Asia Breast Cancer Screening Market, Size, Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Asia Breast Cancer Screening Market Outlook

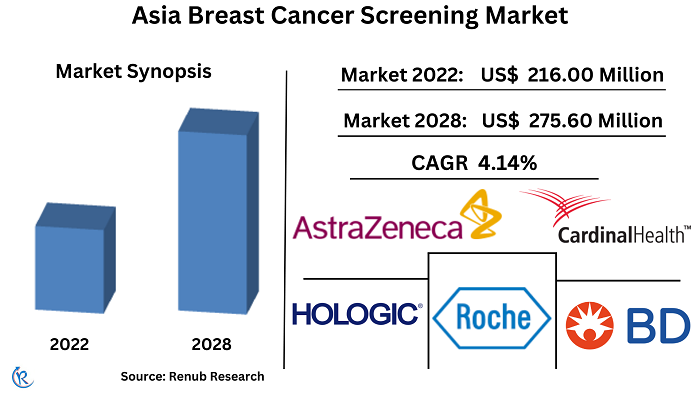

Asia Breast Cancer Screening Market is projected to reach US$ 275.6 Million by 2028, according to Renub Research. Breast cancer stands as the prevailing cancer diagnosis among women and remains the primary cause of cancer-related fatalities in Asia. Breast cancer affects Asian women at an earlier age compared to their Western counterparts. In Asian countries, the peak age for breast cancer occurrence typically falls between 40 and 50 years, whereas in Western countries, it tends to be between 60 and 70 years. This disparity highlights the importance of considering regional and demographic factors when addressing breast cancer prevention, screening, and treatment strategies. Understanding these variations can help tailor healthcare approaches to effectively address the specific needs and challenges faced by different populations in combating breast cancer.

Asia Breast Cancer Screening Market is expected to grow at a CAGR of 4.14% from 2022 to 2028

Asia, the most populous and diverse continent, is home to approximately 4.75 billion people out of the world's total population of 8 billion. By 2050, the continent's population is expected to grow by an additional 1.8 billion individuals. This growth is a result of ongoing socioeconomic development and improved control of communicable diseases, leading to increased life expectancy across all Asian countries. As a consequence, the proportion of individuals aged 65 years and above is projected to double by 2030.

With cancer risk strongly linked to age, this demographic shift raises concerns about the escalating cancer burden and changing cancer patterns in Asian countries. Factors such as changing lifestyles, urbanization, reproductive patterns, dietary changes, obesity, tobacco use, alcohol consumption, chronic infections, and longer lifespans contribute to the rising cancer burden, particularly in low-resource and medium-resource countries in Asia.

Anticipated is the rise in awareness about breast cancer and promotion of optimal treatment through supportive measures by local governments and public organizations. Notably, Breast International Group (BIG) has partnered with the Breast Disease Professional Committee of CMEA (BDPCC) in China, the Korean Cancer Study Group (KCSG) in South Korea, and the Thai Society of Clinical Oncology (TSCO) in Thailand to facilitate research collaborations focused on breast cancer. These initiatives aim to enhance knowledge sharing and cooperation among experts, fostering advancements in breast cancer research and treatment for the benefit of patients in these regions. As a result, Asia Breast Cancer Screening Market was valued at US$ 216 Million in 2022.

With a focus on improving healthcare outcomes, China is poised to make significant strides in Asia breast cancer screening and prevention

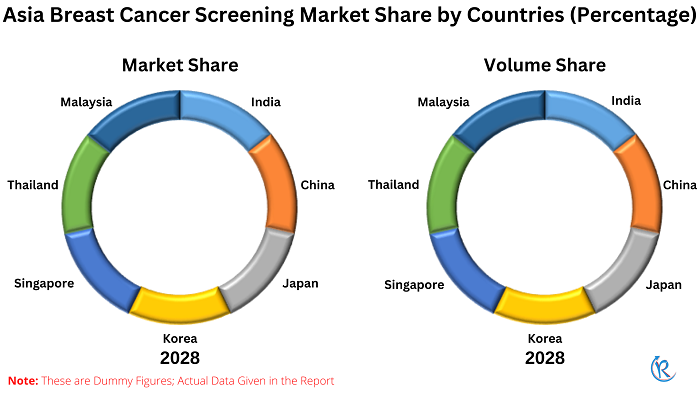

By countries, Asia Breast Cancer Screening Market is breakup into India, China, Japan, Korea, Singapore, Thailand and Malaysia. The Breast Cancer Screening industry in China has witnessed significant growth and development. Factors such as increasing awareness about breast cancer, improving healthcare infrastructure, and rising government initiatives have contributed to this progress. The Chinese government has implemented screening programs and campaigns to promote early detection and treatment. Technological advancements have also played a crucial role, with the adoption of advanced imaging techniques like mammography and ultrasound. Moreover, collaborations between healthcare institutions, research organizations, and industry players have further propelled the growth of the Breast Cancer Screening industry in China.

