Asia Cervical Cancer Screening Market, Size, Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Asia Cervical Cancer Test (Screening) Market Outlook

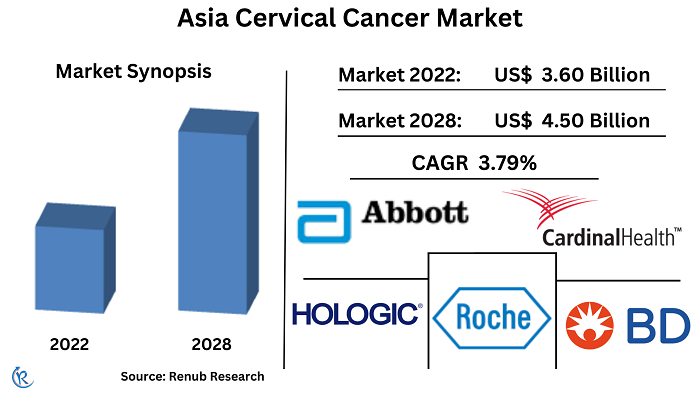

Asia Cervical Cancer Test (Screening) Market will reach US$ 4.5 Billion by 2028, according to Renub Research. Among females in Asia, cervical cancer holds the position of the fourth leading cause of cancer. Effectively managing and detecting cervical cancer early on is crucial in its fight, as it is recognized as one of the most preventable and treatable forms of cancer. This disease underscores the problem of inequity since it is preventable. As awareness about the importance of early detection and prevention increases, more women are seeking regular screenings. Cervical cancer is primarily caused by persistent infection with high-risk types of the human papillomavirus (HPV). Other risk factors include smoking, weakened immune system, long-term use of oral contraceptives, and a family history of cervical cancer.

Governments and healthcare organizations in the Asia Pacific are also implementing initiatives to promote cervical cancer screening programs, including education campaigns and improved access to screening facilities. These efforts aim to reduce the incidence and mortality rates associated with cervical cancer in the region. With advanced technologies and increased emphasis on women's health, the Asia Pacific is experiencing positive trends in cervical cancer screening, leading to improved outcomes and lives saved.

Asia cervical cancer screening industry is projected to grow at a compound annual growth rate (CAGR) of 3.79% between 2022 and 2028

Cervical cancer offers a significant opportunity for prevention, screening, early detection, and treatment in Asia Pacific. Taking steps to implement interventions throughout the prevention and control continuum can effectively reduce the burden of this disease and empower women to live healthy and productive lives. Increased awareness about the importance of early detection, coupled with healthcare initiatives and government efforts, has contributed to the rising trend. Screening programs and improved accessibility to screening facilities are driving the uptake of cervical cancer screening in the region. These advancements aim to reduce the burden of the disease and improve women's health outcomes across Asia.

However, despite the clear benefits and strong rationale for investing in strategies for cervical cancer prevention and control, there is still a lack of sufficient investment, particularly in preventive measures. It is crucial to prioritize and allocate resources towards preventive measures to effectively address cervical cancer and its impact on women's health. The size of the Asia cervical cancer test (screening) market was US$ 3.60 Billion in 2022.

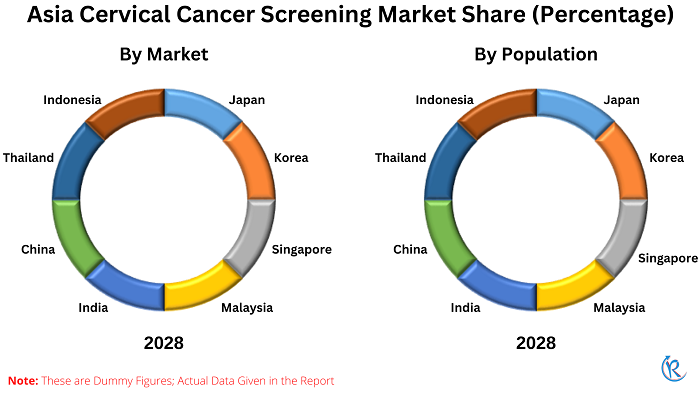

Japan cervical cancer test (screening) market is rapidly growing, making it one of the fastest-growing segments in the country's healthcare industry

By Country, Asia cervical cancer test (screening) market is breakup into Japan, Korea, Singapore, Malaysia, India, China, Thailand and Indonesia. With a focus on preventive healthcare, Japan has implemented robust screening programs to detect cervical cancer at early stages. The market is supported by government initiatives, such as providing subsidized screenings and raising awareness among women. Advanced technologies, such as liquid-based cytology and human papillomavirus (HPV) testing, are widely utilized in Japan's screening practices. The market's growth is driven by the increasing emphasis on women's health, proactive healthcare policies, and the commitment to reduce the burden of cervical cancer in the country.

