujia, murukku, makhane, and more against international brands like Lays, Bingo, and Pringles.

Moreover, Strong distribution, wide flavour range at varied price points, and aggressive promotion are some drivers of PepsiCo and ITC's strong portfolio and market dominance. However, the stronghold of the top players is gradually declining silently, with consumer preferences shifting to these mid-size players like DFM Foods, Balaji Wafers, Prataap Snacks, Maiyas, Laxmi Snacks, and a few others.

Indian Regional Snacks depict the many Types of Snack Foods eaten by the Indian Populace

Adding to diverse tastes in India, most of the snack has been nurtured and relished for ages in different regions of the country, signifying regional specialties and preferences. Demand for snacks is high in North India, followed by West India. These regions are the primary consumers of nankeen, especially in Rajasthan and Gujarat, where namkeen forms an integral part of food habits. Hence, the majority of the namkeen varieties originate from these regions.

Further, the increasing popularity and availability of numerous options in ethnic namkeen and Bhujia drive growth across the areas. Consumption of savoury snacks is considerable in East India, along with street food between meals, travels, etc. The trend shows that consumption of ethnic savouries is about to increase gradually as companies such as Bikaji and Haldiram look to penetrate the market with their broad product offerings.

The snacks market is driven by North India, owing to UP, Delhi NCR, Punjab, and Haryana. At present, the unorganized sector dominates the north Indian business. However, the growth of the Indian snack industry can be predicted by the fact such as a change in lifestyle, urbanization, growing middle-class population, accessibility and availability of snacks in small package sizes, and low prices.

In addition, improvements in companies’ strategies to focus on promoting regional and traditional tastes are steadily growing in the Indian market as well as are ready to flourish in foreign countries. Over the last five years, Indian snack, mainly the North Indian companies, has grown more quickly than Western snacks. It is followed by East India, with Bengali dominating the market.

Key Company Analysis

For nearly two decades, companies have been producing healthy snacking as the next big thing in the Indian snacks industry. Some of the Indian Snacks Industries are Prataap Snacks, Nestle, DFM Foods Ltd, PepsiCo, ITC Limited, Britannia and Agro Tech Foods Ltd.

Renub Research study titled “India Snacks Market Forecast By Sector (Organized & Unorganized), Type (Ethnic Namkeen & Snacks, Ethinc Bhujia, Western Snacks), Region (North, West, East, South) Companies (Prataap Snacks Ltd, Nestle, DFM Food Ltd, PepsiCo India, ITC Limited, Britannia Industries and Agro Tech Food Ltd)”, provides a comprehensive assessment of the fast-evolving, high-growth India Snacks Industry.

Sector – Market breakup from two viewpoints

1. Organized Snacks

2. Un-Organized Snacks

Type – Market breakup from three Viewpoints

1. Ethnic Namkeen & Snacks

2. Ethinc Bhujia

3. Western Snacks

Region – Market breakup from four viewpoints

1. North India

2. West India

3. East India

4. South India

All companies in this report have been covered with three viewpoints:

• Overview

• Strategy

• Sales

Company Analysis:

1. Prataap Snacks Ltd

2. Nestle

3. DFM Food Ltd

4. PepsiCo India

5. ITC Limited

6. Britannia Industries

7. Agro Tech Food Ltd

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Sector, Type, and Region |

| Region Covered | North, West, East, and South |

| Companies Covered | Prataap Snacks Ltd, Nestle, DFM Food Ltd, PepsiCo India, ITC Limited, Britannia Industries and Agro Tech Food Ltd |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report

- How has the Indian snacks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on India snacks market?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the states?

- What is the breakup of the market based on the pack type?

- What is the breakup of the market based on the pack size?

- What is the breakup of the market based on the distribution channel?

- What are the key driving factors and challenges in the market?

- Who are the key players?