With its rapid population growth trajectory, India is poised to make significant strides in the Asia Breast Cancer Mammography Screening industry

By Mammography Screening, Asia Breast Cancer Screening Market is segmented into China, India, Japan, Korea, Singapore, Thailand and Malaysia. India is emerging as the fastest-growing market in the Breast Cancer Mammography Screening industry. The country has witnessed a remarkable surge in breast cancer awareness and a growing emphasis on early detection. The Indian government, along with various healthcare organizations and NGOs, has implemented extensive screening programs and awareness campaigns across the nation.

Technological advancements in mammography imaging and increasing investments in healthcare infrastructure have further boosted the growth of the industry. With a rising population and changing lifestyles, the demand for breast cancer screening services in India is projected to continue its rapid expansion. India commitment to improving breast cancer diagnosis and treatment outcomes positions it as a key player in the global Breast Cancer Mammography Screening industry.

China is expected to witness a significant increase in its market presence in the Asia Breast Cancer MRI Screening industry

By MRI Screening, Asia Breast Cancer Screening Market is divided into China, Japan, India, Korea, Singapore, Thailand and Malaysia. China is poised to experience a surge in its market share within the Breast Cancer MRI Screening industry. The country expanding healthcare infrastructure, growing investments in advanced imaging technologies and increasing awareness about the importance of early breast cancer detection are driving this growth. The Chinese government has also implemented initiatives to improve access to breast cancer screening services, particularly in rural and underserved areas. Collaborations between domestic and international medical institutions, along with the involvement of leading industry players, are contributing to the development and adoption of state-of-the-art MRI screening technologies.

With its accelerating growth rate, China is poised to dominate the Asia Breast Cancer Ultrasound Screening industry

By Ultrasound Screening, Asia Breast Cancer Screening Market is classified into China, Japan, Korea, Singapore, India, Thailand and Malaysia. China is emerging as the fastest-growing market in the Breast Cancer Ultrasound Screening industry. The country's healthcare landscape has witnessed remarkable advancements in ultrasound technology, driving improved accuracy and efficiency in breast cancer diagnosis. Increasing awareness about the importance of early detection and screening has fueled the demand for ultrasound screening services in China. The government's initiatives to expand healthcare access, particularly in rural areas, have further contributed to the industry's rapid growth. Collaborations between healthcare providers, research institutions, and industry leaders have also played a significant role in fostering innovation and driving the adoption of advanced ultrasound screening solutions.

Key company

AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health are key players in the Breast Cancer Ultrasound Screening industry in Asia. These companies are at the forefront of developing and providing advanced ultrasound screening solutions for breast cancer detection and diagnosis.

Renub Research report titled “Asia Breast Cancer Screening Market by Type (Mammography Screening, MRI Screening, and Ultrasound Screening) by Country (China, India, Japan, Korea, Singapore, Thailand and Malaysia) by Company Analysis (AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health)” provides a complete analysis of Europe Breast Cancer Screening Industry.

Types – Market has been covered from 3 viewpoints

1. Mammography Screening

2. MRI Screening

3. Ultrasound Screening

Countries – 7 Asian Country Breast Cancer Screening Market has been Covered

1. China

2. India

3. Japan

4. Korea

5. Singapore

6. Thailand

7. Malaysia

Company Insights:

• Overview

• Recent Development

• Sales Analysis

Companies Covered in the Report:

1. AstraZeneca

2. Hologic Corporation

3. Becton

4. Siemens AG

5. Roche Diagnostics

6. Quest Diagnostics

7. Cardinal Health

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Million |

| Segment Covered | Type, and Countries |

| Countries Covered | China, India, Japan, Korea, Singapore, Thailand, and Malaysia |

| Companies Covered | AstraZeneca, Hologic Corporation, Becton, Siemens AG, Roche Diagnostics, Quest Diagnostics, and Cardinal Health |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyer

5.2 Bargaining Power of Supplier

5.3 Threat of New Entrants

5.4 Rivalry among Existing Competitors

5.5 Threat of Substitute Products

6. SWOT Analysis

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7. Asia Pacific Breast Cancer Screening Analysis