Japan dominates the Pap smear industry with the highest market share in the country

Pap Smear Market, Asia cervical cancer test (screening) market is divided into Japan, Korea, Singapore, Malaysia, India, China, Thailand and Indonesia. The pap smear market in Japan holds significant importance within the healthcare landscape. Pap smear testing, also known as cervical cytology, is widely utilized for the early detection of cervical cancer and precancerous abnormalities. Japan places a strong emphasis on preventive healthcare, leading to a growing demand for pap smear services. The market is supported by well-established screening programs, widespread awareness campaigns, and advanced laboratory infrastructure. With ongoing technological advancements and increasing awareness among women, the Japan pap smear market is expected to exhibit steady growth in the coming years, playing a crucial role in cervical cancer prevention and early intervention.

Japan HPV DNA segment is experiencing remarkable growth, positioning it as the fastest-growing market in this field

The HPV DNA market in the Asia cervical cancer test (screening) market is segmented into several key countries, including Japan, Korea, Singapore, Malaysia, India, China, and Indonesia. These countries play a significant role in the region's cervical cancer screening efforts, with dedicated healthcare initiatives and advanced testing technologies. Japan stands out as the fastest-growing market in the HPV DNA Industry. With its advanced healthcare system and proactive initiatives, the country has witnessed a significant rise in the adoption of HPV DNA testing for cervical cancer screening.

Japan's strong emphasis on preventive healthcare and early detection, coupled with extensive awareness campaigns, has fueled the growth of the HPV DNA market. The increasing demand for accurate and reliable screening methods, along with advancements in testing technologies, has further propelled Japan's position as a leader in the HPV DNA market, contributing to improved cervical cancer prevention and management.

China dominates the VIA industry with the highest market share in the country

VIA Market, Asia cervical cancer test (screening) market is sub segmented into India, China, Thailand and Indonesia. China holds the highest market share in the Visual Inspection with Acetic Acid (VIA) industry. VIA is a cost-effective and accessible screening method for cervical cancer. With its vast population and proactive healthcare initiatives, China has implemented widespread VIA screening programs. The country's commitment to women's health, combined with increased awareness and accessibility, has propelled China to the forefront of the VIA industry, addressing the significant burden of cervical cancer and improving early detection rates.

India is poised to capture a significant market share in the Visual Inspection with Acetic Acid (VIA) industry. The country's large population and focus on improving women's healthcare make it an ideal market for VIA screening. With increasing awareness, government initiatives, and efforts to enhance accessibility to healthcare services, India is well-positioned to address the burden of cervical cancer through VIA screenings. India's potential to capture a substantial market share highlights its commitment to women's health and early detection of cervical cancer.

Key Company

AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health are prominent players in the Asia cervical cancer test (screening) industry. These companies are at the forefront of developing and providing advanced solutions for cervical cancer screening and diagnosis. With their expertise and innovative technologies, they play a vital role in promoting early detection and prevention of cervical cancer across the region. Their contributions in raising awareness, improving testing accuracy, and enhancing access to screening services are instrumental in reducing the burden of cervical cancer and improving women's health outcomes in Asia.

Renub Research report titled “Asia Cervical Cancer Test (Screening) Market by Type (Pap smear Market, HPV DNA Market, VIA Market), by Countries (Japan, Korea, Singapore, Malaysia, India, China, and Indonesia), Company (AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health)” provide complete detail on Asia Cervical Cancer Test (Screening) Industry.