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. PESTLE Analysis

5.1 Political

5.2 Economic

5.3 Social

5.4 Technological

5.5 Legal

5.6 Environmental

6. India Snack Market

7. Market Share – India Snack Market

7.1 By Sector

7.2 By Type

7.3 By Region

8. Sector – India Snack Market

8.1 Organized

8.2 Un- organized

9. Type – India Snack Market

9.1 Cookies & Crackers

9.2 Potato chips

9.3 Tortilla chips, FLIPS & Pretzels

9.4 Ethnic Namkeen & Snacks

9.5 Ethinc Bhujia

9.6 Others

10. Region – India Snack Market

10.1 North-India

10.2 West -India

10.3 East-India

10.4 South-India

11. Key Players

11.1 Prataap Snacks

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Revenue

11.2 Nestle

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Revenue

11.3 DFM Foods Ltd.

11.3.1 Overview

11.3.2 Recent Development

11.3.3 Revenue

11.4 PepsiCo

11.4.1 Overview

11.4.2 Recent Development

11.4.3 Revenue

11.5 ITC Limited

11.5.1 Overview

11.5.2 Recent Development

11.5.3 Revenue

11.6 Britannia

11.6.1 Overview

11.6.2 Recent Development

11.6.3 Revenue

11.7 Agro Tech Foods Ltd. (Conagra Brands)

11.7.1 Overview

11.7.2 Recent Development

11.7.3 Revenue

List of Figures:

Figure-01: India – Snack Market (Billion US$), 2018 – 2022

Figure-02: India – Forecast for Snack Market (Billion US$), 2023 – 2028

Figure-03: Sector – Organized Market (Billion US$), 2018 – 2022

Figure-04: Sector – Forecast for Organized Market (Billion US$), 2023 – 2028

Figure-05: Sector – Un- organized Market (Billion US$), 2018 – 2022

Figure-06: Sector – Forecast for Un- organized Market (Billion US$), 2023 – 2028

Figure-07: Type – Cookies & Crackers Market (Billion US$), 2018 – 2022

Figure-08: Type – Forecast for Cookies & Crackers Market (Billion US$), 2023 – 2028

Figure-09: Type – Potato chips Market (Million US$), 2018 – 2022

Figure-10: Type – Forecast for Potato chips Market (Million US$), 2023 – 2028

Figure-11: Type – Tortilla chips, FLIPS & Pretzels Market (Billion US$), 2018 – 2022

Figure-12: Type – Forecast for Tortilla chips, FLIPS & Pretzels Market (Billion US$), 2023 – 2028

Figure-13: Type – Ethnic Namkeen & Snacks Market (Billion US$), 2018 – 2022

Figure-14: Type – Forecast for Ethnic Namkeen & Snacks Market (Billion US$), 2023 – 2028

Figure-15: Type – Ethinc Bhujia Market (Billion US$), 2018 – 2022

Figure-16: Type – Forecast for Ethinc Bhujia Market (Billion US$), 2023 – 2028

Figure-17: Type – Others Market (Billion US$), 2018 – 2022

Figure-18: Type – Forecast for Others Market (Billion US$), 2023 – 2028

Figure-19: North-India – Snack Market (Billion US$), 2018 – 2022

Figure-20: North-India – Forecast for Snack Market (Billion US$), 2023 – 2028

Figure-21: West-India – Snack Market (Billion US$), 2018 – 2022

Figure-22: West-India – Forecast for Snack Market (Billion US$), 2023 – 2028

Figure-23: East-India – Snack Market (Billion US$), 2018 – 2022

Figure-24: East-India – Forecast for Snack Market (Billion US$), 2023 – 2028

Figure-25: South-India – Snack Market (Billion US$), 2018 – 2022

Figure-26: South-India – Forecast for Snack Market (Billion US$), 2023 – 2028

Figure-27: Prataap Snacks – Global Revenue (Billion US$), 2018 – 2022

Figure-28: Prataap Snacks – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-29: Nestle – Global Revenue (Billion US$), 2018 – 2022

Figure-30: Nestle – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-31: DFM Foods Ltd. – Global Revenue (Million US$), 2018 – 2022

Figure-32: DFM Foods Ltd. – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-33: PepsiCo – Global Revenue (Billion US$), 2018 – 2022

Figure-34: PepsiCo – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-35: ITC Limited – Global Revenue (Billion US$), 2018 – 2022

Figure-36: ITC Limited – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-37: Britannia – Global Revenue (Billion US$), 2018 – 2022

Figure-38: Britannia – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-39: Agro Tech Foods Ltd. (Conagra Brands) – Global Revenue (Million US$), 2018 – 2022

Figure-40: Agro Tech Foods Ltd. (Conagra Brands) – Forecast for Global Revenue (Million US$), 2023 – 2028

List of Tables:

Table-01: India – Snack Market Share by Sector (Percent), 2018 – 2022

Table-02: India – Forecast for Snack Market Share by Sector (Percent), 2023 – 2028

Table-03: India – Snack Market Share by Type (Percent), 2018 – 2022

Table-04: India – Forecast for Snack Market Share by Type (Percent), 2023 – 2028

Table-05: India – Snack Market Share by Region (Percent), 2018 – 2022

Table-06: India – Forecast for Snack Market Share by Region (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com