7.1 Asia Pacific Breast Cancer Market

7.2 Asia Pacific Breast Cancer Population

8. Asia Breast Cancer Screening Population Analysis

8.1 Mammography Screening Population

8.2 MRI & Ultrasound Screening Population

9. Asia Breast Cancer Screening Market Analysis

9.1 Breast Cancer Screening Market

9.1.1 Mammography Screening Market

9.1.2 MRI Screening Market

9.1.3 Ultrasound Screening Market

10. Asia Breast Cancer Screening Population & Market Share Analysis

10.1 Mammography Screening Population Share

10.2 MRI & Ultrasound Screening Population Share

11. Asia Breast Cancer Screening Market Share Analysis

11.1 Asia Breast Cancer Screening Market Share

11.2 Mammography Screening Market Share

11.3 MRI Screening Market Share

11.4 Ultrasound Screening Market Share

12. India

12.1 India Breast Cancer Mammography Screening Population

12.2 India Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

12.3 India Breast Cancer Screening Market

12.3.1 Mammography Screening Market

12.3.2 Magnetic Resonance Imaging (MRI) Screening Market

12.3.3 Ultrasound Screening Market

13. China

13.1 China Breast Cancer Mammography Screening Population

13.2 China Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

13.3 China Breast Cancer Screening Market & Forecast

13.3.1 Mammography Screening Market

13.3.2 Magnetic Resonance Imaging (MRI) Screening Market

13.3.3 Ultrasound Screening Market

14. Japan

14.1 Japan Breast Cancer Mammography Screening Population

14.2 Japan Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

14.3 Japan Breast Cancer Screening Market

14.3.1 Mammography Screening Market

14.3.2 Magnetic Resonance Imaging (MRI) Screening Market

14.3.3 Ultrasound Screening Market

15. Korea

15.1 Korea Breast Cancer Mammography Screening Population

15.2 Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

15.3 Korea Breast Cancer Screening Market

15.3.1 Mammography Screening Market

15.3.2 Magnetic Resonance Imaging (MRI) Screening Market

15.3.3 Ultrasound Screening Market

16. Singapore

16.1 Singapore Breast Cancer Mammography Screening Population

16.2 Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

16.3 Singapore Breast Cancer Screening Market

16.3.1 Mammography Screening Market

16.3.2 Magnetic Resonance Imaging (MRI) Screening Market

16.3.3 Ultrasound Screening Market

17. Thailand

17.1 Thailand Breast Cancer Mammography Screening Population

17.2 Thailand Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

17.3 Thailand Breast Cancer Screening Market

17.3.1 Mammography Screening Market

17.3.2 Magnetic Resonance Imaging (MRI) Screening Market

17.3.3 Ultrasound Screening Market

18. Malaysia

18.1 Malaysia Breast Cancer Mammography Screening Population

18.2 Malaysia Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population

18.3 Malaysia Breast Cancer Screening Market

18.3.1 Mammography Screening Market

18.3.2 Magnetic Resonance Imaging (MRI) Screening Market

18.3.3 Malaysia Breast Cancer Ultrasound Screening Market

19. Company Analysis

19.1 AstraZeneca

19.1.1 Overview

19.1.2 Recent Development

19.1.3 Revenue

19.2 Hologic Corporation

19.2.1 Overview

19.2.2 Recent Development

19.2.3 Revenue

19.3 Becton

19.3.1 Overview

19.3.2 Recent Development

19.3.3 Revenue

19.4 Siemens AG

19.4.1 Overview

19.4.2 Recent Development

19.4.3 Revenue

19.5 Roche Diagnostics

19.5.1 Overview

19.5.2 Recent Development

19.5.3 Revenue

19.6 Quest Diagnostics

19.6.1 Overview

19.6.2 Recent Development

19.6.3 Revenue

19.7 Cardinal Health

19.7.1 Overview

19.7.2 Recent Development

19.7.3 Revenue

List of Figures:

Figure-01: Asia – Breast Cancer Screening Market (Million US$), 2018 – 2022

Figure-02: Asia – Forecast for Breast Cancer Screening Market (Million US$), 2023 – 2028

Figure-03: Asia – Breast Cancer Screening Population (Million), 2018 – 2022

Figure-04: Asia – Forecast for Breast Cancer Screening Population (Million), 2023 – 2028

Figure-05: Asia – Breast Cancer Mammography Screening Population (Million), 2018 – 2022

Figure-06: Asia – Forecast for Breast Cancer Mammography Screening Population (Million), 2023 – 2028

Figure-07: Asia – Breast Cancer MRI & Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-08: Asia – Forecast for Breast Cancer MRI & Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-09: Asia – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-10: Asia – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-11: Asia – Breast Cancer MRI Screening Market (Million US$), 2018 – 2022