Type – Market has been covered from 3 viewpoints:

1. Pap smear Market

2. HPV DNA Market

3. VIA (visual inspection with acetic acid) Market

Pap smear Market – 8 Country have been covered

1. Japan

2. Korea

3. Singapore

4. Malaysia

5. India

6. China

7. Thailand

8. Indonesia

2. HPV DNA Market – 7 Country have been covered

1. Japan

2. Korea

3. Singapore

4. Malaysia

5. India

6. China

7. Indonesia

3. VIA (visual inspection with acetic acid) Market – 4 Country have been covered

1. India

2. China

3. Thailand

4. Indonesia

Companies have been covered from 3 viewpoints

• Overview

• Recent Development

• Sales

Company Covered

1. AstraZeneca

2. Hologic Corporation

3. Becton

4. Siemens AG

5. Roche Diagnostics

6. Quest Diagnostics

7. Cardinal Health

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Tests Covered | Pap Smear Test, HPV DNA Test, and VIA Test |

| Countries Covered | Japan, Korea, Singapore, Malaysia, India, China, and Indonesia |

| Companies Covered | AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyer

5.2 Bargaining Power of Supplier

5.3 Threat of New Entrants

5.4 Rivalry among Existing Competitors

5.5 Threat of Substitute Products

6. SWOT Analysis

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7. Asia Cervical Cancer Screening Analysis

7.1 Asia Cervical Cancer Market

7.2 Asia Cervical Cancer Population

8. Asia Cervical Cancer Test (Screening) Analysis

8.1 Asia Cervical Cancer Test Population

8.1.1 Pap smear Test Population

8.1.2 HPV DNA Test Population

8.1.3 VIA Test Population

8.2 Asia Cervical Cancer Test (Screening) Market

8.2.1 Pap Smear Test Market

8.2.2 HPV DNA Test Market

8.2.3 Visual Inspection with Acetic Acid (VIA) Test Market

9. By Countries - Asia Cervical Cancer Test Market & Population Share Analysis

9.1 Asia Cervical Cancer Test Population Share

9.1.1 Pap Smear Population

9.1.2 HPV DNA Population

9.1.3 VIA Population

9.2 Asia Cervical Cancer Market Share

9.2.1 Pap Smear Market

9.2.2 HPV DNA Market

9.2.3 VIA Market

10. Japan – Cervical Cancer Test Analysis

10.1 Population - Cervical Cancer Test (Screening)

10.1.1 Pap smear Test Population

10.1.2 HPV DNA Test Population

10.2 Market – Cervical Cancer Test (Screening)

10.2.1 Pap Smear Test Market

10.2.2 HPV DNA Test Market

11. South Korea – Cervical Cancer Tests Analysis

11.1 Population – Cervical Cancer Test (Screening)

11.1.1 Pap Smear Test Population

11.1.2 HPV DNA Test Population

11.2 Market – Cervical Cancer Test (Screening)

11.2.1 Pap Smear Test Market

11.2.2 HPV DNA Test Market

12. Singapore – Cervical Cancer Tests Analysis

12.1 Population – Cervical Cancer Test (Screening)

12.1.1 Pap Smear Test Population

12.1.2 HPV DNA Test Population

12.2 Market – Cervical Cancer Test (Screening)

12.2.1 Pap Smear Test Market

12.2.2 HPV DNA Test Market

13. Malaysia – Cervical Cancer Test Analysis

13.1 Population – Cervical Cancer Test (Screening)

13.1.1 Pap Smear Test Population

13.1.2 HPV DNA Test Population

13.2 Market – Cervical Cancer Test (Screening)

13.3 Pap Smear Test Market

13.4 HPV DNA Test Market

14. India – Cervical Cancer Test Analysis

14.1 Population – Cervical Cancer Test (Screening)

14.1.1 Pap Smear Test Population

14.1.2 HPV DNA Test Population

14.1.3 VIA Test Population

14.2 Market – Cervical Cancer Test (Screening)

14.2.1 Pap Smear Test Market

14.2.2 HPV DNA Test Market

14.2.3 VIA Test Market

15. China – Cervical Cancer Test Analysis

15.1 Population – Cervical Cancer Test (Screening)

15.1.1 Pap Smear Test Population

15.1.2 HPV DNA Test Population

15.1.3 VIA Test Population

15.2 Market – Cervical Cancer Test (Screening)

15.2.1 Pap Smear Test Population

15.2.2 HPV DNA Test Population

15.2.3 VIA Test Market

16. Thailand – Cervical Cancer Test Analysis

16.1 Population – Cervical Cancer Test (Screening)

16.1.1 Pap Smear Test Population

16.1.2 VIA Test Population

16.2 Market – Cervical Cancer Test (Screening)

16.2.1 Pap Smear Test Market

16.2.2 VIA Test Market

17. Indonesia – Cervical Cancer Test Analysis

17.1 Population – Cervical Cancer Test (Screening)

17.1.1 Pap Smear Test Population

17.1.2 HPV DNA Test Population

17.1.3 VIA Test Population

17.1.4 Pap smear & VIA Test Population

17.2 Market – Cervical Cancer Test (Screening)

17.2.1 Pap smear Test Market

17.2.2 HPV DNA Test Market

17.2.3 VIA Test Market

17.2.4 Pap smear & VIA Test Market

18. Company Analysis

18.1 Abbott laboratories

18.1.1 Overview

18.1.2 Recent Development

18.1.3 Revenue

18.2 Hologic Corporation

18.2.1 Overview

18.2.2 Recent Development

18.2.3 Revenue

18.3 Becton

18.3.1 Overview

18.3.2 Recent Development

18.3.3 Revenue

18.4 Siemens AG

18.4.1 Overview

18.4.2 Recent Development

18.4.3 Revenue

18.5 Roche Diagnostics

18.5.1 Overview

18.5.2 Recent Development

18.5.3 Revenue

18.6 Quest Diagnostics

18.6.1 Overview

18.6.2 Recent Development

18.6.3 Revenue

18.7 Cardinal Health

18.7.1 Overview

18.7.2 Recent Development

18.7.3 Revenue

List of Figures:

Figure-01: Asia – Cervical Cancer Test (Screening) Market (Billion US$), 2018 – 2022

Figure-02: Asia – Forecast for Cervical Cancer Test (Screening) Market (Billion US$), 2023 – 2028

Figure-03: Asia – Cervical Cancer Test (Screening) Population Volume (Million), 2018 – 2022

Figure-04: Asia – Forecast for Cervical Cancer Test (Screening) Population Volume (Million), 2023 – 2028

Figure-05: Asia – Pap Smear Test Population Volume (Million), 2018 – 2022

Figure-06: Asia – Forecast for Pap Smear Test Population Volume (Million), 2023 – 2028

Figure-07: Asia – HPV DNA Test Population Volume (Million), 2018 – 2022

Figure-08: Asia – Forecast for HPV DNA Test Population Volume (Million), 2023 – 2028

Figure-09: Asia – Visual Inspection with Acetic Acid (VIA) Test Population Volume (Million), 2018 – 2022

Figure-10: Asia – Forecast for Visual Inspection with Acetic Acid (VIA) Test Population Volume (Million), 2023 – 2028

Figure-11: Asia – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-12: Asia – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-13: Asia – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-14: Asia – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-15: Asia – Visual Inspection with Acetic Acid (VIA) Test Market (Million US$), 2018 – 2022

Figure-16: Asia – Forecast for Visual Inspection with Acetic Acid (VIA) Test Market (Million US$), 2023 – 2028

Figure-17: Japan – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-18: Japan – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-19: Japan – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-20: Japan – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-21: Japan – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-22: Japan – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-23: Japan – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-24: Japan – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-25: South Korea – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-26: South Korea – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-27: South Korea – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-28: South Korea – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-29: South Korea – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-30: South Korea – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-31: South Korea – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-32: South Korea – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-33: Singapore – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-34: Singapore – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-35: Singapore – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-36: Singapore – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-37: Singapore – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-38: Singapore – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-39: Singapore – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-40: Singapore – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-41: Malaysia – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-42: Malaysia – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-43: Malaysia – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-44: Malaysia – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-45: Malaysia – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-46: Malaysia – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-47: Malaysia – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-48: Malaysia – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-49: India – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-50: India – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-51: India – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-52: India – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-53: India – VIA Test Population Volume (Thousand), 2018 – 2022

Figure-54: India – Forecast for VIA Test Population Volume (Thousand), 2023 – 2028

Figure-55: India – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-56: India – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-57: India – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-58: India – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-59: India – VIA Test Market Market (Million US$), 2018 – 2022

Figure-60: India – Forecast forVIA Test Market Market (Million US$), 2023 – 2028

Figure-61: China – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-62: China – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-63: China – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-64: China – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-65: China – VIA Test Population Volume (Thousand), 2018 – 2022

Figure-66: China – Forecast for VIA Test Population Volume (Thousand), 2023 – 2028