Figure-12: Asia – Forecast for Breast Cancer MRI Screening Market (Million US$), 2023 – 2028

Figure-13: Asia – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-14: Asia – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-15: India – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-16: India – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-17: India – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-18: India – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-19: India – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-20: India – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-21: India – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-22: India – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-23: India – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-24: India – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-25: China – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-26: China – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-27: China – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-28: China – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-29: China – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-30: China – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-31: China – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-32: China – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-33: China – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-34: China – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-35: Japan – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-36: Japan – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-37: Japan – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-38: Japan – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-39: Japan – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-40: Japan – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-41: Japan – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-42: Japan – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-43: Japan – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-44: Japan – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-45: Korea – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-46: Korea – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-47: Korea – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-48: Korea – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-49: Korea – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-50: Korea – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-51: Korea – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-52: Korea – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-53: Korea – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-54: Korea – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-55: Singapore – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-56: Singapore – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-57: Singapore – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-58: Singapore – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-59: Singapore – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-60: Singapore – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-61: Singapore – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-62: Singapore – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-63: Singapore – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-64: Singapore – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-65: Thailand – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-66: Thailand – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-67: Thailand – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-68: Thailand – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-69: Thailand – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-70: Thailand – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-71: Thailand – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-72: Thailand – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-73: Thailand – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-74: Thailand – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-75: Malaysia – Breast Cancer Mammography Screening Population (Thousand), 2018 – 2022

Figure-76: Malaysia – Forecast for Breast Cancer Mammography Screening Population (Thousand), 2023 – 2028

Figure-77: Malaysia – Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2018 – 2022

Figure-78: Malaysia – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) and Ultrasound Screening Population (Thousand), 2023 – 2028

Figure-79: Malaysia – Breast Cancer Mammography Screening Market (Million US$), 2018 – 2022

Figure-80: Malaysia – Forecast for Breast Cancer Mammography Screening Market (Million US$), 2023 – 2028

Figure-81: Malaysia – Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2018 – 2022

Figure-82: Malaysia – Forecast for Breast Cancer Magnetic Resonance Imaging (MRI) Screening Market (Million US$), 2023 – 2028

Figure-83: Malaysia – Breast Cancer Ultrasound Screening Market (Million US$), 2018 – 2022

Figure-84: Malaysia – Forecast for Breast Cancer Ultrasound Screening Market (Million US$), 2023 – 2028

Figure-85: AstraZeneca – Global Revenue (Million US$), 2018 – 2022

Figure-86: AstraZeneca – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-87: Hologic Corporation – Global Revenue (Million US$), 2018 – 2022

Figure-88: Hologic Corporation – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-89: Becton – Global Revenue (Million US$), 2018 – 2022

Figure-90: Becton – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-91: Siemens AG – Global Revenue (Million US$), 2018 – 2022

Figure-92: Siemens AG – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-93: Roche Diagnostics – Global Revenue (Million US$), 2018 – 2022

Figure-94: Roche Diagnostics – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-95: Quest Diagnostics – Global Revenue (Million US$), 2018 – 2022

Figure-96: Quest Diagnostics – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-97: Cardinal Health – Global Revenue (Million US$), 2018 – 2022

Figure-98: Cardinal Health – Forecast for Global Revenue (Million US$), 2023 – 2028

List of Tables:

Table-01: Asia – Mammography Screening Population Share by Country (Percent), 2018 – 2022

Table-02: Asia – Forecast for Mammography Screening Population Share by Country (Percent), 2023 – 2028

Table-03: Asia – MRI & Ultrasound Screening Population Share by Country (Percent), 2018 – 2022

Table-04: Asia – Forecast for MRI & Ultrasound Screening Population Share by Country (Percent), 2023 – 2028

Table-05: Asia – Breast Cancer Screening Market Share by Country (Percent), 2018 – 2022

Table-06: Asia – Forecast for Breast Cancer Screening Market Share by Country (Percent), 2023 – 2028

Table-07: Asia – Mammography Screening Market Share by Country (Percent), 2018 – 2022

Table-08: Asia – Forecast for Mammography Screening Market Share by Country (Percent), 2023 – 2028

Table-09: Asia – MRI Screening Market Share by Country (Percent), 2018 – 2022

Table-10: Asia – Forecast for MRI Screening Market Share by Country (Percent), 2023 – 2028

Table-11: Asia – Ultrasound Screening Market Share by Country (Percent), 2018 – 2022

Table-12: Asia – Forecast for Ultrasound Screening Market Share by Country (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com