Figure-67: China – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-68: China – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-69: China – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-70: China – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-71: China – VIA Test Market Market (Million US$), 2018 – 2022

Figure-72: China – Forecast forVIA Test Market Market (Million US$), 2023 – 2028

Figure-73: Thailand – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-74: Thailand – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-75: Thailand – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-76: Thailand – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-77: Thailand – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-78: Thailand – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-79: Thailand – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-80: Thailand – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-81: Indonesia – Pap Smear Test Population Volume (Thousand), 2018 – 2022

Figure-82: Indonesia – Forecast for Pap Smear Test Population Volume (Thousand), 2023 – 2028

Figure-83: Indonesia – HPV DNA Test Population Volume (Thousand), 2018 – 2022

Figure-84: Indonesia – Forecast for HPV DNA Test Population Volume (Thousand), 2023 – 2028

Figure-85: Indonesia – VIA Test Population Volume (Thousand), 2018 – 2022

Figure-86: Indonesia – Forecast for VIA Test Population Volume (Thousand), 2023 – 2028

Figure-87: Indonesia – Pap smear & VIA Test Population Volume (Thousand), 2018 – 2022

Figure-88: Indonesia – Forecast for Pap smear & VIA Test Population Volume (Thousand), 2023 – 2028

Figure-89: Indonesia – Pap Smear Test Market (Million US$), 2018 – 2022

Figure-90: Indonesia – Forecast for Pap Smear Test Market (Million US$), 2023 – 2028

Figure-91: Indonesia – HPV DNA Test Market (Million US$), 2018 – 2022

Figure-92: Indonesia – Forecast for HPV DNA Test Market (Million US$), 2023 – 2028

Figure-93: Indonesia – VIA Test Market (Million US$), 2018 – 2022

Figure-94: Indonesia – Forecast for VIA Test Market (Million US$), 2023 – 2028

Figure-95: Indonesia – Pap smear & VIA Test Market (Million US$), 2018 – 2022

Figure-96: Indonesia – Forecast for Pap smear & VIA Test Market (Million US$), 2023 – 2028

Figure-97: Abbott laboratories – Global Revenue (Billion US$), 2018 – 2022

Figure-98: Abbott laboratories – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-99: Hologic Corporation – Global Revenue (Billion US$), 2018 – 2022

Figure-100: Hologic Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-101: Becton – Global Revenue (Billion US$), 2018 – 2022

Figure-102: Becton – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-103: Siemens AG – Global Revenue (Billion US$), 2018 – 2022

Figure-104: Siemens AG – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-105: Roche Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-106: Roche Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-107: Quest Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-108: Quest Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-109: Cardinal Health – Global Revenue (Billion US$), 2018 – 2022

Figure-110: Cardinal Health – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: Asia – Cervical Cancer Test (Screening) Population Volume Share (Percent), 2018 – 2022

Table-02: Asia – Forecast for Cervical Cancer Test (Screening) Population Volume Share (Percent), 2023 – 2028

Table-03: Asia – Pap Smear Test Population Volume Share by Country (Percent), 2018 – 2022

Table-04: Asia – Forecast for Pap Smear Test Population Volume Share by Country (Percent), 2023 – 2028

Table-05: Asia – HPV DNA Test Population Volume Share by Country (Percent), 2018 – 2022

Table-06: Asia – Forecast for HPV DNA Test Population Volume Share by Country (Percent), 2023 – 2028

Table-07: Asia – VIA Test Population Volume Share by Country (Percent), 2018 – 2022

Table-08: Asia – Forecast for VIA Test Population Volume Share by Country (Percent), 2023 – 2028

Table-09: Asia – Cervical Cancer Test (Screening) Market Share (Percent), 2018 – 2022

Table-10: Asia – Forecast for Cervical Cancer Test (Screening) Market Share (Percent), 2023 – 2028

Table-11: Asia – Pap Smear Test Market Share by Country (Percent), 2018 – 2022

Table-12: Asia – Forecast for Pap Smear Test Market Share by Country (Percent), 2023 – 2028

Table-13: Asia – HPV DNA Test Market Share by Country (Percent), 2018 – 2022

Table-14: Asia – Forecast for HPV DNA Test Market Share by Country (Percent), 2023 – 2028

Table-15: Asia – VIA Test Market Share by Country (Percent), 2018 – 2022

Table-16: Asia – Forecast for VIA Test Market Share by Country (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com